Asset investment in real estate provides tangible ownership and long-term appreciation, while tokenized real estate offers fractional ownership with increased liquidity and accessibility. Combining traditional assets with tokenized real estate enhances portfolio diversification by balancing stability and flexibility. This hybrid approach lowers entry barriers and distributes risk across both physical properties and blockchain-based tokens.

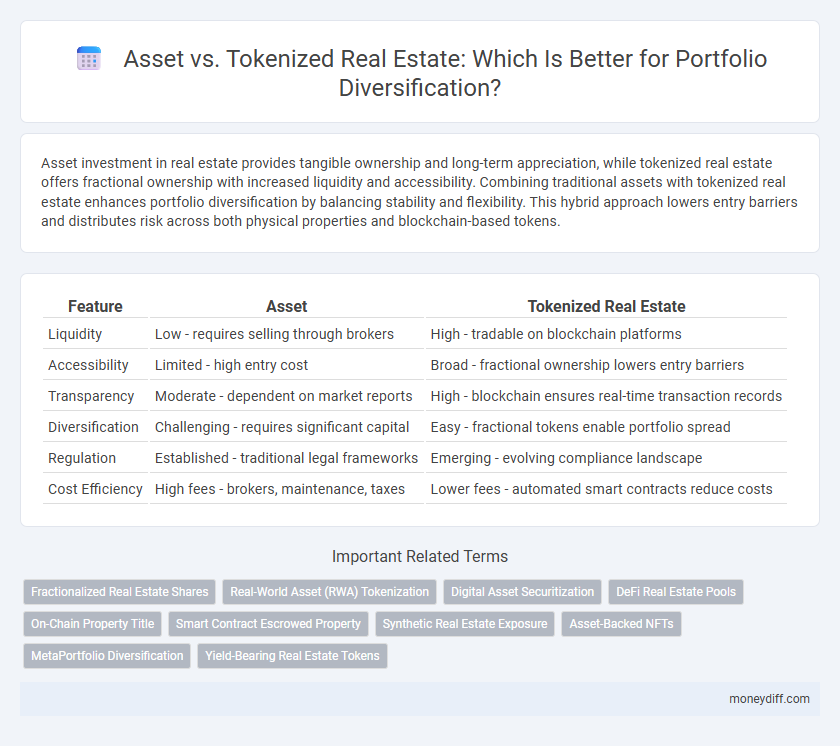

Table of Comparison

| Feature | Asset | Tokenized Real Estate |

|---|---|---|

| Liquidity | Low - requires selling through brokers | High - tradable on blockchain platforms |

| Accessibility | Limited - high entry cost | Broad - fractional ownership lowers entry barriers |

| Transparency | Moderate - dependent on market reports | High - blockchain ensures real-time transaction records |

| Diversification | Challenging - requires significant capital | Easy - fractional tokens enable portfolio spread |

| Regulation | Established - traditional legal frameworks | Emerging - evolving compliance landscape |

| Cost Efficiency | High fees - brokers, maintenance, taxes | Lower fees - automated smart contracts reduce costs |

Introduction to Asset and Tokenized Real Estate

Assets represent tangible or intangible resources with economic value, such as real estate, stocks, or bonds, which investors use to diversify portfolios and manage risk. Tokenized real estate digitizes property ownership by issuing blockchain-based tokens, enabling fractional investment and enhanced liquidity compared to traditional real estate assets. This innovation broadens access to real estate markets, allowing investors to diversify portfolios with lower capital and increased flexibility.

Key Differences Between Traditional Assets and Tokenized Real Estate

Traditional assets like stocks and bonds offer liquidity and regulatory clarity, while tokenized real estate leverages blockchain technology to provide fractional ownership and increased accessibility. Tokenized real estate enables smaller investment minimums and faster transaction settlements compared to conventional real estate, which often requires significant capital and lengthy processes. Diversification benefits arise as tokenized real estate adds exposure to tangible property markets with enhanced flexibility, contrasting the more static nature of traditional asset portfolios.

How Tokenization is Revolutionizing Real Estate Investment

Tokenized real estate transforms traditional asset ownership by converting property into digitized tokens, enabling fractional investment and increased liquidity within portfolios. This innovation lowers barriers to entry, offering investors diversified access to global real estate markets without the complexities of direct property management. Enhanced transparency and blockchain security further drive efficiency and trust in real estate investment diversification strategies.

Diversifying Portfolios with Traditional Assets

Traditional assets like real estate, stocks, and bonds provide stable portfolio diversification by offering tangible value and historical performance data. These assets reduce overall portfolio risk through low correlation with volatile markets and generate consistent income streams. Incorporating conventional real estate with stocks and fixed income enhances long-term growth and capital preservation in diversified investment portfolios.

Benefits of Tokenized Real Estate for Investors

Tokenized real estate offers investors enhanced liquidity by enabling fractional ownership and easier asset transfer on blockchain platforms. It reduces traditional barriers such as high entry costs and limited market access, allowing for broad portfolio diversification with smaller capital commitments. Transparent, secure, and efficient, tokenized assets empower investors to optimize risk management and seize new opportunities in global real estate markets.

Risk Analysis: Asset vs. Tokenized Real Estate

Traditional assets offer stable valuations grounded in tangible market history, whereas tokenized real estate introduces volatility through emerging blockchain technologies. Risk analysis reveals liquidity challenges and regulatory uncertainties unique to tokenized properties, while conventional real estate risks are often tied to market fluctuations and physical asset management. Diversifying portfolios with tokenized real estate requires careful assessment of cybersecurity risks, smart contract reliability, and fractional ownership complexities compared to traditional asset holdings.

