Assets provide tangible value and long-term stability, making them a reliable choice for wealth building, whereas digital collectibles offer unique ownership experiences with potential for high volatility and speculative gains. Investing in traditional assets like real estate or stocks often ensures steady appreciation, while digital collectibles, such as NFTs, depend heavily on market trends and community interest. Balancing both can diversify a portfolio, blending the security of assets with the innovative growth potential of digital collectibles.

Table of Comparison

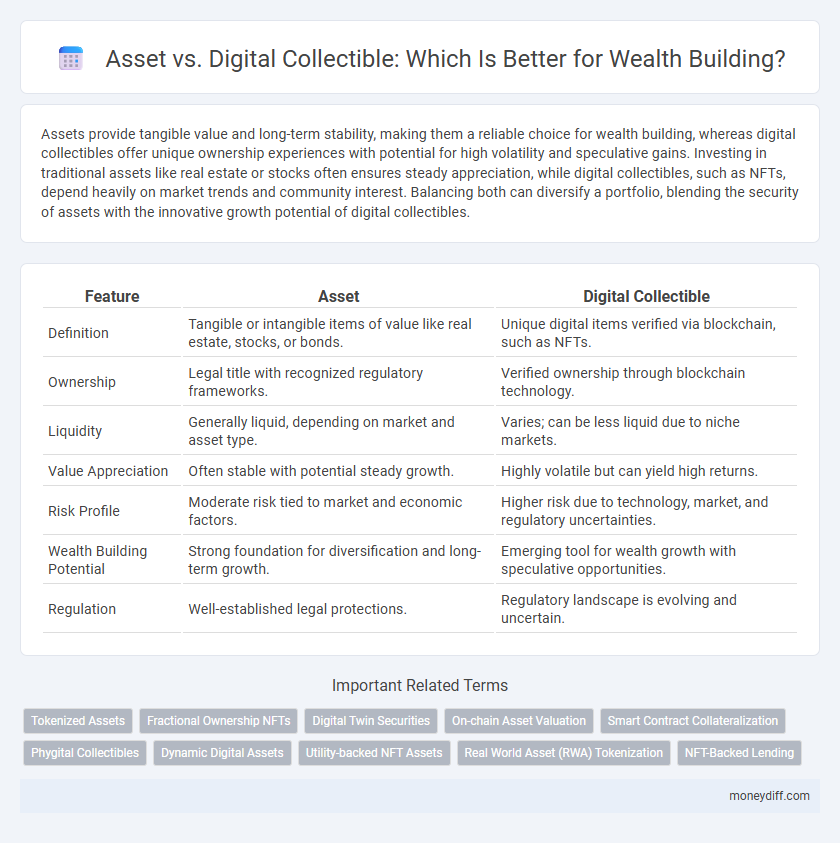

| Feature | Asset | Digital Collectible |

|---|---|---|

| Definition | Tangible or intangible items of value like real estate, stocks, or bonds. | Unique digital items verified via blockchain, such as NFTs. |

| Ownership | Legal title with recognized regulatory frameworks. | Verified ownership through blockchain technology. |

| Liquidity | Generally liquid, depending on market and asset type. | Varies; can be less liquid due to niche markets. |

| Value Appreciation | Often stable with potential steady growth. | Highly volatile but can yield high returns. |

| Risk Profile | Moderate risk tied to market and economic factors. | Higher risk due to technology, market, and regulatory uncertainties. |

| Wealth Building Potential | Strong foundation for diversification and long-term growth. | Emerging tool for wealth growth with speculative opportunities. |

| Regulation | Well-established legal protections. | Regulatory landscape is evolving and uncertain. |

Understanding Assets: Foundations of Wealth Building

Assets represent tangible or intangible resources with intrinsic value that generate income, appreciate over time, or provide utility, forming the core foundation of wealth building. Digital collectibles, including NFTs, are emerging asset classes offering potential for growth and diversification but often carry higher volatility and speculative risk compared to traditional assets like real estate, stocks, or bonds. Understanding asset fundamentals--such as liquidity, scalability, and long-term appreciation--is essential for strategic wealth accumulation and risk management.

