Gold has long been a trusted asset for preserving wealth due to its intrinsic value and stability during market fluctuations. Digital gold offers ease of access, liquidity, and fractional ownership without the need for physical storage, making it appealing for modern investors. While traditional gold provides tangible security, digital gold enhances convenience and flexibility in asset management.

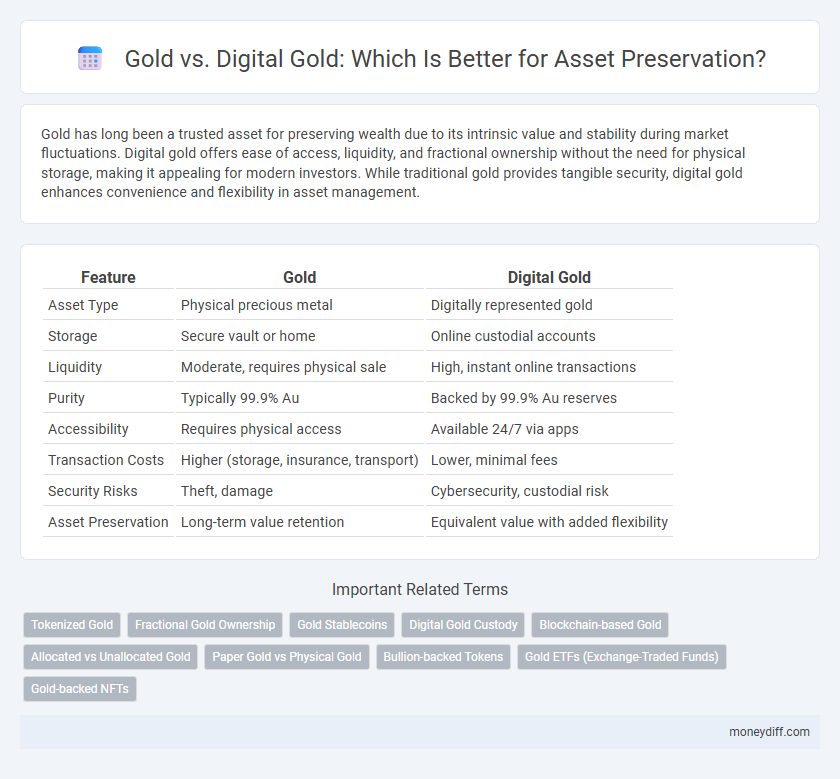

Table of Comparison

| Feature | Gold | Digital Gold |

|---|---|---|

| Asset Type | Physical precious metal | Digitally represented gold |

| Storage | Secure vault or home | Online custodial accounts |

| Liquidity | Moderate, requires physical sale | High, instant online transactions |

| Purity | Typically 99.9% Au | Backed by 99.9% Au reserves |

| Accessibility | Requires physical access | Available 24/7 via apps |

| Transaction Costs | Higher (storage, insurance, transport) | Lower, minimal fees |

| Security Risks | Theft, damage | Cybersecurity, custodial risk |

| Asset Preservation | Long-term value retention | Equivalent value with added flexibility |

Understanding Gold and Digital Gold

Gold has historically been a reliable asset for wealth preservation due to its intrinsic value and limited supply, serving as a hedge against inflation and economic instability. Digital gold offers a modern alternative by representing ownership of physical gold through blockchain technology, providing ease of transaction, liquidity, and fractional ownership. Understanding the differences in security, storage, and market accessibility between physical gold and digital gold is essential for optimizing asset preservation strategies.

Historical Performance of Physical Gold

Physical gold has consistently demonstrated robust asset preservation through centuries of economic volatility, maintaining purchasing power better than many fiat currencies. Historical data shows gold's average annual return of around 1.5% above inflation over the last 50 years, highlighting its role as a reliable hedge against currency depreciation. Unlike digital gold, physical gold offers tangible ownership and no counterparty risk, contributing to its enduring value in wealth preservation strategies.

Digital Gold: Technology Meets Tradition

Digital Gold combines the timeless value of gold with cutting-edge blockchain technology, offering enhanced transparency, ease of transaction, and fractional ownership. Unlike physical gold, digital gold eliminates storage concerns and enables instant, secure transfers across global markets. This fusion of tradition and technology provides a versatile asset preservation method, appealing to tech-savvy investors seeking liquidity and security.

Security Aspects: Physical vs. Digital Gold

Gold offers tangible security through physical possession, allowing individuals to store and safeguard coins or bars in secure vaults or personal safes, minimizing reliance on digital systems. Digital gold, however, depends on cybersecurity measures, including encryption, multi-factor authentication, and trusted platforms to protect assets from hacking, fraud, or system failures. While physical gold faces risks like theft or loss, digital gold risks center around digital vulnerabilities, emphasizing the need for robust technological safeguards and regulatory compliance.

Accessibility and Liquidity Comparison

Gold remains a traditional asset for preservation with high intrinsic value but limited accessibility due to physical storage and higher transaction barriers. Digital gold offers superior accessibility through online platforms, enabling instant purchases and sales without physical handling. Liquidity in digital gold outperforms physical gold as it allows seamless conversion to cash or other assets anytime, enhancing flexibility for investors.

