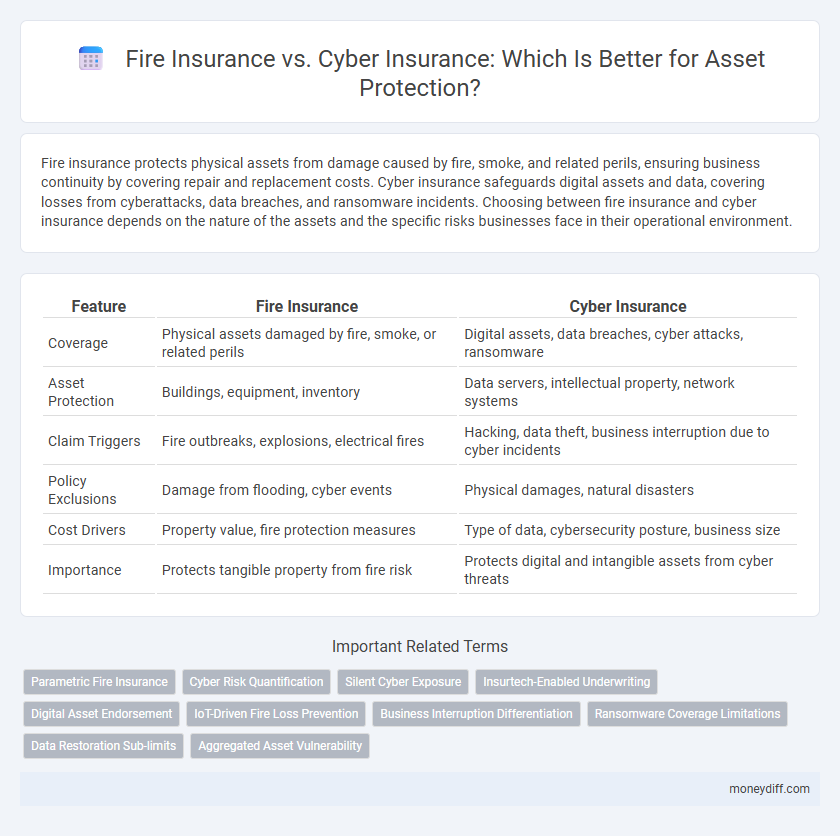

Fire insurance protects physical assets from damage caused by fire, smoke, and related perils, ensuring business continuity by covering repair and replacement costs. Cyber insurance safeguards digital assets and data, covering losses from cyberattacks, data breaches, and ransomware incidents. Choosing between fire insurance and cyber insurance depends on the nature of the assets and the specific risks businesses face in their operational environment.

Table of Comparison

| Feature | Fire Insurance | Cyber Insurance |

|---|---|---|

| Coverage | Physical assets damaged by fire, smoke, or related perils | Digital assets, data breaches, cyber attacks, ransomware |

| Asset Protection | Buildings, equipment, inventory | Data servers, intellectual property, network systems |

| Claim Triggers | Fire outbreaks, explosions, electrical fires | Hacking, data theft, business interruption due to cyber incidents |

| Policy Exclusions | Damage from flooding, cyber events | Physical damages, natural disasters |

| Cost Drivers | Property value, fire protection measures | Type of data, cybersecurity posture, business size |

| Importance | Protects tangible property from fire risk | Protects digital and intangible assets from cyber threats |

Introduction to Fire Insurance and Cyber Insurance

Fire insurance provides financial protection against damages caused by fire incidents, safeguarding physical assets such as buildings, inventory, and equipment. Cyber insurance covers losses from cyber threats like data breaches, hacking, and ransomware attacks, protecting digital assets and liability exposures. Both insurance types are essential for comprehensive asset protection in the evolving risk landscape of businesses.