What Are Digital Collectibles? An Overview

Digital collectibles are unique digital assets secured on blockchain technology, representing ownership of virtual items such as art, music, or virtual real estate. Unlike traditional assets, digital collectibles offer provable scarcity and individuality through non-fungible tokens (NFTs), enabling new forms of asset ownership and trading. Their rising popularity in wealth building stems from potential appreciation, liquidity, and accessibility in emerging digital economies.

Key Differences Between Traditional Assets and Digital Collectibles

Traditional assets such as real estate, stocks, and bonds represent tangible or financial instruments with established market value, legal frameworks, and long-term appreciation potential. Digital collectibles, often in the form of NFTs, provide unique, blockchain-verified ownership of digital items but feature higher volatility, limited regulatory oversight, and speculative value growth. The key differences lie in liquidity, regulatory protection, and intrinsic versus perceived worth, influencing their roles in diversified wealth-building strategies.

Evaluating Risk and Return: Assets vs Digital Collectibles

Assets such as real estate, stocks, and bonds typically offer more stable returns and lower risk profiles compared to digital collectibles like NFTs, which are highly volatile and speculative. Traditional assets benefit from established markets and regulatory frameworks that help mitigate risk and provide clearer valuation metrics. Conversely, digital collectibles present potential for high returns driven by market hype but carry significant uncertainty due to liquidity challenges and price fluctuations.

Liquidity: How Easy Is It to Trade Assets vs Digital Collectibles?

Assets such as stocks and real estate generally offer higher liquidity due to established markets and regulatory frameworks facilitating faster transactions. Digital collectibles, including NFTs, often face lower liquidity since trading depends on niche platforms and fluctuating demand within smaller communities. Understanding the liquidity spectrum is essential for wealth building, as assets with greater ease of trade provide more flexibility and quicker access to capital.

Market Volatility: Navigating Price Fluctuations

Asset markets typically exhibit more stable price movements due to underlying economic fundamentals and regulatory oversight, making them a safer option for wealth building amid market volatility. Digital collectibles, such as NFTs, experience extreme price fluctuations driven by speculative demand and limited liquidity, increasing risk exposure for investors. Understanding these volatility patterns is crucial for asset allocation strategies aimed at preserving long-term wealth.

Accessibility and Ownership: Barriers to Entry

Assets typically offer broader accessibility with fewer barriers to entry, allowing individuals to invest in real estate, stocks, or bonds through established platforms and regulated markets. Digital collectibles, often tied to blockchain technology, require understanding of digital wallets and cryptocurrencies, which can limit accessibility due to technical knowledge and market volatility. Ownership of traditional assets is generally more straightforward and legally recognized, while digital collectibles depend on secure digital infrastructure and can face issues with intellectual property rights and platform dependency.

Security Concerns: Protecting Your Investments

Assets generally offer stronger regulatory protections and established legal frameworks, reducing security risks compared to digital collectibles, which are vulnerable to hacking, fraud, and uncertain ownership rights. Digital collectibles rely heavily on blockchain technology, but smart contract vulnerabilities and lack of standardized security protocols can expose investors to significant threats. Prioritizing asset diversification and utilizing secure wallets with multi-factor authentication are essential strategies for safeguarding wealth in both traditional and digital investment landscapes.

Tax Implications of Assets and Digital Collectibles

Assets such as real estate and stocks are taxed based on capital gains rates, dividend income, or rental income, with specific regulations varying by jurisdiction. Digital collectibles, including NFTs, often face more complex tax treatments due to their classification as property or collectibles, potentially resulting in higher capital gains taxes or taxable events upon transfer or sale. Understanding the distinct tax implications and reporting requirements for both traditional assets and digital collectibles is crucial for effective wealth building and compliance.

