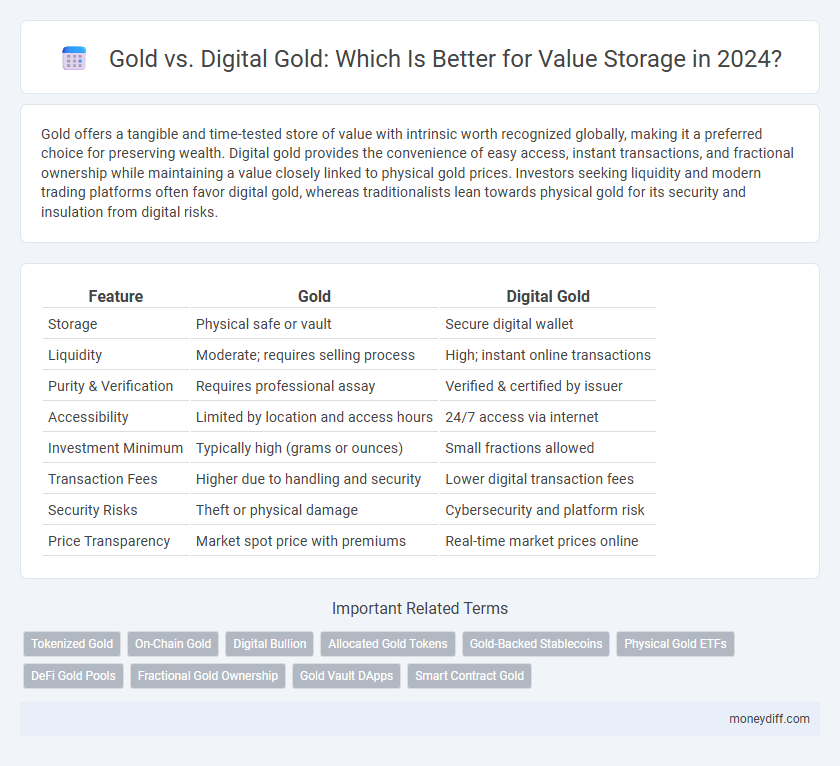

Gold offers a tangible and time-tested store of value with intrinsic worth recognized globally, making it a preferred choice for preserving wealth. Digital gold provides the convenience of easy access, instant transactions, and fractional ownership while maintaining a value closely linked to physical gold prices. Investors seeking liquidity and modern trading platforms often favor digital gold, whereas traditionalists lean towards physical gold for its security and insulation from digital risks.

Table of Comparison

| Feature | Gold | Digital Gold |

|---|---|---|

| Storage | Physical safe or vault | Secure digital wallet |

| Liquidity | Moderate; requires selling process | High; instant online transactions |

| Purity & Verification | Requires professional assay | Verified & certified by issuer |

| Accessibility | Limited by location and access hours | 24/7 access via internet |

| Investment Minimum | Typically high (grams or ounces) | Small fractions allowed |

| Transaction Fees | Higher due to handling and security | Lower digital transaction fees |

| Security Risks | Theft or physical damage | Cybersecurity and platform risk |

| Price Transparency | Market spot price with premiums | Real-time market prices online |

Understanding Gold as a Traditional Store of Value

Gold has long been recognized as a traditional store of value due to its intrinsic scarcity, physical tangibility, and historical stability against inflation and currency fluctuations. Unlike digital gold, which represents ownership through digital tokens or blockchain records, physical gold offers direct ownership without counterparty risk. Investors often turn to gold in times of economic uncertainty as a safe-haven asset that preserves wealth across generations.

What Is Digital Gold?

Digital gold represents a modern alternative to traditional gold investment by allowing users to buy and store ownership of gold in a digital format without the need for physical possession. This asset is typically backed by real gold held in secure vaults, enabling instant buy, sell, and transfer transactions online with lower entry barriers and enhanced liquidity. Digital gold platforms often provide transparent audits, fractional ownership, and reduced storage costs compared to physical gold, making it a convenient and efficient tool for value storage.

Key Differences Between Physical Gold and Digital Gold

Physical gold offers tangibility and intrinsic value as a finite precious metal, enabling direct ownership and use in jewelry or bars. Digital gold represents ownership through electronic certificates or tokens backed by physical gold, providing easy liquidity, lower transaction costs, and seamless online trading. Key differences lie in storage requirements, with physical gold needing secure safekeeping, while digital gold relies on digital wallets and platform security.

Security Aspects: Gold vs Digital Gold

Physical gold offers intrinsic security through its tangible nature, resistant to cyber threats and digital hacks, making it a reliable store of value during technological failures. Digital gold provides enhanced accessibility and instant liquidity but relies heavily on cybersecurity measures and trusted custodians to prevent fraud, hacking, and asset mismanagement. Investors prioritize security protocols, encryption standards, and regulatory compliance when evaluating digital gold platforms to mitigate risks compared to the time-tested security of physical gold.

Liquidity Comparison: Selling and Accessing Value

Gold offers high liquidity with a global market where physical assets can be sold directly through dealers, auctions, or exchanges, often requiring verification and transportation time. Digital gold provides instant access and ease of transaction via online platforms, enabling quick selling and transferring of value without physical handling. Although digital gold enhances liquidity through 24/7 market availability, physical gold may retain universal acceptance in certain markets despite longer settlement processes.