Liquidity Comparison: Tokenized Real Estate vs. Conventional Assets

Tokenized real estate offers enhanced liquidity compared to conventional real estate assets due to fractional ownership and blockchain-enabled trading platforms, allowing investors to buy and sell shares swiftly. Conventional assets typically require lengthy transaction processes and higher capital commitments, limiting quick portfolio adjustments. The liquidity premium of tokenized real estate significantly improves portfolio diversification strategies by providing greater flexibility and faster access to capital.

Accessibility and Global Reach in Tokenized Real Estate

Tokenized real estate leverages blockchain technology to offer fractional ownership, significantly enhancing accessibility compared to traditional assets that require substantial capital and complex processes. This innovative approach allows investors worldwide to participate in real estate markets without geographic limitations, enabling a truly global investment portfolio. Increased liquidity and lower entry barriers in tokenized real estate facilitate diversified asset exposure and risk mitigation across international markets.

Regulatory Considerations for Tokenized and Traditional Assets

Regulatory considerations for tokenized real estate revolve around securities laws, anti-money laundering (AML) regulations, and investor protection frameworks that vary by jurisdiction, requiring compliance with digital asset legislation. Traditional assets are governed by established regulatory bodies like the SEC or FCA, ensuring robust oversight but often involving slower transaction processes. Understanding these regulatory landscapes is crucial for investors seeking portfolio diversification through tokenized or traditional assets to mitigate compliance risks and optimize legal security.

Strategic Portfolio Diversification: Choosing the Right Mix

Strategic portfolio diversification requires balancing traditional assets with tokenized real estate to optimize risk and return profiles. Tokenized real estate offers fractional ownership, enhanced liquidity, and access to global markets, complementing conventional real estate and financial instruments in a diversified portfolio. Integrating both asset classes strategically enhances capital allocation efficiency and mitigates market volatility.

Related Important Terms

Fractionalized Real Estate Shares

Fractionalized real estate shares enable investors to diversify portfolios by acquiring smaller, tradable portions of high-value properties, reducing capital entry barriers compared to traditional full-asset ownership. Tokenized real estate combines blockchain technology with fractional ownership, enhancing liquidity and transparency while offering scalable exposure across global markets.

Real-World Asset (RWA) Tokenization

Tokenized real estate enables fractional ownership of high-value real-world assets (RWAs), enhancing portfolio diversification by providing liquidity and access to previously illiquid markets. Unlike traditional assets, RWA tokenization leverages blockchain technology to offer transparent, secure, and efficient investment in real estate, reducing barriers and enabling global participation.

Digital Asset Securitization

Digital asset securitization transforms traditional real estate into tokenized securities, enabling fractional ownership and enhanced liquidity for diversified portfolios. Tokenized real estate leverages blockchain technology to offer transparent, efficient asset management and broader access to global investors compared to conventional physical asset investments.

DeFi Real Estate Pools

DeFi real estate pools enable fractional ownership of tokenized real estate assets, offering enhanced liquidity and portfolio diversification compared to traditional real estate investments. These pools leverage blockchain technology to provide seamless access to diverse property-backed tokens, reducing entry barriers and increasing capital efficiency for investors.

On-Chain Property Title

On-chain property titles enable direct ownership verification and enhanced transparency, reducing fraud risks compared to traditional asset holdings. Tokenized real estate facilitates fractional ownership and liquidity, allowing investors to diversify portfolios with smaller capital increments while maintaining secure, immutable property records on the blockchain.

Smart Contract Escrowed Property

Smart Contract Escrowed Property leverages blockchain technology to securely automate transactions and ownership transfers, reducing counterparty risks and increasing transparency compared to traditional assets. Tokenized real estate enables fractional ownership and liquidity in portfolios, enhancing diversification while maintaining compliance and efficient asset management through programmable escrow agreements.

Synthetic Real Estate Exposure

Synthetic real estate exposure offers portfolio diversification by providing asset-like benefits without direct property ownership, allowing investors to access real estate market performance through tokenized derivatives and blockchain-based platforms. Unlike traditional assets, these synthetic tokens enhance liquidity, reduce entry barriers, and enable fractional investment in diverse real estate indexes and projects.

Asset-Backed NFTs

Asset-backed NFTs in tokenized real estate enable fractional ownership, enhancing liquidity and accessibility compared to traditional assets. This innovation diversifies portfolios by combining the tangible value of real estate with the digital flexibility of blockchain technology.

MetaPortfolio Diversification

MetaPortfolio diversification enhances investment strategies by integrating traditional assets with tokenized real estate, enabling broader exposure and liquidity. Tokenized real estate within a MetaPortfolio allows fractional ownership and seamless trading, optimizing risk distribution compared to conventional asset-only portfolios.

Yield-Bearing Real Estate Tokens

Yield-bearing real estate tokens offer enhanced portfolio diversification by combining the liquidity and fractional ownership benefits of digital assets with the income generation of traditional real estate investments. These tokens provide consistent rental yields and potential capital appreciation, making them a compelling alternative to conventional asset holdings in diversified investment strategies.

Asset vs Tokenized Real Estate for portfolio diversification. Infographic

moneydiff.com

moneydiff.com