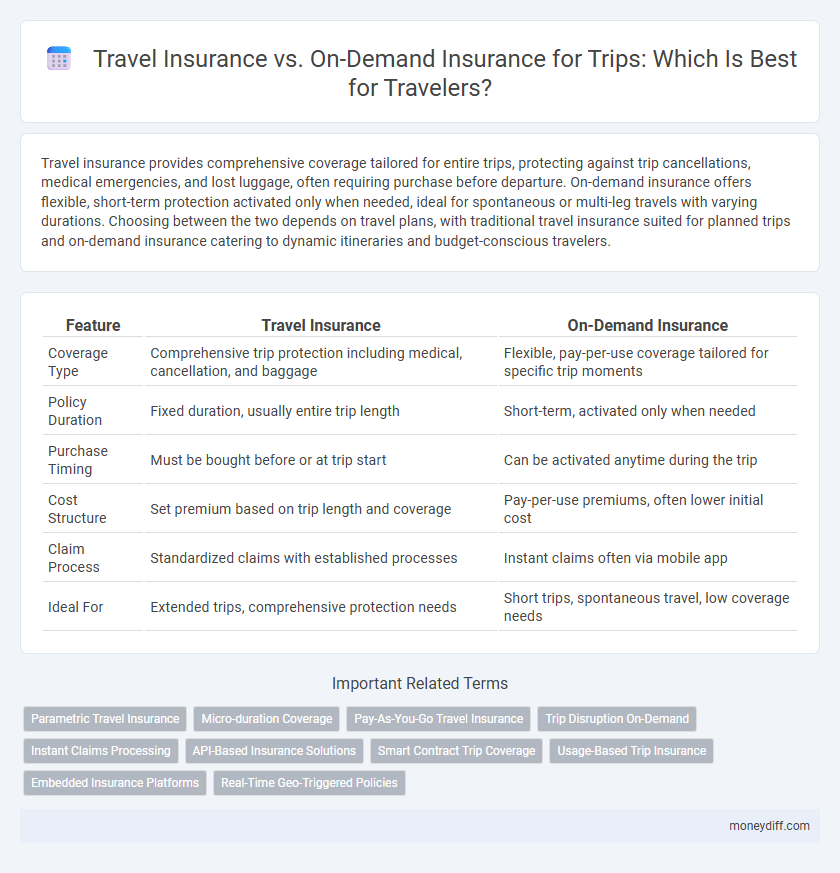

Travel insurance provides comprehensive coverage tailored for entire trips, protecting against trip cancellations, medical emergencies, and lost luggage, often requiring purchase before departure. On-demand insurance offers flexible, short-term protection activated only when needed, ideal for spontaneous or multi-leg travels with varying durations. Choosing between the two depends on travel plans, with traditional travel insurance suited for planned trips and on-demand insurance catering to dynamic itineraries and budget-conscious travelers.

Table of Comparison

| Feature | Travel Insurance | On-Demand Insurance |

|---|---|---|

| Coverage Type | Comprehensive trip protection including medical, cancellation, and baggage | Flexible, pay-per-use coverage tailored for specific trip moments |

| Policy Duration | Fixed duration, usually entire trip length | Short-term, activated only when needed |

| Purchase Timing | Must be bought before or at trip start | Can be activated anytime during the trip |

| Cost Structure | Set premium based on trip length and coverage | Pay-per-use premiums, often lower initial cost |

| Claim Process | Standardized claims with established processes | Instant claims often via mobile app |

| Ideal For | Extended trips, comprehensive protection needs | Short trips, spontaneous travel, low coverage needs |

Understanding Travel Insurance: Key Features

Travel insurance typically covers trip cancellations, medical emergencies, lost luggage, and travel delays, providing comprehensive protection for extended trips. On-demand insurance offers flexible, short-term coverage activated only for specific periods, ideal for spontaneous or brief travel needs. Comparing policy limits, exclusions, and claim processes ensures travelers select insurance that best aligns with their trip duration and risk profile.

