Asset management involves allocating resources to traditional financial assets like stocks and bonds, emphasizing stable returns and liquidity. Green assets prioritize investments in environmentally sustainable projects, integrating ESG criteria to support long-term ecological benefits while aiming for financial growth. Choosing between asset and green asset management depends on balancing financial goals with environmental impact considerations.

Table of Comparison

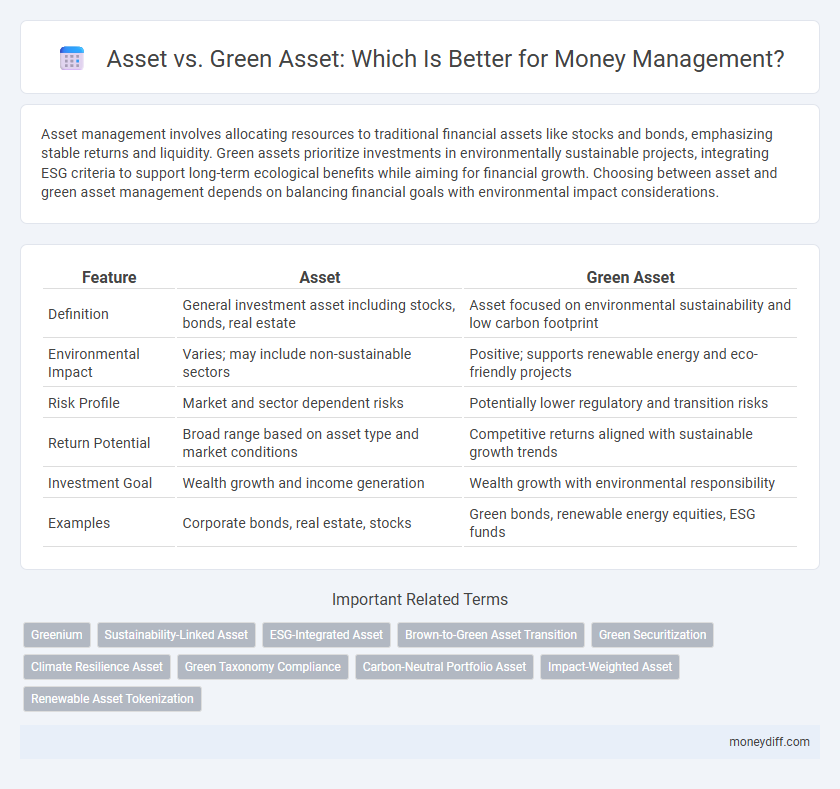

| Feature | Asset | Green Asset |

|---|---|---|

| Definition | General investment asset including stocks, bonds, real estate | Asset focused on environmental sustainability and low carbon footprint |

| Environmental Impact | Varies; may include non-sustainable sectors | Positive; supports renewable energy and eco-friendly projects |

| Risk Profile | Market and sector dependent risks | Potentially lower regulatory and transition risks |

| Return Potential | Broad range based on asset type and market conditions | Competitive returns aligned with sustainable growth trends |

| Investment Goal | Wealth growth and income generation | Wealth growth with environmental responsibility |

| Examples | Corporate bonds, real estate, stocks | Green bonds, renewable energy equities, ESG funds |

Understanding Traditional Assets in Money Management

Traditional assets in money management primarily include stocks, bonds, real estate, and cash equivalents, which offer liquidity and established market valuation. These assets generate returns through dividends, interest, or capital appreciation, forming the foundation of many investment portfolios. Understanding the risk, yield, and market behavior of traditional assets is essential before considering the sustainable benefits of green assets.

What Defines a Green Asset?

A green asset is defined by its contribution to environmental sustainability, such as investments in renewable energy, energy-efficient technologies, or projects that reduce carbon emissions. Unlike traditional assets, green assets prioritize ecological impact alongside financial returns, aligning with ESG (Environmental, Social, and Governance) criteria. This focus on sustainability helps investors support the transition to a low-carbon economy while managing risk associated with environmental regulations.

Key Differences Between Asset and Green Asset

Assets represent any resource with economic value owned by an individual or company, including stocks, bonds, real estate, and cash. Green assets specifically refer to investments in environmentally sustainable projects or companies, such as renewable energy, clean technology, and sustainable agriculture. The key differences lie in their environmental impact focus, regulatory incentives often associated with green assets, and growing demand driven by climate-conscious investors seeking both financial returns and positive ecological outcomes.

Financial Performance: Traditional vs. Green Assets

Traditional assets often yield stable financial returns driven by established markets and predictable cash flows, while green assets may present higher volatility but offer growth potential through sustainability incentives and regulatory support. Green assets, including renewable energy projects and environmentally-focused investments, attract increasing capital due to rising demand for responsible investment aligned with ESG criteria. Financial performance comparison reveals that though traditional assets typically prioritize short-term gains, green assets emphasize long-term value creation through reduced risk exposure and alignment with global climate goals.

Risk Factors: Asset vs. Green Asset

Traditional assets often carry risks linked to market volatility, regulatory changes, and environmental liabilities. Green assets typically present lower long-term regulatory risks due to alignment with sustainable policies but may face unique challenges like technology adoption and evolving environmental standards. Risk assessment in money management must balance potential returns against these differing factors to optimize portfolio resilience.