Cost Efficiency: Fees, Premiums, and Hidden Charges

Gold offers tangible value storage but often involves higher costs due to dealer premiums, storage fees, and insurance charges that can erode returns over time. Digital gold provides a cost-efficient alternative with lower transaction fees, minimal premiums, and reduced hidden charges by leveraging blockchain technology for secure, transparent ownership records. Investors seeking to optimize cost efficiency favor digital gold for its scalability and reduced overhead compared to physical gold assets.

Storage and Custodial Risks: Physical vs Digital

Gold offers tangible ownership with storage options including private vaults and insured safety deposit boxes, mitigating custodial risks through physical control. Digital gold depends on third-party custodians and blockchain security, exposing holders to cyber attacks, platform insolvency, and regulatory vulnerabilities. Evaluating storage solutions requires balancing physical safeguarding challenges against digital asset service reliability and technological risk factors.

Regulatory and Tax Implications

Gold remains a tangible asset with well-established regulatory frameworks and clearer tax implications, often subject to capital gains tax and specific import/export regulations. Digital gold, while offering ease of access and fractional ownership, faces evolving regulatory scrutiny around custody, anti-money laundering compliance, and ambiguity in tax treatment across jurisdictions. Investors must navigate these differences to optimize asset security and tax efficiency in their portfolio strategies.

Market Volatility and Price Stability

Gold has historically been a reliable asset for value storage due to its resistance to market volatility and long-term price stability. Digital gold, represented by blockchain-backed tokens, offers enhanced liquidity and ease of transaction but is subject to cryptocurrency market fluctuations and regulatory risks. Investors seeking stable value preservation may prefer physical gold, while those prioritizing accessibility might consider digital gold as a complementary asset.

Choosing the Best Option: Factors to Consider

Gold offers a tangible, historically stable store of value with intrinsic worth recognized globally, while digital gold provides accessibility, ease of transfer, and often lower transaction costs through blockchain technology. Key factors to consider include security protocols, liquidity, market volatility, regulatory environment, and personal investment goals. Assessing these elements helps investors determine whether the physical resilience of gold or the convenience and innovation of digital gold aligns best with their asset storage strategy.

Related Important Terms

Tokenized Gold

Tokenized gold offers a secure, transparent, and divisible alternative to physical gold, allowing investors to trade gold assets on blockchain platforms with lower barriers and enhanced liquidity. Unlike traditional gold, which requires storage and insurance costs, tokenized gold combines the intrinsic value of gold with the efficiency and accessibility of digital assets.

On-Chain Gold

On-chain gold offers transparent, secure, and easily transferable ownership of gold assets through blockchain technology, enhancing liquidity and reducing counterparty risk compared to physical gold. Digital gold tokens represent fractionalized real gold stored in vaults, enabling seamless global trading and instant settlement while preserving intrinsic value.

Digital Bullion

Digital bullion offers enhanced liquidity and secure, blockchain-verified ownership, making it a modern alternative to traditional physical gold for value storage. Unlike physical gold, digital bullion enables fractional investments and instant transactions, optimizing accessibility and portfolio diversification.

Allocated Gold Tokens

Allocated gold tokens offer a secure and transparent method of value storage by representing ownership of physical gold held in professional vaults, combining the stability of gold with the convenience of digital assets. Unlike traditional gold, these tokens provide instant liquidity, fractional ownership, and seamless transferability on blockchain platforms, making them an efficient alternative for diversifying investment portfolios.

Gold-Backed Stablecoins

Gold-backed stablecoins combine the intrinsic value stability of physical gold with the liquidity and accessibility of digital assets, offering a secure store of value resistant to market volatility. These tokens are increasingly preferred over traditional gold as they enable instant transactions and fractional ownership while maintaining price stability through real-world asset backing.

Physical Gold ETFs

Physical Gold ETFs offer investors direct exposure to tangible gold assets, combining the liquidity of digital trading with the security of holding physical bullion stored in secure vaults. Unlike digital gold, which represents ownership claims without physical delivery, Physical Gold ETFs provide transparency, lower counterparty risk, and can serve as an effective hedge against inflation and currency fluctuations in asset portfolios.

DeFi Gold Pools

Gold remains a historically stable asset for value storage, but DeFi Gold Pools offer enhanced liquidity and accessibility through tokenized digital gold on blockchain platforms. These decentralized finance mechanisms enable users to seamlessly trade, stake, and earn yields on digital gold assets, combining traditional gold's intrinsic value with the efficiency of digital finance.

Fractional Gold Ownership

Fractional gold ownership enables investors to purchase portions of physical gold, offering tangible asset security and long-term value preservation without the need for full-bar acquisition. Digital gold platforms leverage blockchain technology to provide fraud-proof, easily transferable, and instantly accessible gold shares, combining traditional asset stability with modern liquidity benefits.

Gold Vault DApps

Gold Vault DApps offer a decentralized platform for storing digital representations of physical gold, combining the intrinsic value of gold with blockchain transparency and security. These applications facilitate fractional ownership, instant transfers, and lower entry barriers compared to traditional gold investments, enhancing liquidity and accessibility for asset holders.

Smart Contract Gold

Smart Contract Gold leverages blockchain technology to provide transparent, secure, and easily divisible ownership compared to traditional physical gold, enabling efficient value storage and transfer. Unlike digital gold tokens backed by centralized custodians, smart contract gold operates on decentralized protocols, ensuring tamper-proof asset verification and reducing counterparty risks.

Gold vs Digital Gold for value storage Infographic

moneydiff.com

moneydiff.com