Defining Asset Protection in the Digital Age

Asset protection in the digital age requires comprehensive coverage that addresses both physical and virtual vulnerabilities, underscoring the importance of fire insurance for tangible property and cyber insurance for data integrity and cybersecurity breaches. Fire insurance safeguards physical assets against damage caused by flames, smoke, and related hazards, while cyber insurance mitigates financial losses from data breaches, ransomware attacks, and other online threats. Effective asset protection strategies integrate these policies to ensure robust defense against evolving risks in an interconnected environment.

Key Features of Fire Insurance

Fire insurance typically covers damages caused by fire, smoke, lightning, explosions, and sometimes water damage from firefighting efforts, protecting physical assets like buildings and inventory. This type of policy often includes coverage for structural repair costs, temporary relocation expenses, and loss of business income due to fire-related interruptions. In contrast to cyber insurance, fire insurance does not cover digital threats or data breaches, focusing solely on tangible asset protection from fire-related incidents.

Core Components of Cyber Insurance

Cyber insurance core components include data breach coverage, liability protection, and business interruption losses, specifically designed to address digital threats like hacking and ransomware. Fire insurance primarily covers physical asset damage caused by fire or related perils but does not extend to cyber risks or data compromise. Integrating cyber insurance with traditional fire insurance ensures comprehensive protection for both physical and digital assets against evolving threats.

Coverage Comparison: Physical vs. Digital Assets

Fire insurance primarily covers physical assets such as buildings, equipment, and inventory against damage or loss caused by fire, smoke, or related perils. Cyber insurance focuses on protecting digital assets including data, software, and network infrastructure from cyberattacks, data breaches, and ransomware. The key distinction lies in the scope of coverage: fire insurance mitigates tangible property risks while cyber insurance addresses intangible, technology-driven threats to asset security.

Common Risks Covered by Fire Insurance

Fire insurance primarily covers damages caused by fire, lightning, explosions, and smoke, protecting physical assets such as buildings, inventory, and equipment from direct fire-related losses. It also includes coverage for water damage resulting from firefighting efforts and structural repairs due to fire incidents. Common risks under fire insurance exclude cyber threats, emphasizing protection against tangible, property-based hazards rather than intangible digital risks.

Typical Threats Protected by Cyber Insurance

Cyber insurance primarily protects against data breaches, ransomware attacks, and business interruption caused by cyber incidents, addressing risks that traditional fire insurance policies do not cover. Fire insurance typically covers physical damage to property and assets due to fire, smoke, or explosion but does not extend to digital threats or cybercrime-related losses. Organizations facing increasing cyber threats should integrate cyber insurance to safeguard sensitive information, network systems, and financial stability from evolving cyber risks.

Cost Considerations: Premiums and Deductibles

Fire insurance premiums are generally determined by factors such as property value, location, and fire risk history, often resulting in moderate to high costs with variable deductibles based on the claim amount. Cyber insurance premiums depend on organizational cybersecurity posture, data sensitivity, and claim history, typically involving higher premiums to cover complex cyber risks and sometimes higher deductibles linked to the extent of data restoration. Evaluating cost considerations in asset protection requires analyzing the trade-off between premium affordability and deductible limits tailored to specific property or digital asset vulnerabilities.

Choosing the Right Insurance for Your Asset Portfolio

Fire insurance provides coverage against physical damage to assets caused by fire-related incidents, protecting property, equipment, and inventory. Cyber insurance safeguards digital assets and data from threats like cyberattacks, data breaches, and ransomware, essential for businesses relying on technology. Selecting the right insurance depends on the specific risks associated with your asset portfolio, balancing tangible property protection with coverage for digital vulnerabilities.

Integrating Fire and Cyber Insurance in Risk Management

Integrating fire and cyber insurance in risk management enhances comprehensive asset protection by addressing both physical and digital threats that businesses face. Fire insurance covers damages from fires, explosions, and smoke, while cyber insurance mitigates risks from data breaches, ransomware, and network interruptions. Combining these policies ensures a holistic approach to safeguarding critical assets and continuity of operations.

