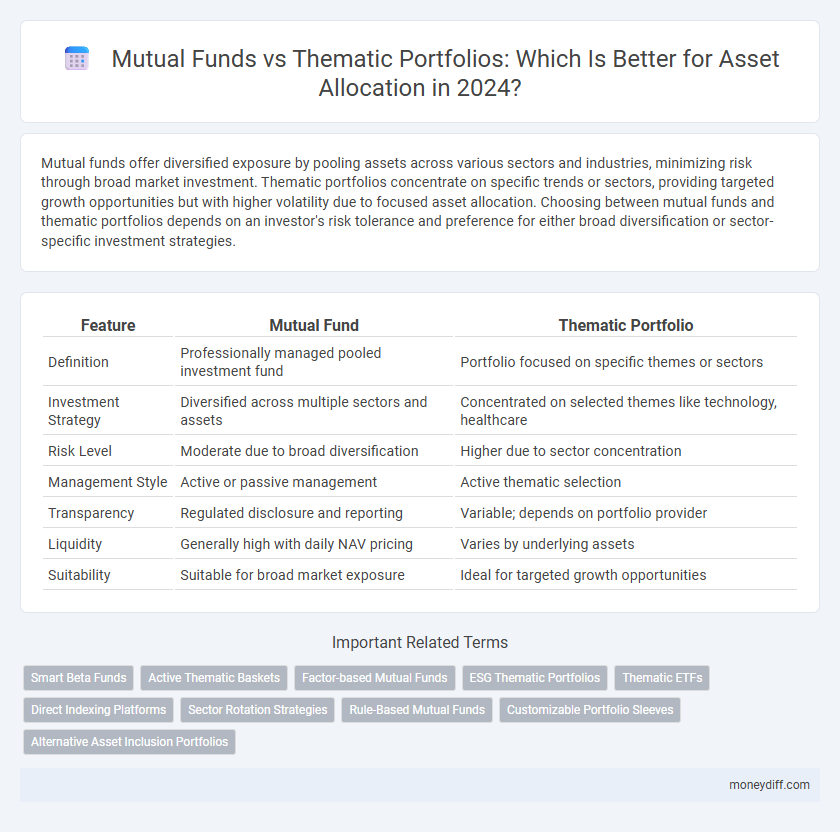

Mutual funds offer diversified exposure by pooling assets across various sectors and industries, minimizing risk through broad market investment. Thematic portfolios concentrate on specific trends or sectors, providing targeted growth opportunities but with higher volatility due to focused asset allocation. Choosing between mutual funds and thematic portfolios depends on an investor's risk tolerance and preference for either broad diversification or sector-specific investment strategies.

Table of Comparison

| Feature | Mutual Fund | Thematic Portfolio |

|---|---|---|

| Definition | Professionally managed pooled investment fund | Portfolio focused on specific themes or sectors |

| Investment Strategy | Diversified across multiple sectors and assets | Concentrated on selected themes like technology, healthcare |

| Risk Level | Moderate due to broad diversification | Higher due to sector concentration |

| Management Style | Active or passive management | Active thematic selection |

| Transparency | Regulated disclosure and reporting | Variable; depends on portfolio provider |

| Liquidity | Generally high with daily NAV pricing | Varies by underlying assets |

| Suitability | Suitable for broad market exposure | Ideal for targeted growth opportunities |

Understanding Mutual Funds: Key Features and Benefits

Mutual funds pool investments from multiple investors to create a diversified portfolio managed by professional fund managers, offering access to a wide range of asset classes such as equities, bonds, and money markets. They provide liquidity, regulatory oversight, and cost-efficiency through economies of scale, making them suitable for various risk appetites and financial goals. In contrast to thematic portfolios, mutual funds emphasize broad diversification and risk management, which can enhance long-term wealth accumulation for investors.