What is On-Demand Trip Insurance?

On-demand trip insurance offers flexible, short-term coverage that activates only for the duration of your trip, making it ideal for spontaneous or infrequent travelers. Unlike traditional travel insurance, it allows policyholders to purchase protection exactly when needed through digital platforms, often covering trip cancellation, medical emergencies, and lost luggage. This solution maximizes affordability and convenience by eliminating the need for long-term commitments or upfront payments.

Coverage Comparison: Traditional vs. On-Demand Policies

Travel insurance policies typically offer comprehensive coverage including trip cancellations, medical emergencies, lost luggage, and travel delays, often requiring purchase well before departure. On-demand insurance provides flexible, time-bound protection activated only during the trip, with tailored coverage options such as medical emergencies or specific activities, often at lower costs. Comparing coverage, traditional travel insurance ensures broader protection and predictable premiums, while on-demand insurance caters to short-term, customizable needs with more limited scope.

Pricing Differences: Which Option Saves You More?

Travel insurance typically offers comprehensive coverage for an entire trip at a fixed price, often resulting in cost savings for longer or multiple trips. On-demand insurance charges by usage, making it more affordable for short, specific timeframes or last-minute protection but potentially more expensive for extended travel. Comparing your trip duration and coverage needs helps determine which pricing model delivers better value and savings.

Flexibility and Customization: Tailoring Your Trip Protection

Travel insurance offers comprehensive coverage tailored to the length and destination of your trip, often requiring upfront payment and fixed terms. On-demand insurance provides greater flexibility by allowing travelers to activate coverage only when needed, customizing protection for specific activities or time frames. This pay-as-you-go model enhances control over trip protection costs and coverage options, adapting dynamically to changing travel plans.

Claims Process: Speed and Simplicity Compared

Travel insurance typically offers comprehensive coverage with a claims process that can be slower due to thorough documentation and verification requirements. On-demand insurance provides faster claims processing, leveraging digital platforms to simplify submission and approval, ideal for short-term or spontaneous trips. Speed and simplicity in claims handling make on-demand insurance a preferred choice for travelers seeking quick financial relief without extensive paperwork.

Real-Life Scenarios: When Each Insurance Shines

Travel insurance excels during extended trips, covering emergencies like medical treatment, trip cancellations, and lost luggage, ideal for vacations or business travel. On-demand insurance offers flexibility for shorter or spontaneous trips, activating coverage only when needed, perfect for last-minute weekend getaways or isolated flight segments. Real-life scenarios highlight travel insurance for comprehensive protection and on-demand insurance for cost-efficient, immediate coverage tailored to specific travel events.

Limitations and Exclusions to Watch Out For

Travel insurance often includes comprehensive coverage for trip cancellations, medical emergencies, and lost luggage but may exclude pre-existing medical conditions, adventure sports, or trips to high-risk areas. On-demand insurance offers flexible, short-term protection tailored to specific activities but typically imposes strict limits on coverage duration and may exclude certain incidents like natural disasters or pandemics. Understanding policy limitations and exclusions is crucial to avoid unexpected out-of-pocket expenses during travel.

Digital Experience: Mobile Apps vs. Standard Platforms

Travel insurance increasingly leverages mobile apps, offering real-time policy management, instant claims processing, and location-based assistance that enhance user convenience and responsiveness. On-demand insurance platforms favor digital-first solutions with intuitive interfaces designed for quick activation and tailored coverage during specific trip segments. Mobile apps provide superior digital experiences through features like push notifications, document storage, and direct chat support, whereas standard platforms often rely on web portals with limited interactivity and slower response times.

Choosing the Right Insurance for Your Travel Needs

Travel insurance offers comprehensive coverage including trip cancellation, medical emergencies, and lost luggage protection tailored for extended trips, while on-demand insurance provides flexible, short-term policies ideal for spontaneous or brief journeys. Evaluating the duration, destination risks, and specific coverage needs ensures selecting the right policy maximizes protection without unnecessary costs. Understanding policy limits, claim processes, and customer reviews further refines the decision for optimal travel security.