Sustainable Investment Strategies with Green Assets

Green assets prioritize environmental sustainability by incorporating renewable energy, low-carbon technologies, and eco-friendly infrastructure, aligning with global climate goals. Sustainable investment strategies leverage green assets to reduce carbon footprints while aiming for competitive financial returns, balancing economic growth with ecological responsibility. Integrating green assets into portfolios enhances risk management by addressing regulatory shifts and growing demand for climate-conscious investments.

Regulatory Impact on Asset and Green Asset Choices

Regulatory frameworks increasingly favor green assets by offering incentives such as tax breaks, subsidies, and stricter compliance requirements for traditional assets, driving investors to prioritize environmentally sustainable investments. Financial institutions must integrate environmental risk assessments and disclosure standards, as non-compliance with evolving regulations can result in penalties and reduced asset liquidity. The shift in regulatory policies accelerates capital allocation toward green assets, enhancing their market value and influencing portfolio management strategies within asset management sectors.

Portfolio Diversification: Balancing Assets and Green Assets

Portfolio diversification involves balancing traditional assets such as stocks and bonds with green assets like renewable energy investments and sustainable infrastructure. Allocating capital to green assets can reduce environmental risk while potentially enhancing long-term returns in a low-carbon economy. Integrating both asset types helps achieve financial stability and supports ESG (Environmental, Social, and Governance) criteria for responsible money management.

Long-Term Value: Green Asset Returns vs. Conventional Assets

Green assets demonstrate superior long-term value through sustainable returns driven by increasing environmental regulations and growing consumer demand for eco-friendly solutions. These assets tend to outperform conventional financial instruments by mitigating climate-related risks and capitalizing on the transition to a low-carbon economy. Investors prioritizing green assets benefit from enhanced portfolio resilience and consistent growth aligned with global sustainability targets.

Future Trends in Money Management: Green Assets Rise

Green assets, including renewable energy investments and sustainable infrastructure, are increasingly prioritized in money management due to growing environmental concerns and regulatory pressures. Traditional assets often face heightened risks from climate change, prompting investors to shift towards green assets for long-term resilience and positive environmental impact. The rise of green bonds and ESG-focused funds illustrates a major future trend in capital allocation favoring sustainable finance.

Related Important Terms

Greenium

Green assets often command a premium known as Greenium, reflecting investors' willingness to pay higher prices for environmentally responsible investments compared to traditional assets. This price differential highlights the growing demand in sustainable finance for assets that generate positive environmental impact alongside financial returns.

Sustainability-Linked Asset

Sustainability-linked assets are financial instruments tied to environmental, social, and governance (ESG) performance, differentiating them from traditional assets by integrating sustainability criteria into money management. These assets drive capital towards projects with measurable sustainability outcomes, aligning investment strategies with long-term environmental goals and corporate responsibility.

ESG-Integrated Asset

ESG-integrated assets incorporate environmental, social, and governance criteria into traditional asset management, enhancing risk-adjusted returns compared to conventional assets. Investing in green assets emphasizes sustainable projects and technologies, aligning portfolios with long-term global climate goals while managing financial performance.

Brown-to-Green Asset Transition

The Brown-to-Green Asset Transition involves reallocating investments from carbon-intensive, traditional Brown assets to sustainable, environmentally-friendly Green assets to reduce climate risks and enhance long-term financial returns. Emphasizing renewable energy projects, green bonds, and low-carbon infrastructure, this transition supports decarbonization goals and aligns portfolio strategies with global environmental regulations and investor demand for sustainable finance.

Green Securitization

Green securitization transforms traditional assets into eco-friendly financial instruments by pooling green loans or sustainable projects into asset-backed securities. This approach enhances capital flow to renewable energy, energy efficiency, and other environmentally beneficial sectors while minimizing carbon risks in investment portfolios.

Climate Resilience Asset

Climate resilience assets are investments specifically designed to withstand and mitigate risks associated with climate change, offering enhanced long-term stability compared to traditional assets. These green assets integrate environmental sustainability metrics, driving capital toward infrastructure and technologies that support adaptive capacity and reduce vulnerability to climate-related disruptions.

Green Taxonomy Compliance

Green assets comply with the EU Green Taxonomy, ensuring investments support environmentally sustainable economic activities and meet rigorous criteria for reducing climate impact. Traditional assets may lack this compliance, making green assets crucial for aligning portfolios with sustainable finance regulations and advancing responsible money management.

Carbon-Neutral Portfolio Asset

Carbon-neutral portfolio assets prioritize investments in renewable energy, green bonds, and sustainable infrastructure, significantly reducing carbon footprints compared to traditional assets. Integrating green assets into money management strategies enhances environmental impact while maintaining strong financial returns.

Impact-Weighted Asset

Impact-weighted assets integrate environmental, social, and governance (ESG) metrics into traditional asset valuations, enabling investors to quantify the positive and negative externalities of their portfolios. This approach enhances money management by prioritizing green assets that deliver measurable sustainability benefits alongside financial returns.

Renewable Asset Tokenization

Renewable asset tokenization transforms traditional assets into digital green assets, enabling fractional ownership and increasing liquidity in sustainable investments. This innovation drives efficient capital allocation towards renewable energy projects, enhancing transparency and fostering environmental impact in money management strategies.

Asset vs Green Asset for money management. Infographic

moneydiff.com

moneydiff.com