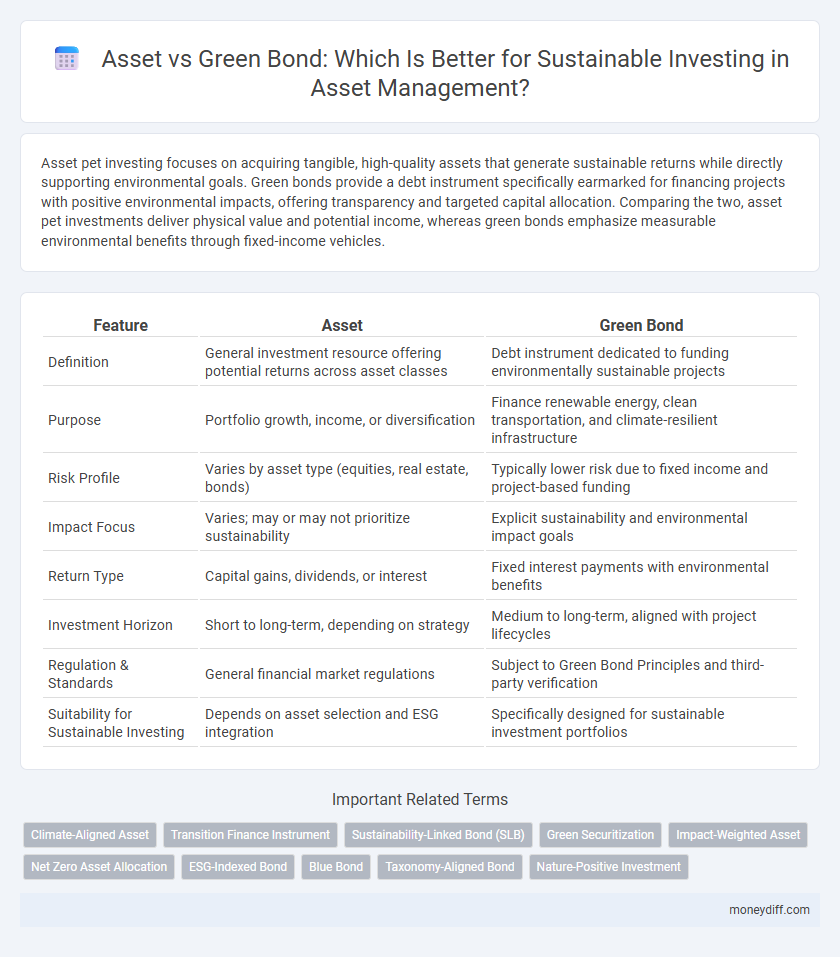

Asset pet investing focuses on acquiring tangible, high-quality assets that generate sustainable returns while directly supporting environmental goals. Green bonds provide a debt instrument specifically earmarked for financing projects with positive environmental impacts, offering transparency and targeted capital allocation. Comparing the two, asset pet investments deliver physical value and potential income, whereas green bonds emphasize measurable environmental benefits through fixed-income vehicles.

Table of Comparison

| Feature | Asset | Green Bond |

|---|---|---|

| Definition | General investment resource offering potential returns across asset classes | Debt instrument dedicated to funding environmentally sustainable projects |

| Purpose | Portfolio growth, income, or diversification | Finance renewable energy, clean transportation, and climate-resilient infrastructure |

| Risk Profile | Varies by asset type (equities, real estate, bonds) | Typically lower risk due to fixed income and project-based funding |

| Impact Focus | Varies; may or may not prioritize sustainability | Explicit sustainability and environmental impact goals |

| Return Type | Capital gains, dividends, or interest | Fixed interest payments with environmental benefits |

| Investment Horizon | Short to long-term, depending on strategy | Medium to long-term, aligned with project lifecycles |

| Regulation & Standards | General financial market regulations | Subject to Green Bond Principles and third-party verification |

| Suitability for Sustainable Investing | Depends on asset selection and ESG integration | Specifically designed for sustainable investment portfolios |

Understanding Asset Investment in Sustainable Finance

Asset investment in sustainable finance emphasizes acquiring tangible or intangible resources that generate long-term environmental and social value. Unlike green bonds, which are debt instruments earmarked specifically for financing eco-friendly projects, assets encompass a broader range including renewable energy facilities, sustainable real estate, and social infrastructure. Understanding the distinctions helps investors balance portfolio diversification with targeted impact goals in sustainable investing.

