Term life insurance offers affordable, straightforward coverage for a specified period, making it ideal for those seeking temporary financial protection. Indexed universal life insurance combines lifelong coverage with a cash value component that grows based on market index performance, providing flexibility and potential for wealth accumulation. Choosing between the two depends on individual financial goals, budget, and the need for flexibility versus simplicity.

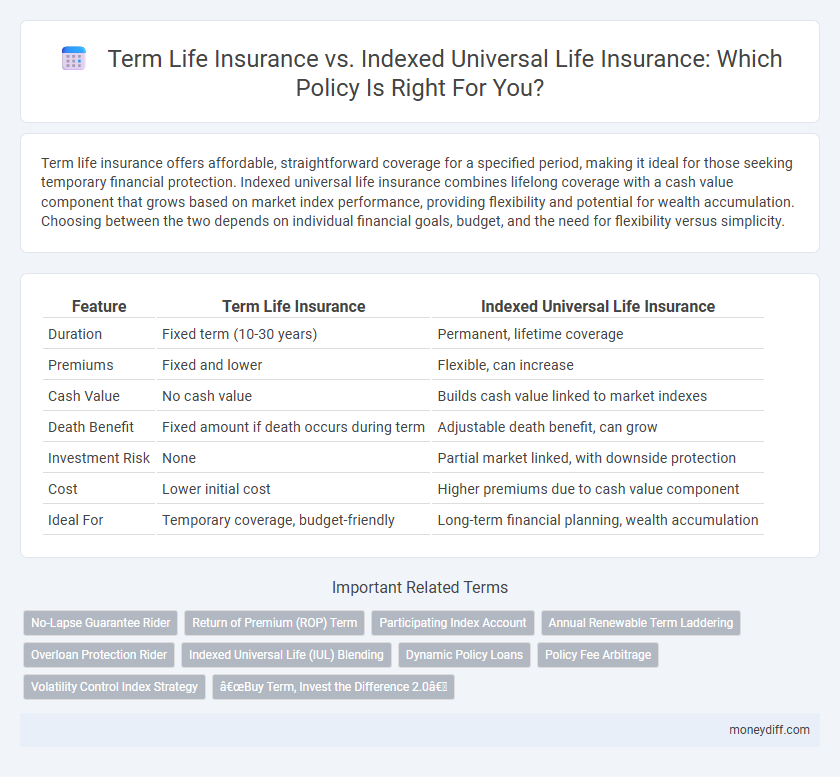

Table of Comparison

| Feature | Term Life Insurance | Indexed Universal Life Insurance |

|---|---|---|

| Duration | Fixed term (10-30 years) | Permanent, lifetime coverage |

| Premiums | Fixed and lower | Flexible, can increase |

| Cash Value | No cash value | Builds cash value linked to market indexes |

| Death Benefit | Fixed amount if death occurs during term | Adjustable death benefit, can grow |

| Investment Risk | None | Partial market linked, with downside protection |

| Cost | Lower initial cost | Higher premiums due to cash value component |

| Ideal For | Temporary coverage, budget-friendly | Long-term financial planning, wealth accumulation |

Understanding Term Life Insurance

Term life insurance provides affordable, temporary coverage for a specified period, typically 10 to 30 years, offering a death benefit without cash value accumulation. It is ideal for individuals seeking straightforward protection to cover financial obligations such as mortgages or education expenses. Unlike indexed universal life insurance, term life does not build cash value or offer investment components, keeping premiums lower and simpler.

What Is Indexed Universal Life Insurance?

Indexed Universal Life Insurance (IUL) is a permanent life insurance policy that combines a death benefit with a cash value component linked to a stock market index, such as the S&P 500. The cash value grows based on the index's performance, offering potential upside without direct exposure to market losses due to a guaranteed minimum interest rate. IUL policies provide flexible premiums, adjustable death benefits, and a blend of life insurance protection with growth opportunities, differentiating them from term life policies that offer coverage for a fixed period without cash value accumulation.

Key Differences Between Term Life and IUL

Term life insurance provides coverage for a specified period with fixed premiums and no cash value accumulation, making it cost-effective for temporary needs. Indexed universal life (IUL) combines flexible premiums and lifelong coverage with a cash value component tied to a stock market index, offering potential growth and tax advantages. Key differences include the duration of coverage, premium flexibility, cash value accumulation, and the financial risk linked to market performance in IUL policies.

Cost Comparison: Term Life vs IUL

Term life insurance typically offers lower initial premiums compared to Indexed Universal Life (IUL) policies, making it more affordable for short-term coverage. IUL insurance involves higher and often increasing premiums due to its cash value component and investment features tied to market indexes. Policyholders should evaluate long-term cost implications and financial goals when comparing the immediate affordability of term life to the flexibility and potential for cash accumulation in IUL.

Flexibility and Customization Options

Indexed universal life insurance offers greater flexibility and customization options compared to term life insurance, allowing policyholders to adjust premiums, death benefits, and investment choices within the policy. Term life insurance provides fixed coverage for a specified period with limited flexibility, focusing primarily on affordable, straightforward protection. The cash value component and indexed interest accumulation in indexed universal life policies enable long-term financial planning and adaptation to changing needs.

Cash Value Accumulation in IUL

Indexed Universal Life (IUL) insurance offers cash value accumulation linked to market indices, allowing potential growth based on index performance without direct market risk. Term life insurance provides pure death benefit coverage without cash value or investment features. The cash value in IUL policies can be accessed through loans or withdrawals, enhancing long-term financial planning and flexibility.

