Physical collectibles offer tangible ownership that can be displayed, traded, and appreciated for their material value and craftsmanship. Digital collectibles provide verifiable authenticity and ease of transfer through blockchain technology, enabling secure ownership and global access without physical limitations. Both asset types have unique benefits, with physical collectibles emphasizing sensory engagement and digital collectibles prioritizing transparency and liquidity.

Table of Comparison

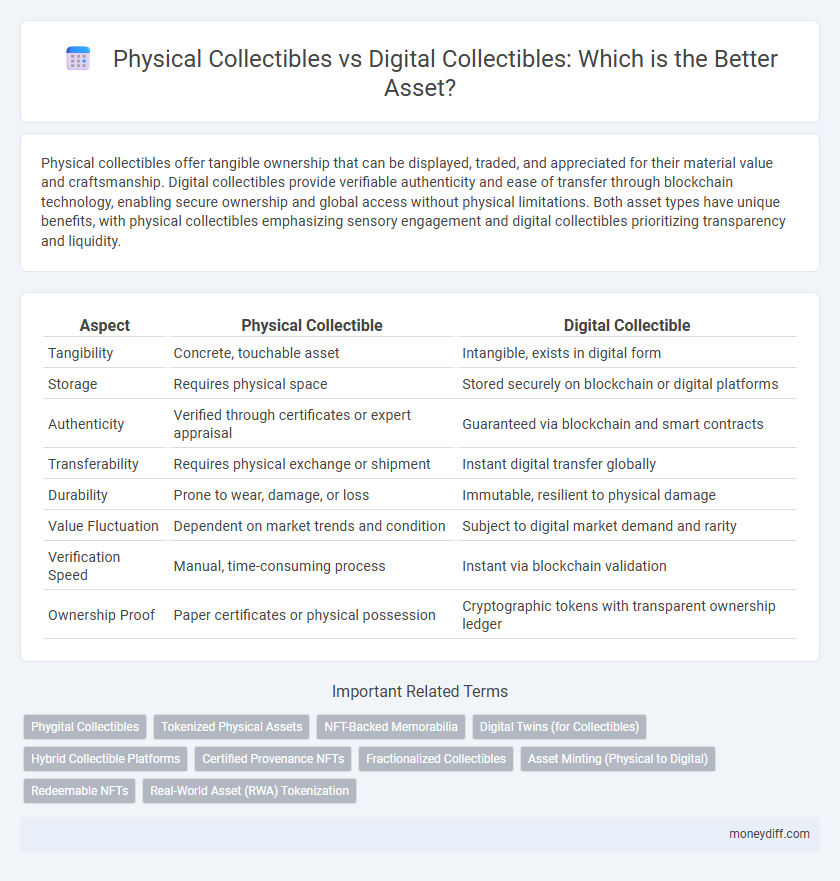

| Aspect | Physical Collectible | Digital Collectible |

|---|---|---|

| Tangibility | Concrete, touchable asset | Intangible, exists in digital form |

| Storage | Requires physical space | Stored securely on blockchain or digital platforms |

| Authenticity | Verified through certificates or expert appraisal | Guaranteed via blockchain and smart contracts |

| Transferability | Requires physical exchange or shipment | Instant digital transfer globally |

| Durability | Prone to wear, damage, or loss | Immutable, resilient to physical damage |

| Value Fluctuation | Dependent on market trends and condition | Subject to digital market demand and rarity |

| Verification Speed | Manual, time-consuming process | Instant via blockchain validation |

| Ownership Proof | Paper certificates or physical possession | Cryptographic tokens with transparent ownership ledger |

Introduction to Collectibles as Assets

Physical collectibles, such as coins, stamps, and rare toys, hold intrinsic value due to their tangible nature and historical significance, often appreciating over time as limited editions or vintage items. Digital collectibles, including NFTs and blockchain-based assets, leverage cryptographic authentication to establish provenance and scarcity in a virtual environment, transforming how ownership and asset transfer occur. Both forms represent unique investment opportunities within alternative asset classes, blending traditional collecting with innovative technology-driven markets.

Defining Physical Collectibles

Physical collectibles are tangible assets such as coins, stamps, or action figures that hold intrinsic value due to their rarity, condition, and historical significance. These assets require physical storage and maintenance to preserve their value over time. Their market value is often influenced by authenticity, provenance, and collector demand within established trading networks.

Understanding Digital Collectibles

Digital collectibles, secured by blockchain technology, offer verifiable ownership and provenance that physical collectibles cannot match, minimizing risks of forgery. They enable instant, global transferability and fractional ownership, expanding access to diverse asset markets. Unlike physical collectibles, digital assets provide enhanced liquidity and integration with virtual ecosystems and decentralized finance platforms.

Tangibility and Storage Considerations

Physical collectibles offer tangible ownership that can be directly handled and displayed, providing sensory value and a unique presence. Digital collectibles, stored on blockchain or cloud platforms, eliminate physical space constraints and enable easy transferability but may depend on technology and network security. Each option presents distinct considerations in terms of asset tangibility and storage requirements, influencing choice based on personal preferences and risk tolerance.

Authenticity and Verification Methods

Physical collectibles rely on traditional authentication methods such as certificates of authenticity, expert appraisals, and unique markings that verify provenance and prevent counterfeiting. Digital collectibles utilize blockchain technology, providing immutable proof of ownership and authenticity through decentralized ledger records, which are easily verifiable and resistant to fraud. These contrasting verification methods influence asset security, with digital collectibles offering enhanced transparency and tracking compared to physical counterparts.