What Are Green Bonds? A Comprehensive Overview

Green bonds are fixed-income financial instruments specifically designed to fund projects with positive environmental benefits, such as renewable energy, clean transportation, and sustainable agriculture. Unlike traditional asset investment, green bonds provide investors with the opportunity to support sustainable development while receiving regular interest payments and principal repayment. This innovative financing mechanism enhances portfolio diversification by aligning investment strategies with environmental, social, and governance (ESG) criteria, making it a crucial asset class for sustainable investing.

Key Differences Between Assets and Green Bonds

Assets represent tangible or intangible resources owned by an investor, including real estate, stocks, or commodities, while green bonds are fixed-income instruments specifically issued to finance environmentally sustainable projects. Key differences lie in risk profile, liquidity, and purpose: assets offer diversified investment opportunities with varying risk and returns, whereas green bonds provide targeted funding for eco-friendly initiatives with relatively stable yields. Green bonds also include transparency requirements and environmental impact reporting, which distinguish them from traditional assets.

Environmental Impact: Asset vs Green Bond

Assets directly contribute to environmental impact through tangible investments in renewable energy, sustainable infrastructure, and eco-friendly technologies, driving measurable reductions in carbon emissions. Green bonds specifically finance projects with clear environmental benefits, ensuring capital allocation to initiatives promoting clean energy, waste reduction, and biodiversity protection. Compared to general assets, green bonds offer transparency and accountability through standardized reporting and third-party verification, enhancing their credibility in sustainable investing.

Risk and Return Profiles in Asset and Green Bond Investing

Assets in sustainable investing offer diversified risk and return profiles depending on their type, with conventional assets often presenting higher volatility but potentially greater returns. Green bonds provide more stable, fixed-income returns with lower risk, supported by the dedicated use of proceeds for environmental projects. Investors prioritize green bonds for risk-averse strategies seeking steady income alongside positive environmental impact, contrasting with asset classes that balance sustainability with higher growth potential and market exposure.

Market Trends: Growth of Assets and Green Bonds

The rapid expansion of sustainable investing has driven significant growth in both assets under management (AUM) and green bond issuance, reflecting increasing investor demand for eco-friendly financial products. Market data from 2023 highlights a surge in global assets allocated to ESG-focused funds, surpassing $40 trillion, while green bond issuance reached a record $520 billion, indicating robust market confidence and regulatory support. This parallel growth underscores a trend where traditional asset managers integrate green bonds to enhance portfolio sustainability and meet environmental, social, and governance (ESG) objectives.

Regulatory Frameworks for Sustainable Assets vs Green Bonds

Regulatory frameworks for sustainable assets often encompass broad criteria, including environmental, social, and governance (ESG) factors, while green bonds are governed by more specific standards such as the Green Bond Principles (GBP) and Climate Bonds Standard (CBS). Sustainable asset regulations involve disclosure requirements, taxonomy alignment, and ongoing impact assessments to ensure transparency and accountability across diverse asset classes. Green bonds benefit from targeted regulatory guidance that mandates the use of proceeds for environmentally beneficial projects, enhancing investor confidence and market integrity.

How to Choose: Asset Allocation or Green Bond Investing?

Choosing between asset allocation and green bond investing hinges on balancing risk, return, and sustainability goals. Asset allocation offers diversified exposure across sectors and geographies, optimizing risk-adjusted returns, while green bonds provide fixed income solutions specifically earmarked for environmental projects, enhancing the portfolio's impact on climate change mitigation. Investors prioritizing steady income and targeted ecological benefits may prefer green bonds, whereas those seeking broad market growth and risk diversification might favor strategic asset allocation incorporating sustainable assets.

Case Studies: Success Stories in Asset and Green Bond Investments

Case studies reveal that asset investments in renewable energy projects, such as solar farms in California, consistently outperform traditional portfolios by generating stable long-term returns while promoting environmental benefits. Green bonds issued by governments and corporations, including the Netherlands' green bond program, have successfully financed infrastructure improvements and reduced carbon emissions by directly linking capital to specific sustainability goals. These success stories demonstrate that both asset investments and green bonds serve as effective tools for sustainable investing, aligning financial performance with environmental impact.