Future Trends: Which Holds Greater Wealth-Building Potential?

Digital collectibles leverage blockchain technology, offering unique ownership and scarcity that can drive significant appreciation in value over time. Traditional assets like real estate and stocks provide foundational stability and proven long-term growth, often benefiting from regulatory frameworks and market liquidity. Future wealth-building potential depends on integrating digital collectibles within diversified portfolios, capitalizing on their innovation while maintaining the steady returns of conventional assets.

Related Important Terms

Tokenized Assets

Tokenized assets represent ownership in real-world assets such as real estate or commodities, offering liquidity and fractional investment opportunities that traditional digital collectibles often lack. Unlike digital collectibles, tokenized assets provide more stable value appreciation and regulatory oversight, making them a more reliable vehicle for wealth building.

Fractional Ownership NFTs

Fractional Ownership NFTs enable diversified investment portfolios by dividing high-value assets into tradable digital shares, enhancing liquidity and accessibility compared to traditional assets. This innovative approach leverages blockchain technology to democratize wealth building, allowing investors to own fractions of real estate, art, or collectibles without requiring full asset acquisition.

Digital Twin Securities

Digital Twin Securities represent a transformative asset class that merges the tangibility of traditional assets with the liquidity and programmability of digital collectibles, enabling fractional ownership and enhanced market accessibility for wealth building. Unlike conventional assets, these blockchain-backed digital twins provide verifiable provenance, real-time trading capabilities, and increased transparency, positioning them as a critical innovation in asset diversification and portfolio optimization.

On-chain Asset Valuation

On-chain asset valuation leverages blockchain transparency to accurately assess digital collectibles' market value, providing immutable proof of ownership and transaction history. This enhanced verifiability distinguishes digital collectibles from traditional assets, enabling more precise wealth-building strategies through real-time liquidity and fractional ownership opportunities.

Smart Contract Collateralization

Smart Contract Collateralization enables assets to be securely tokenized and leveraged as collateral, enhancing liquidity and unlocking new avenues for wealth building. Unlike traditional digital collectibles, such tokenized assets provide verifiable ownership and programmable enforcement, making them more reliable for financial applications and asset-backed lending.

Phygital Collectibles

Phygital collectibles combine the tangibility of physical assets with the liquidity and verifiability of digital assets, offering a unique blend for wealth building by bridging traditional asset ownership and blockchain technology. This hybrid model enhances diversification and asset security, positioning phygital collectibles as a promising alternative to purely digital or physical investments in the evolving asset landscape.

Dynamic Digital Assets

Dynamic digital assets, such as programmable NFTs and tokenized real estate, offer enhanced liquidity and customizable features compared to traditional digital collectibles, enabling more strategic wealth building. Unlike static collectibles, these assets adapt to market conditions and user interactions, driving potential appreciation and diversified investment portfolios.

Utility-backed NFT Assets

Utility-backed NFT assets provide tangible value by offering exclusive access, rights, or services, distinguishing them from traditional digital collectibles that often lack inherent utility. Integrating utility into NFT assets enhances their potential for wealth building by fostering continuous demand and unlocking real-world applications in finance, gaming, and intellectual property.

Real World Asset (RWA) Tokenization

Real World Asset (RWA) tokenization transforms physical assets like real estate, commodities, and art into digital tokens, offering increased liquidity and fractional ownership compared to traditional assets. Unlike digital collectibles, which often hold speculative value, RWA tokens provide tangible wealth-building opportunities by directly linking blockchain technology to real-world market value and cash flow generation.

NFT-Backed Lending

NFT-backed lending leverages digital collectibles as collateral, enabling asset owners to unlock liquidity without selling their NFTs. This innovative financial service bridges traditional asset management and blockchain technology, enhancing wealth-building opportunities through decentralized finance.

Asset vs Digital Collectible for wealth building. Infographic

moneydiff.com

moneydiff.com