Liquidity and Marketplaces

Physical collectibles often face limited liquidity due to geographic constraints and dependency on in-person transactions through auctions or specialty stores. Digital collectibles leverage blockchain technology, enabling instant ownership transfers and access to a global marketplace such as OpenSea or Rarible, significantly increasing liquidity. Marketplaces for digital assets provide real-time pricing and broader buyer networks, enhancing market efficiency compared to physical collectibles.

Risks and Security Factors

Physical collectibles face risks such as theft, environmental damage, and deterioration over time, requiring secure storage and insurance to protect their value. Digital collectibles, often secured through blockchain technology, minimize physical vulnerabilities but face cybersecurity threats like hacking, wallet loss, and fraud. Both asset types demand distinct security strategies to safeguard ownership and maintain asset integrity.

Value Appreciation and Volatility

Physical collectibles often retain intrinsic value due to their tangible nature and rarity, leading to relatively stable value appreciation over time. Digital collectibles, such as NFTs, can experience rapid value fluctuations driven by market demand and technological trends, resulting in higher volatility. Investors seeking long-term asset growth may prefer physical collectibles for consistency, while digital collectibles appeal to those tolerating greater risk for potential high rewards.

Legal and Regulatory Perspectives

Physical collectibles face complex legal challenges including ownership verification, transfer restrictions, and import/export regulations, whereas digital collectibles, particularly non-fungible tokens (NFTs), reside on blockchain platforms subject to evolving regulatory scrutiny regarding intellectual property rights and anti-money laundering compliance. Jurisdictions vary widely in classifying digital assets, impacting taxation, consumer protection, and securities law applicability, which complicates the legal framework for both asset types. Understanding these regulatory nuances is critical for collectors and investors to mitigate legal risks and ensure compliance in managing physical and digital collectibles.

Future Trends in Collectible Assets

Future trends in collectible assets are shifting towards digital collectibles, leveraging blockchain technology and NFTs for verifiable ownership and rarity. Physical collectibles maintain value through tangibility and historical significance, yet face challenges in storage and authenticity verification. Integration of augmented reality and virtual environments will enhance the appeal and accessibility of digital assets in evolving markets.

Related Important Terms

Phygital Collectibles

Phygital collectibles combine the tangible value of physical assets with the unique, verifiable ownership features of digital collectibles using blockchain technology. This hybrid asset model enhances provenance, authenticity, and market liquidity, bridging traditional collectible markets with the emerging digital economy.

Tokenized Physical Assets

Tokenized physical assets combine the tangibility of physical collectibles with the liquidity and tradability of digital tokens, enabling fractional ownership and seamless transfer on blockchain platforms. This fusion enhances asset accessibility and provenance verification, bridging traditional collectibles markets with decentralized digital ecosystems.

NFT-Backed Memorabilia

NFT-backed memorabilia transforms traditional physical collectibles by providing verifiable ownership and provenance through blockchain technology, enhancing authenticity and liquidity. This fusion of digital and physical assets allows collectors to securely trade rare items while maintaining their unique value in both tangible and digital marketplaces.

Digital Twins (for Collectibles)

Digital twins for collectibles enhance asset management by creating precise virtual replicas of physical items, enabling real-time tracking and authenticity verification. These digital counterparts improve liquidity and accessibility in the collectibles market while preserving provenance and condition data securely on blockchain platforms.

Hybrid Collectible Platforms

Hybrid collectible platforms integrate physical collectibles with digital assets through blockchain technology, offering verified ownership and enhanced liquidity. These platforms enable seamless trading, authentication, and provenance tracking, bridging the gap between tangible items and digital tokens for diversified asset portfolios.

Certified Provenance NFTs

Physical collectibles offer tangible value and traditional ownership verification, while digital collectibles leverage Certified Provenance NFTs to provide immutable blockchain records ensuring authenticity and transparent history. NFTs enable secure asset transfer and enhanced liquidity, transforming how collectors verify and trade unique items in digital markets.

Fractionalized Collectibles

Fractionalized collectibles enable investors to own partial shares of high-value physical or digital assets, unlocking liquidity and access previously unavailable in traditional collectible markets. Digital fractionalized collectibles, often secured by blockchain technology, offer enhanced transparency and ease of transfer compared to physical counterparts requiring storage and authentication.

Asset Minting (Physical to Digital)

Asset minting bridges physical collectibles with digital assets by converting tangible items into blockchain-verified tokens, enhancing provenance, liquidity, and security. This process ensures authentic ownership records and facilitates seamless trade of digital collectibles derived from physical assets.

Redeemable NFTs

Redeemable NFTs bridge the gap between physical collectibles and digital assets by providing verifiable ownership and interoperability on blockchain platforms, allowing holders to exchange or redeem their digital tokens for tangible items. This fusion enhances asset liquidity and authenticity, leveraging smart contracts to authenticate provenance and streamline redemption processes.

Real-World Asset (RWA) Tokenization

Real-World Asset (RWA) tokenization transforms physical collectibles like art and rare items into digital assets on blockchain, enhancing liquidity and accessibility. Digital collectibles offer verifiable ownership through NFTs, enabling fractional investment and streamlined transferability compared to traditional physical assets.

Physical Collectible vs Digital Collectible for asset. Infographic

moneydiff.com

moneydiff.com