Future Outlook: The Role of Assets and Green Bonds in Sustainable Investing

Assets and green bonds play complementary roles in sustainable investing, with assets providing diversified exposure to environmentally responsible companies while green bonds directly fund projects targeting climate change mitigation and renewable energy. The future outlook indicates growing institutional interest in green bonds due to their transparent impact metrics and fixed-income benefits, while sustainable assets continue to evolve through enhanced ESG integration and innovation. Increased regulatory support and investor demand are expected to accelerate the allocation of capital toward both green bonds and sustainability-focused asset classes.

Related Important Terms

Climate-Aligned Asset

Climate-aligned assets prioritize investments that directly support carbon reduction and environmental sustainability, offering measurable impacts aligned with global climate goals. Green bonds finance specific eco-friendly projects, but climate-aligned assets provide broader portfolio integration, enhancing long-term green investment strategies.

Transition Finance Instrument

Transition finance instruments, such as green bonds, enable investors to fund projects that facilitate the shift towards a low-carbon economy by targeting companies in carbon-intensive sectors. Unlike traditional assets, green bonds offer a clear framework for measuring environmental impact and aligning investment portfolios with sustainable development goals.

Sustainability-Linked Bond (SLB)

Sustainability-Linked Bonds (SLBs) differ from traditional green bonds by linking financial incentives directly to the issuer's achievement of pre-determined sustainability performance targets, rather than earmarking funds for specific green projects. This approach allows investors to support broader corporate sustainability goals, increasing the flexibility and impact of sustainable investing within diverse asset portfolios.

Green Securitization

Green securitization leverages financial assets like green bonds to pool and transform sustainable cash flows into tradable securities, enhancing liquidity and access to capital for eco-friendly projects. Compared to traditional green bonds, green securitization offers diversified risk exposure and scalable financing structures, accelerating investments in renewable energy, energy efficiency, and climate resilience.

Impact-Weighted Asset

Impact-weighted assets integrate environmental, social, and governance (ESG) metrics directly into financial valuation, offering a more comprehensive measure of sustainability compared to traditional green bonds, which primarily finance specific environmentally friendly projects. This approach enables investors to assess the true long-term impact and risk of their portfolios, fostering more effective allocation of capital toward sustainable development goals.

Net Zero Asset Allocation

Net Zero Asset Allocation prioritizes directing investments into assets that contribute to emissions reductions, contrasting with Green Bonds which specifically finance environmentally friendly projects. This strategic shift emphasizes long-term sustainability by optimizing asset portfolios towards low-carbon and climate-resilient holdings.

ESG-Indexed Bond

ESG-indexed bonds integrate environmental, social, and governance criteria directly into asset valuation, enhancing sustainable investing by linking bond returns to measurable ESG performance metrics. Compared to traditional green bonds, which finance specific eco-projects, ESG-indexed bonds offer diversified exposure to a broader range of responsible assets, aligning portfolio growth with sustainability outcomes.

Blue Bond

Blue Bonds specifically finance marine and ocean-related projects, offering targeted sustainable investment opportunities within the broader asset class of green bonds. These instruments channel capital towards conservation efforts, sustainable fisheries, and ocean health, differentiating them from general green bonds that cover a wider range of environmental initiatives.

Taxonomy-Aligned Bond

Taxonomy-aligned bonds, a subset of green bonds, comply with the EU taxonomy by exclusively financing environmentally sustainable projects, enhancing transparency and investor confidence in sustainable investing. Compared to general green bonds, these assets provide stricter assurance of ecological impact, aligning with regulatory frameworks to support the transition to a low-carbon economy.

Nature-Positive Investment

Nature-positive investments prioritize assets that actively restore biodiversity and ecosystem health, contrasting with green bonds which primarily finance projects with environmental benefits but may not guarantee direct positive biodiversity outcomes. By integrating nature-positive criteria, asset portfolios enhance long-term sustainability and resilience, driving measurable impact beyond traditional green bond frameworks.

Asset vs Green Bond for sustainable investing. Infographic

moneydiff.com

moneydiff.com