Storage and Maintenance Considerations

Gold offers tangible storage options like safety deposit boxes and home vaults, requiring secure, physical protection against theft or damage, whereas digital gold relies on encrypted online platforms and secure digital wallets, minimizing physical space but necessitating cybersecurity measures. Physical gold demands periodic maintenance to prevent tarnishing and degradation, while digital gold requires ongoing software updates and vigilance against hacking or cyber threats. Choosing between the two depends on balancing the reliability of physical custody with the convenience and security protocols of digital asset management.

Regulatory and Legal Implications

Gold remains a trusted asset for preservation due to clear regulatory frameworks and long-established legal precedents governing ownership and transfer. Digital gold operates within evolving regulatory landscapes that vary by jurisdiction, potentially affecting asset security and compliance requirements. Investors must consider these legal implications carefully to ensure protection against fraud and regulatory risks in both physical and digital gold markets.

Cost Analysis: Buying, Selling, and Holding

Gold involves higher transaction costs due to dealer premiums, storage fees, and insurance expenses, making buying and selling relatively expensive. Digital gold offers lower entry costs with minimal transaction fees, reduced storage costs, and instant liquidity, enhancing cost efficiency in trading. Holding traditional gold may incur ongoing physical security expenses, while digital gold reduces these overheads through secure online custody solutions.

Market Volatility and Price Stability

Gold has historically demonstrated strong price stability, serving as a reliable hedge against market volatility and inflation. Digital gold, while offering liquidity and ease of transaction, remains susceptible to higher price fluctuations driven by cryptocurrency market dynamics. Investors seeking asset preservation often prioritize physical gold for its time-tested stability amid economic uncertainty.

Choosing the Right Option for Asset Preservation

Gold offers timeless value and tangible security as a physical asset, making it a reliable choice for long-term preservation against inflation and economic instability. Digital gold provides convenience, instant liquidity, and ease of storage through blockchain technology, appealing to investors seeking modern asset management solutions. Selecting the right option depends on individual preferences for security, accessibility, and risk tolerance in preserving wealth.

Related Important Terms

Tokenized Gold

Tokenized gold offers a secure and transparent way to preserve assets by combining the intrinsic value of physical gold with blockchain technology, enabling fractional ownership and easy trading. Unlike traditional gold, digital gold tokens reduce storage costs and enhance liquidity while maintaining backing by verified gold reserves.

Fractional Gold Ownership

Fractional gold ownership offers a flexible alternative to traditional physical gold by allowing investors to purchase and hold precise portions of gold assets, enhancing liquidity and accessibility in asset preservation. Digital gold platforms provide secured, audited holdings stored in insured vaults, combining the tangible value of gold with the convenience of digital transactions and lower entry barriers.

Gold Stablecoins

Gold stablecoins combine the intrinsic value of physical gold with the ease of digital asset transfer, offering a secure, transparent, and liquid option for asset preservation. These blockchain-backed tokens provide price stability linked to gold, reducing volatility compared to traditional cryptocurrencies while ensuring global accessibility and instant settlement.

Digital Gold Custody

Digital gold custody offers secure, blockchain-backed storage solutions that enhance asset preservation through transparent, tamper-proof records and instant liquidity. Compared to physical gold, it reduces risks of theft, damage, and high storage costs while enabling seamless ownership transfer and fractional investment opportunities.

Blockchain-based Gold

Blockchain-based digital gold offers enhanced transparency, security, and liquidity compared to traditional physical gold, enabling easier verification of ownership and seamless global transactions. Its decentralized ledger technology mitigates risks of counterfeit assets and theft, providing a reliable store of value for long-term asset preservation.

Allocated vs Unallocated Gold

Allocated gold offers direct ownership of physical bullion securely stored in vaults, providing maximum protection against counterparty risk, whereas unallocated gold represents a claim against a dealer's holdings, exposing investors to the risk of insolvency. Digital gold platforms often utilize unallocated gold structures for liquidity and ease of transfer, but allocated gold remains the preferred choice for long-term asset preservation due to its tangible backing and secure ownership.

Paper Gold vs Physical Gold

Physical gold offers tangible security and intrinsic value, making it a reliable asset for long-term preservation against inflation and economic uncertainty. Paper gold, representing ownership through certificates or ETFs, provides liquidity and ease of trade but carries counterparty risk and lacks direct possession of the precious metal.

Bullion-backed Tokens

Bullion-backed tokens represent a secure digital asset that combines the intrinsic value of physical gold with blockchain transparency and liquidity, offering seamless asset preservation against market volatility. Unlike traditional gold, these tokens enable fractional ownership, instant transferability, and reduced storage costs, making them a superior option for investors seeking long-term wealth protection.

Gold ETFs (Exchange-Traded Funds)

Gold ETFs offer a convenient and liquid alternative to physical gold for asset preservation, enabling investors to gain exposure to gold prices without the risks of storage and security. Digital gold platforms, backed by physical gold holdings, combine ease of access with transparency, making them a competitive choice for diversified portfolios focusing on long-term value retention.

Gold-backed NFTs

Gold-backed NFTs offer a modern solution for asset preservation by combining the intrinsic value of physical gold with the transparency and liquidity of blockchain technology. These digital tokens enable fractional ownership and seamless transfer of gold assets while mitigating traditional storage and security risks.

Gold vs Digital Gold for asset preservation Infographic

moneydiff.com

moneydiff.com