Suitability Based on Financial Goals

Term life insurance offers affordable, fixed coverage ideal for individuals seeking straightforward protection during specific time frames, such as mortgage repayment or income replacement. Indexed universal life insurance combines lifelong coverage with a cash value component tied to market indices, suitable for those aiming for flexible premiums and potential growth aligned with retirement savings or estate planning. Selecting between the two depends on financial goals, risk tolerance, and the need for investment-linked cash accumulation versus pure death benefit protection.

Death Benefit Guarantees Explained

Term life insurance provides a fixed death benefit guarantee for a specified period, ensuring beneficiaries receive a predetermined sum if the insured passes away within the term. Indexed universal life insurance offers flexible death benefits that can increase based on the performance of market indexes, but the guarantees often depend on policy terms and may involve caps or participation rates. Understanding the distinctions in death benefit guarantees is crucial for selecting a policy that aligns with long-term financial security and legacy planning.

Tax Advantages of Each Policy

Term life insurance offers tax-free death benefits and premiums that are typically lower, but it does not accumulate cash value or provide tax-deferred growth. Indexed universal life insurance combines a death benefit with a tax-deferred cash value accumulation linked to a market index, allowing for potential tax-free policy loans and withdrawals. The tax advantages of indexed universal life policies include tax-deferred growth on cash value and tax-free access to cash through loans, while term life focuses primarily on straightforward tax-free death benefits.

Choosing the Right Policy for Your Money Management Strategy

Term life insurance offers affordable, straightforward coverage for a specific period, ideal for temporary financial obligations and budget-conscious individuals. Indexed universal life insurance combines lifetime protection with potential cash value growth linked to a market index, appealing to those seeking flexible premiums and investment opportunities. Evaluating factors like risk tolerance, long-term financial goals, and cash flow needs helps determine the optimal policy for effective money management.

Related Important Terms

No-Lapse Guarantee Rider

Term life insurance offers straightforward protection with fixed premiums but lacks cash value accumulation and no-lapse guarantees. Indexed Universal Life (IUL) policies with a No-Lapse Guarantee Rider ensure lifelong coverage by preventing policy lapses even during cash value depletion, combining flexible premiums with potential indexed interest growth.

Return of Premium (ROP) Term

Return of Premium (ROP) Term life insurance offers the policyholder a full refund of paid premiums if they outlive the policy term, providing a cost-effective way to secure coverage with potential cash value return, unlike Indexed Universal Life (IUL) insurance, which accumulates cash value linked to market indexes but often includes higher premiums and investment risk. ROP Term is ideal for those seeking straightforward protection with a guaranteed premium return, while IUL suits individuals prioritizing flexible premiums and potential growth through indexed interest crediting.

Participating Index Account

Participating Index Account within Indexed Universal Life (IUL) insurance offers policyholders the potential for cash value growth linked to a stock market index, combining downside protection with upside participation, unlike Term Life insurance which provides coverage with no cash value or investment component. IUL's Participating Index Account features a credited interest rate based on index performance, subject to caps and floors, offering a flexible and tax-advantaged alternative to traditional term policies that only provide a death benefit.

Annual Renewable Term Laddering

Annual Renewable Term laddering offers flexible, cost-effective coverage that allows policyholders to stagger term life insurance expirations, optimizing protection while minimizing premiums over time. Indexed Universal Life insurance provides permanent coverage with cash value growth tied to market indexes, offering potential for higher returns but typically with higher costs and increased complexity compared to term strategies.

Overloan Protection Rider

The Overloan Protection Rider in indexed universal life insurance prevents policy lapse by covering loan amounts exceeding cash value, a feature absent in term life insurance policies that lack cash value accumulation. Indexed universal life offers flexible premiums and potential cash value growth tied to market indices, whereas term life provides affordable coverage without investment components or overloan safeguards.

Indexed Universal Life (IUL) Blending

Indexed Universal Life (IUL) insurance combines the flexibility of universal life policies with the potential for cash value growth linked to market indexes, offering policyholders the opportunity to accumulate savings while maintaining life insurance protection. Blending IUL with term life insurance strategies can optimize coverage affordability and long-term financial growth by balancing lower-cost term premiums with the cash value accumulation potential of IUL.

Dynamic Policy Loans

Term life insurance offers straightforward coverage without loan options, while Indexed Universal Life (IUL) insurance provides dynamic policy loans that allow policyholders to borrow against the cash value with flexible repayment terms tied to the policy's index performance. This dynamic loan feature in IUL policies can enhance financial planning by leveraging growth potential and providing liquidity, unlike the fixed, no-cash-value nature of term life insurance.

Policy Fee Arbitrage

Term life insurance offers lower initial premiums with fixed policy fees, while Indexed Universal Life (IUL) policies have higher fees that are offset by potential cash value growth linked to market indexes. Policy fee arbitrage occurs as IUL policyholders benefit from credited interest exceeding fees, contrasting with term life's fixed fee structure that provides pure death benefit coverage without cash accumulation.

Volatility Control Index Strategy

Term life insurance offers straightforward coverage with fixed premiums and death benefits, ideal for budget-conscious individuals seeking temporary protection. Indexed universal life insurance with a Volatility Control Index Strategy provides flexible premiums, cash value growth tied to market indices, and downside protection by managing investment risk through volatility control techniques.

“Buy Term, Invest the Difference 2.0”

Term life insurance offers affordable coverage with fixed premiums and a guaranteed death benefit for a set period, making it ideal for temporary financial protection. The "Buy Term, Invest the Difference 2.0" strategy emphasizes purchasing low-cost term policies while allocating savings into diversified investment accounts to potentially achieve higher returns compared to the cash value growth of Indexed Universal Life (IUL) insurance.

Term life vs Indexed universal life for insurance. Infographic

moneydiff.com

moneydiff.com