Index funds offer broad market exposure with low fees by tracking a specific market index, making them ideal for passive investors seeking simplicity and cost-efficiency. Smart beta funds blend passive and active strategies by weighting securities based on factors like value or volatility, aiming to enhance returns while maintaining diversification. Choosing between the two depends on an investor's risk tolerance, desired level of market exposure, and preference for potential outperformance versus pure market replication.

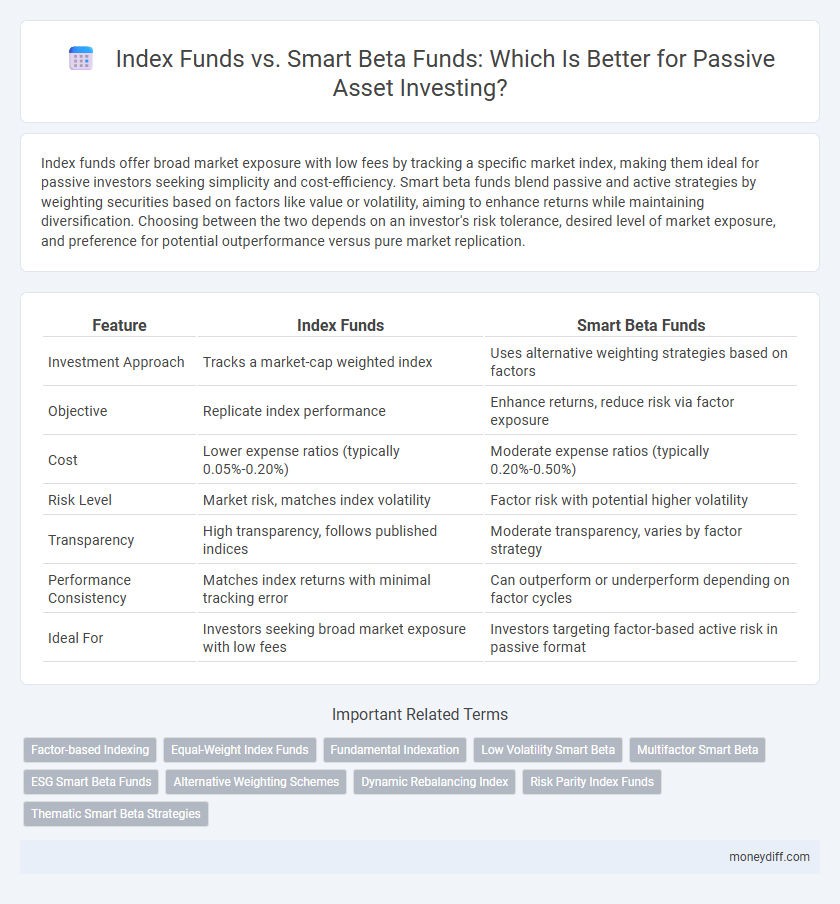

Table of Comparison

| Feature | Index Funds | Smart Beta Funds |

|---|---|---|

| Investment Approach | Tracks a market-cap weighted index | Uses alternative weighting strategies based on factors |

| Objective | Replicate index performance | Enhance returns, reduce risk via factor exposure |

| Cost | Lower expense ratios (typically 0.05%-0.20%) | Moderate expense ratios (typically 0.20%-0.50%) |

| Risk Level | Market risk, matches index volatility | Factor risk with potential higher volatility |

| Transparency | High transparency, follows published indices | Moderate transparency, varies by factor strategy |

| Performance Consistency | Matches index returns with minimal tracking error | Can outperform or underperform depending on factor cycles |

| Ideal For | Investors seeking broad market exposure with low fees | Investors targeting factor-based active risk in passive format |

Understanding Index Funds: The Basics

Index funds are a type of passive investment vehicle designed to replicate the performance of a specific market index, such as the S&P 500, by holding a diversified portfolio that matches the index components. These funds typically feature low expense ratios due to their minimal active management and transparent structure, making them cost-effective for long-term investors. By tracking broad market indices, index funds offer consistent market returns with reduced volatility, providing a straightforward way to gain diversified exposure in passive investing strategies.