Related Important Terms

Parametric Fire Insurance

Parametric fire insurance provides rapid, predefined payouts based on specific trigger events such as temperature thresholds or fire duration, offering transparent and efficient protection for physical assets against fire damage. In contrast, cyber insurance covers losses from digital attacks, data breaches, and network downtime, addressing intangible asset risks with tailored policies that complement parametric models by focusing on cybersecurity incidents rather than physical hazards.

Cyber Risk Quantification

Cyber insurance offers specialized coverage for data breaches, ransomware, and network intrusions, quantifying cyber risk through detailed analytics and incident history to tailor asset protection strategies. Unlike traditional fire insurance that covers physical damage, cyber insurance emphasizes loss estimation from business interruption, reputational harm, and regulatory fines, making cyber risk quantification essential for accurate policy underwriting and risk management.

Silent Cyber Exposure

Fire insurance primarily covers physical damage to assets caused by fire, excluding losses from cyber incidents, whereas cyber insurance addresses data breaches, cyberattacks, and digital threats that can cause significant financial harm without physical damage. Silent cyber exposure arises when traditional fire insurance policies inadvertently cover cyber-related losses, creating ambiguity and potential gaps in asset protection.

Insurtech-Enabled Underwriting

Fire insurance provides protection against physical damages caused by fire, using traditional underwriting methods focused on property value and historical fire risk data. Cyber insurance leverages insurtech-enabled underwriting that incorporates real-time threat intelligence, behavioral analytics, and automated risk assessment to address dynamic digital vulnerabilities and asset protection.

Digital Asset Endorsement

Fire insurance primarily protects physical assets from damage caused by fire, while cyber insurance safeguards digital assets and data from cyberattacks, including breaches and ransomware. Digital Asset Endorsement enhances traditional fire insurance by extending coverage to digital files, software, and electronic records, bridging the gap between physical and cyber asset protection.

IoT-Driven Fire Loss Prevention

Fire insurance protects physical assets against damage caused by fire incidents, while cyber insurance covers losses from cyberattacks and data breaches, particularly critical as IoT devices increasingly control fire detection systems. IoT-driven fire loss prevention integrates real-time monitoring and automated response technologies, enhancing risk mitigation by enabling faster detection and response, thereby reducing the financial impact covered under fire insurance policies.

Business Interruption Differentiation

Fire insurance predominantly covers physical damages and losses caused by fire incidents, directly protecting business assets and premises, whereas cyber insurance primarily addresses financial losses and operational downtime resulting from cyberattacks or data breaches, emphasizing business interruption related to digital threats and system failures. The differentiation lies in fire insurance safeguarding tangible property and immediate recovery costs, while cyber insurance mitigates risks associated with digital disruptions, including data restoration, legal expenses, and extended business interruption losses.

Ransomware Coverage Limitations

Fire insurance typically excludes coverage for cyber incidents, leaving ransomware attacks on digital assets unprotected, whereas cyber insurance explicitly addresses ransomware coverage but often imposes strict limitations and sub-limits on the amount payable. Understanding policy terms and coverage limits in cyber insurance is crucial for comprehensive asset protection against both physical fire damage and evolving ransomware threats.

Data Restoration Sub-limits

Fire insurance typically covers physical asset damage with limited or no provisions for data restoration, while cyber insurance explicitly includes sub-limits for data restoration costs to recover digital assets and mitigate cyberattack impacts. Understanding these distinctions is crucial for businesses seeking comprehensive asset protection that addresses both tangible property and critical data recovery needs.

Aggregated Asset Vulnerability

Fire insurance primarily protects physical assets such as buildings and inventory from damage caused by fire, while cyber insurance covers digital assets and data breaches, addressing vulnerabilities in information systems. Understanding aggregated asset vulnerability requires assessing how physical and digital risks can compound overall exposure, emphasizing the need for integrated coverage to safeguard both tangible and intangible assets effectively.

Fire insurance vs Cyber insurance for asset protection. Infographic

moneydiff.com

moneydiff.com