Decoding Thematic Portfolios: An Overview

Mutual funds diversify investments across various sectors and asset classes, offering balanced risk and steady returns, while thematic portfolios concentrate on specific market trends or sectors such as technology or sustainability, targeting higher growth potential. Thematic portfolios require deep market insight and active management to capitalize on emerging opportunities, making them suitable for investors with a higher risk tolerance. Understanding the underlying themes, along with historical performance and sector volatility, is essential for optimizing asset allocation between mutual funds and thematic portfolios.

Risk Assessment: Comparing Mutual Funds and Thematic Portfolios

Mutual funds offer diversified exposure across sectors and asset classes, reducing unsystematic risk through professional management and regulatory oversight. Thematic portfolios concentrate investments in specific trends or sectors, increasing volatility and sector-specific risk but providing targeted growth potential. Investors must evaluate risk tolerance and investment horizon carefully, as thematic portfolios inherently carry higher market and theme-related risks compared to the broader diversification of mutual funds.

Portfolio Diversification: Mutual Funds vs Thematic Investing

Mutual funds provide extensive portfolio diversification by pooling assets across various sectors, reducing overall investment risk through broad market exposure. Thematic portfolios concentrate investments in specific sectors or trends, offering targeted exposure but increasing sector-specific risk. Investors seeking balanced risk mitigation typically prefer mutual funds, while those aiming for high-growth potential in niche areas may opt for thematic investing.

Performance Evaluation: Historical Returns and Growth Potential

Mutual funds typically offer diversified exposure across multiple sectors, resulting in steadier historical returns and reduced volatility compared to thematic portfolios, which concentrate on specific trends or industries and may exhibit higher growth potential but increased risk. Performance evaluation of mutual funds often emphasizes consistent returns and risk-adjusted metrics like Sharpe ratio, whereas thematic portfolios require analysis of sector-specific growth drivers and cyclical trends to assess future performance. Investors should compare historical CAGR, alpha generation, and drawdown levels to determine alignment with their risk tolerance and investment objectives.

Cost Structure: Fees and Charges Explained

Mutual funds typically charge expense ratios ranging from 0.5% to 2%, covering management and administrative fees, while thematic portfolios often incur higher costs due to specialized asset selection and active management. Investors should consider front-end or back-end load fees in mutual funds, whereas thematic portfolios may impose performance fees that impact overall returns. Understanding these cost structures helps in assessing long-term investment efficiency and aligning asset allocation with financial goals.

Investment Flexibility: Redemption and Liquidity Options

Mutual funds offer high liquidity with daily redemption options, allowing investors to easily access their money at prevailing net asset values. Thematic portfolios, while potentially offering targeted exposure to specific sectors or trends, often come with longer lock-in periods or limited redemption windows, affecting liquidity. Investors seeking flexible exit strategies generally prefer mutual funds due to their transparent and frequent redemption policies.

Tax Implications for Mutual Funds and Thematic Portfolios

Mutual funds benefit from favorable tax treatment, including long-term capital gains taxed at 10% beyond a Rs1 lakh exemption and indexation benefits for debt funds, optimizing post-tax returns. Thematic portfolios, often structured as equity-oriented investments or sector-specific funds, face similar capital gains tax rates but may incur higher short-term capital gains taxes if portfolios are actively traded. Understanding these tax nuances is crucial for investors aiming to maximize after-tax wealth in both mutual funds and thematic portfolios.

Suitability: Identifying the Right Option for Different Investors

Mutual funds suit investors seeking diversified exposure with professional management and lower risk tolerance, offering a balanced asset allocation across sectors. Thematic portfolios cater to investors aiming for targeted growth in specific industries or trends, accepting higher volatility and sector concentration. Assessing individual risk appetite, investment horizon, and financial goals ensures selecting the most appropriate asset for optimal portfolio performance.

Future Trends: The Evolving Landscape of Asset Management

Mutual funds continue to offer diversified risk management and ease of access, but thematic portfolios are gaining traction by targeting specific sectors aligned with emerging technologies and sustainability trends. The future of asset management will likely emphasize customization, with thematic portfolios allowing investors to capitalize on growth areas such as clean energy, artificial intelligence, and biotechnology. Advanced analytics and AI-driven platforms are transforming portfolio strategies, enabling more precise asset allocation and real-time adaptation to market shifts.