What Are Smart Beta Funds?

Smart Beta Funds combine traditional passive index strategies with rules-based approaches to capture specific factors such as value, size, momentum, or volatility, aiming to outperform standard market-cap weighted index funds. Unlike conventional index funds that track broad market indices, Smart Beta Funds adjust weightings based on fundamental metrics or risk factors to potentially enhance returns and reduce risk. These funds offer a middle ground between passive and active management by systematically exploiting market inefficiencies while maintaining lower fees.

Key Differences Between Index and Smart Beta Funds

Index funds replicate traditional market-cap weighted indexes, offering broad market exposure and low costs by passively tracking established benchmarks like the S&P 500. Smart beta funds use alternative weighting strategies based on factors such as volatility, momentum, or quality, aiming to enhance returns or reduce risk compared to standard indexes. These funds blend passive investing with strategic factor tilts, providing a semi-active approach that targets specific investment themes or risk-return profiles.

Performance Comparison: Index vs Smart Beta

Smart Beta funds leverage factor-based strategies, such as value, momentum, and low volatility, to potentially outperform traditional Index funds that track broad market benchmarks. Historical data suggests Smart Beta funds may deliver higher risk-adjusted returns compared to conventional Index funds, although with increased tracking error and fees. Investors seeking enhanced alpha with moderate risk tolerance often favor Smart Beta strategies over pure passive Index fund investing for portfolio diversification and performance optimization.

Risk Factors in Passive Investing Strategies

Index funds offer broad market exposure with lower tracking error and minimal management intervention, reducing unsystematic risk. Smart beta funds use factor-based rules to overweight specific risk premia like value, momentum, or low volatility, potentially increasing exposure to style risk and factor cyclicality. Understanding these risk factors is crucial for passive investors seeking to balance diversification benefits against targeted factor exposures.

Costs and Fees: Index Funds vs Smart Beta Funds

Index funds typically feature lower expense ratios, averaging around 0.03% to 0.10%, making them cost-efficient for passive investing. Smart beta funds, employing factor-based strategies, often incur higher fees ranging from 0.20% to 0.50% due to active management components and complex methodologies. Investors seeking cost-effective options usually favor index funds, while those willing to pay higher fees for potential enhanced returns consider smart beta funds.

Portfolio Diversification: Which Fund Wins?

Index funds provide broad market exposure by tracking a specific benchmark, offering inherent diversification across various sectors and asset classes. Smart Beta funds enhance this approach by selectively weighting components based on factors like value, momentum, or volatility, potentially improving risk-adjusted returns. For portfolio diversification, Smart Beta funds offer a more tailored risk exposure compared to the traditional, market-cap-weighted diversification of index funds.

Tax Efficiency: Smart Beta vs Traditional Indexing

Smart Beta funds often exhibit higher tax efficiency compared to traditional index funds due to their active rebalancing strategies, which can minimize capital gains distributions. Traditional index funds typically track market cap-weighted benchmarks, resulting in more frequent forced sales that generate taxable events. Investors seeking passive strategies with tax advantages may benefit from Smart Beta's rules-based approach that emphasizes tax-managed portfolio construction.

Investor Suitability: Who Should Choose Which?

Index funds suit investors seeking broad market exposure with low fees and minimal portfolio management, ideal for those prioritizing simplicity and long-term growth. Smart beta funds attract investors aiming for enhanced returns or risk-adjusted performance by systematically tilting toward specific factors like value, momentum, or volatility. Risk tolerance, investment goals, and willingness to accept factor-specific risks determine suitability between passive index and smart beta strategies.

Long-Term Outlook for Index and Smart Beta Funds

Index funds offer broad market exposure with low fees, providing consistent long-term growth aligned with overall market performance. Smart beta funds utilize alternative weighting strategies based on factors like value, momentum, or volatility, aiming to outperform traditional indices while maintaining passive management benefits. Over the long term, smart beta funds may deliver higher returns and better risk-adjusted performance, though they often involve increased complexity and tracking error compared to standard index funds.