Related Important Terms

Parametric Travel Insurance

Parametric travel insurance offers fixed payouts triggered by specific events like flight delays or weather disruptions, providing immediate compensation without lengthy claims processing, unlike traditional travel insurance which requires detailed claim validation. On-demand insurance allows travelers to activate coverage only when needed, enhancing flexibility and cost-efficiency compared to standard annual policies.

Micro-duration Coverage

Micro-duration coverage in travel insurance offers tailored protection for specific, short segments of a trip, such as a single flight or day excursion, providing cost-effective and flexible options. On-demand insurance enhances this by allowing travelers to activate coverage instantly through mobile apps, ensuring real-time protection without committing to traditional, longer-term travel policies.

Pay-As-You-Go Travel Insurance

Pay-as-you-go travel insurance offers flexible coverage tailored to specific trip durations and activities, providing cost-effective protection compared to traditional travel insurance plans with fixed terms. This on-demand model allows travelers to pay only for the coverage they need during actual travel days, optimizing expenses and ensuring comprehensive protection against trip cancellations, medical emergencies, and lost belongings.

Trip Disruption On-Demand

Trip Disruption On-Demand insurance offers immediate, customizable coverage for sudden itinerary changes, unlike traditional travel insurance which requires advance purchase and covers predefined risks. This flexible option provides real-time protection against cancellations, delays, or interruptions, ensuring travelers can adapt quickly to unforeseen events during their journey.

Instant Claims Processing

Travel insurance offers comprehensive coverage but often involves lengthy claims processing, whereas on-demand insurance provides instant claims processing through digital platforms, ensuring quick reimbursement for trip-related incidents. The integration of real-time claim verification and automated approvals in on-demand insurance significantly enhances customer convenience during unexpected travel disruptions.

API-Based Insurance Solutions

API-based travel insurance solutions enable seamless integration of coverage options into booking platforms, offering travelers customized policies that activate instantly for specific trip durations, whereas on-demand insurance leverages real-time data to provide flexible, usage-based protection tailored to dynamic travel needs. Insurtech companies increasingly adopt API models to streamline underwriting, claims processing, and policy management, enhancing customer experience and operational efficiency in both traditional travel and on-demand insurance markets.

Smart Contract Trip Coverage

Smart Contract Trip Coverage leverages blockchain technology to automate claims processing and ensure transparency in both Travel Insurance and On-Demand Insurance, offering real-time verification and instant payouts. This innovation reduces fraud risks and enhances policyholder trust by executing coverage terms through self-executing code tailored for trip-related contingencies.

Usage-Based Trip Insurance

Usage-based trip insurance offers personalized coverage by charging premiums based on actual travel behavior, such as trip duration and destinations visited, unlike traditional travel insurance with fixed rates. This adaptive model enhances cost efficiency and risk management by tailoring protection to real-time usage patterns, providing travelers with a flexible and economical alternative.

Embedded Insurance Platforms

Embedded insurance platforms streamline access to travel insurance by integrating coverage options directly into booking processes, offering seamless protection tailored to the trip's specifics. On-demand insurance provides flexible, short-term policies activated as needed, whereas traditional travel insurance often requires upfront commitment for the entire trip duration, highlighting the convenience and customization benefits of embedded solutions.

Real-Time Geo-Triggered Policies

Real-time geo-triggered policies in travel insurance automatically activate coverage when travelers enter specific locations, ensuring immediate protection tailored to regional risks. On-demand insurance leverages this technology by offering flexible, pay-as-you-go plans that dynamically adjust premiums based on the traveler's GPS location and trip duration.

Travel Insurance vs On-Demand Insurance for trips. Infographic

moneydiff.com

moneydiff.com