Related Important Terms

Smart Beta Funds

Smart Beta Funds combine systematic strategies with factor-based investing to deliver enhanced risk-adjusted returns compared to traditional Mutual Funds and Thematic Portfolios, which often rely on market capitalization or sector trends. These funds optimize asset allocation by targeting specific investment factors such as value, momentum, or volatility, providing a more disciplined approach to portfolio construction and potentially improving diversification and performance stability.

Active Thematic Baskets

Active thematic baskets within mutual funds offer targeted exposure to high-growth sectors by dynamically adjusting holdings based on market trends and sector performance, optimizing asset allocation for enhanced returns. These baskets combine the diversification benefits of mutual funds with the focused investment strategy of thematic portfolios, allowing investors to capitalize on specific themes while managing risk effectively.

Factor-based Mutual Funds

Factor-based mutual funds strategically invest in assets exhibiting specific factors such as value, momentum, or quality, providing diversified exposure within a mutual fund framework. Thematic portfolios concentrate on trends or sectors but often carry higher volatility and less diversification compared to factor-based mutual funds, which leverage quantitative models for risk-adjusted returns.

ESG Thematic Portfolios

Mutual funds offer diversified asset allocations managed by professionals, while ESG thematic portfolios specifically target investments aligned with environmental, social, and governance criteria, catering to investors seeking sustainable impact alongside financial returns. ESG thematic portfolios emphasize sectors such as renewable energy, clean technology, and social equity, providing focused exposure to companies driving positive sustainability outcomes.

Thematic ETFs

Thematic ETFs offer targeted exposure to specific sectors or trends, providing investors with a focused asset allocation that aligns with evolving market themes, unlike broad-based mutual funds that aim for diversified holdings. These exchange-traded funds combine the liquidity and transparency of traditional ETFs with the strategic advantage of thematic investing, often resulting in potentially higher returns tied to innovation-driven growth areas.

Direct Indexing Platforms

Direct indexing platforms enable investors to customize mutual fund-like portfolios with thematic asset allocations, offering tax efficiency and personalized exposure to sectors or ESG criteria. Unlike traditional mutual funds, these platforms provide granular control over individual securities, enhancing diversification and alignment with specific investment themes.

Sector Rotation Strategies

Mutual funds offer diversified exposure across multiple sectors with professional management, while thematic portfolios concentrate investments in specific themes or sectors, enabling targeted sector rotation strategies to capitalize on market cycles. Sector rotation in thematic portfolios allows investors to dynamically shift assets toward outperforming sectors, enhancing potential returns compared to the broader allocation approach of mutual funds.

Rule-Based Mutual Funds

Rule-based mutual funds implement predefined investment criteria to manage assets systematically, reducing emotional bias and enhancing portfolio discipline. Unlike thematic portfolios that concentrate on specific sectors or trends, rule-based mutual funds offer diversified exposure while adhering to strict algorithmic guidelines, optimizing risk-adjusted returns.

Customizable Portfolio Sleeves

Mutual funds offer professionally managed asset pools with broad diversification, while thematic portfolios allow investors to customize portfolio sleeves targeting specific sectors or trends such as technology, healthcare, or sustainability. Customizable portfolio sleeves enhance asset allocation flexibility by enabling tailored exposure within a thematic framework, optimizing risk-adjusted returns aligned with individual investment goals.

Alternative Asset Inclusion Portfolios

Mutual funds offer diversified exposure across various sectors and asset classes, providing steady returns through professionally managed portfolios, while thematic portfolios concentrate on specific trends or industries, enabling targeted investment strategies with potential for higher growth. Inclusion of alternative assets such as real estate, commodities, or private equity in these portfolios enhances risk-adjusted returns and adds diversification beyond traditional equity and fixed income instruments.

Mutual Fund vs Thematic Portfolio for asset. Infographic

moneydiff.com

moneydiff.com