Related Important Terms

Factor-based Indexing

Factor-based indexing in smart beta funds enhances passive investing by systematically targeting specific risk factors such as value, momentum, or low volatility, offering higher potential returns and diversification compared to traditional index funds that simply track market-cap-weighted indices. Index funds provide broad market exposure with lower fees, while smart beta funds optimize portfolio performance through factor tilts, appealing to investors seeking a balance of passive management and strategic factor exposure.

Equal-Weight Index Funds

Equal-weight index funds allocate capital uniformly across all constituents, reducing concentration risk common in traditional market-cap weighted index funds, and enhancing diversification for passive investors. These funds often outperform cap-weighted counterparts over long periods by providing greater exposure to mid- and small-cap stocks, aligning well with smart beta strategies aimed at risk-adjusted returns.

Fundamental Indexation

Fundamental indexation in smart beta funds selects and weights assets based on financial metrics such as earnings, book value, and dividends, aiming to capture value and quality factors that traditional market-cap weighted index funds may overlook. This approach often provides enhanced risk-adjusted returns and reduces exposure to market bubbles compared to passive investing solely through conventional index funds.

Low Volatility Smart Beta

Low Volatility Smart Beta funds strategically weight stocks to minimize fluctuations, outperforming traditional index funds by reducing downside risk while maintaining market exposure. These funds utilize factors like volatility and beta to deliver more stable returns, making them a preferred choice for risk-averse passive investors seeking consistent income and capital preservation.

Multifactor Smart Beta

Multifactor Smart Beta funds enhance passive investing by systematically combining factors like value, momentum, quality, and low volatility to achieve diversified exposure and potential outperformance versus traditional market-cap-weighted index funds. These funds offer a rules-based strategy that captures multiple risk premia, aiming to balance risk and return more effectively than conventional index funds.

ESG Smart Beta Funds

ESG Smart Beta Funds enhance passive investing by combining environmental, social, and governance criteria with factor-based strategies, offering improved risk-adjusted returns compared to traditional index funds. These funds leverage systematic rules to overweight sustainable companies while maintaining diversification and transparency, appealing to investors seeking both ethical impact and financial performance.

Alternative Weighting Schemes

Smart Beta Funds utilize alternative weighting schemes such as fundamental factors or volatility metrics to enhance portfolio diversification and potentially improve risk-adjusted returns compared to traditional market-cap weighted Index Funds. These approaches systematically tilt exposure towards specific investment styles or risk characteristics, offering passive investors targeted strategies without the complexity of active management.

Dynamic Rebalancing Index

Dynamic rebalancing indexes in smart beta funds systematically adjust portfolio weights based on factors like volatility or momentum, offering enhanced risk-adjusted returns compared to traditional index funds that passively track market capitalization. This adaptive approach helps investors maintain targeted exposures and potentially achieve better diversification, making smart beta funds a compelling option for passive investing.

Risk Parity Index Funds

Risk Parity Index Funds balance risk equally across asset classes by allocating capital based on volatility, offering a more diversified and risk-managed approach compared to traditional Index Funds or Smart Beta Funds that weight investments by market capitalization or factor exposure. This method aims to reduce portfolio drawdowns and improve risk-adjusted returns, making Risk Parity strategies increasingly popular among passive investors seeking stability and consistent growth.

Thematic Smart Beta Strategies

Thematic smart beta strategies in passive investing target specific market trends or sectors by combining factor-based weighting with thematic exposures, enhancing diversification beyond traditional index funds. These funds leverage data-driven factor tilts like momentum, value, and low volatility within themes such as technology or clean energy to potentially outperform standard market-cap weighted index funds.

Index Funds vs Smart Beta Funds for passive investing Infographic

moneydiff.com

moneydiff.com