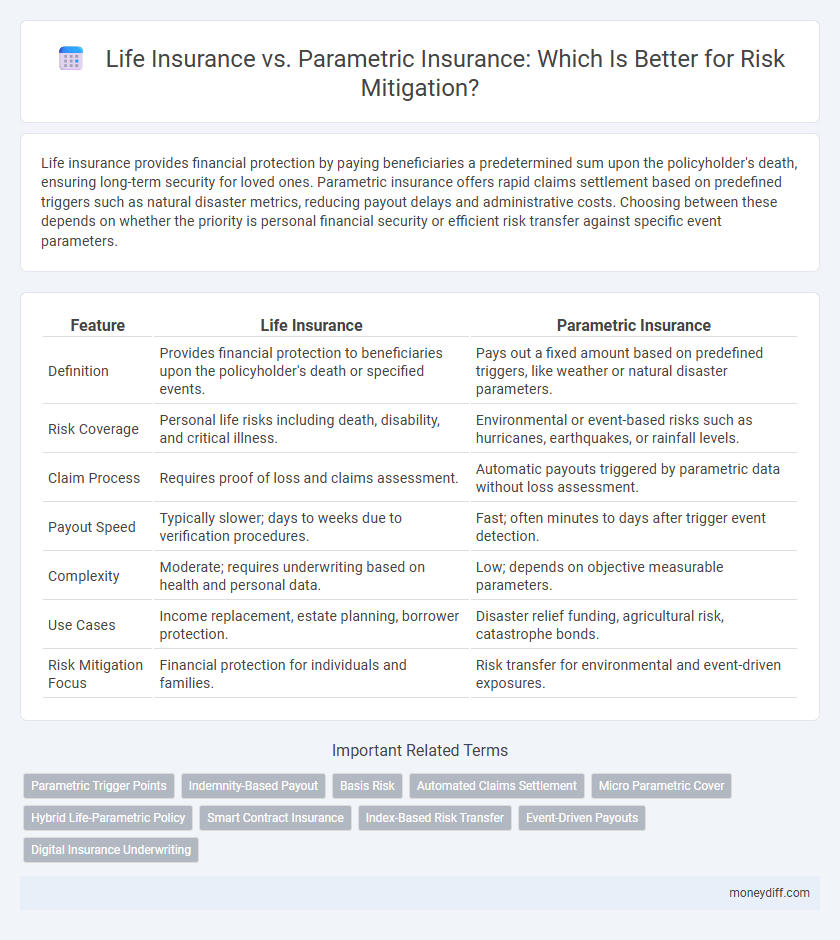

Life insurance provides financial protection by paying beneficiaries a predetermined sum upon the policyholder's death, ensuring long-term security for loved ones. Parametric insurance offers rapid claims settlement based on predefined triggers such as natural disaster metrics, reducing payout delays and administrative costs. Choosing between these depends on whether the priority is personal financial security or efficient risk transfer against specific event parameters.

Table of Comparison

| Feature | Life Insurance | Parametric Insurance |

|---|---|---|

| Definition | Provides financial protection to beneficiaries upon the policyholder's death or specified events. | Pays out a fixed amount based on predefined triggers, like weather or natural disaster parameters. |

| Risk Coverage | Personal life risks including death, disability, and critical illness. | Environmental or event-based risks such as hurricanes, earthquakes, or rainfall levels. |

| Claim Process | Requires proof of loss and claims assessment. | Automatic payouts triggered by parametric data without loss assessment. |

| Payout Speed | Typically slower; days to weeks due to verification procedures. | Fast; often minutes to days after trigger event detection. |

| Complexity | Moderate; requires underwriting based on health and personal data. | Low; depends on objective measurable parameters. |

| Use Cases | Income replacement, estate planning, borrower protection. | Disaster relief funding, agricultural risk, catastrophe bonds. |

| Risk Mitigation Focus | Financial protection for individuals and families. | Risk transfer for environmental and event-driven exposures. |

Understanding Life Insurance: Traditional Risk Coverage

Life insurance provides financial protection by paying a death benefit to beneficiaries upon the insured's death, covering risks like income loss and funeral expenses. It operates on indemnity principles, requiring proof of loss and underwriting based on health and lifestyle factors. Traditional life insurance focuses on personal and family risk mitigation with predictable premiums and benefits, differing fundamentally from parametric insurance which triggers payouts based on predefined events.

What Is Parametric Insurance? Modern Solutions Explained

Parametric insurance provides a risk mitigation solution that pays out predetermined amounts based on the occurrence of specific, measurable events such as natural disasters or weather conditions, eliminating the need for lengthy claims assessments common in traditional life insurance. Unlike life insurance, which compensates beneficiaries upon the policyholder's death, parametric insurance focuses on quick, objective payouts triggered by verified data points, offering faster financial relief. This modern approach leverages technology and data analytics to improve transparency and efficiency in managing diverse risks.

Key Differences Between Life Insurance and Parametric Insurance

Life insurance provides financial compensation based on the policyholder's death or specified life events, typically requiring claim assessment and proof of loss. Parametric insurance offers payout triggered by predefined parameters or indices, such as natural disaster magnitude, eliminating the need for traditional loss verification. The main difference lies in claim processing speed and basis: life insurance depends on actual loss assessment, while parametric insurance relies on objective event measurements for rapid, transparent risk mitigation.

Coverage Triggers: Claim Processes Compared

Life insurance coverage triggers are typically based on specific events such as death or terminal illness, requiring claimants to provide extensive documentation including death certificates and medical records to initiate claim processing. Parametric insurance relies on predefined, measurable parameters like weather data or earthquake magnitude to trigger claims, enabling faster payouts without the need for traditional loss assessment. This streamlined claim process in parametric insurance reduces administrative delays, making it a more efficient option for rapid risk mitigation in scenarios with clear, quantifiable triggers.

Premium Structures and Cost Considerations

Life insurance premiums are typically fixed or age-based, offering predictable costs over policy terms, while parametric insurance premiums fluctuate based on risk models and trigger events, often resulting in more variable pricing. Parametric insurance can reduce administrative expenses and claims adjustment costs due to automated payouts tied to predefined parameters, impacting overall cost-effectiveness. Understanding these premium structures is crucial for selecting risk mitigation strategies aligned with financial planning and risk tolerance.

Payout Mechanisms: Fixed vs. Variable Benefits

Life insurance provides fixed benefits determined by the policy terms, offering predictable financial support upon the policyholder's death or specific events. Parametric insurance delivers variable payouts based on predefined parameters, such as natural disaster intensity or weather indices, enabling quicker claims settlement without loss assessment. This flexibility allows parametric insurance to cover risks with measurable triggers, whereas life insurance ensures guaranteed fixed compensation for beneficiaries.

Flexibility and Customization in Risk Mitigation

Life insurance offers customizable coverage options tailored to individual financial needs and life stages, providing flexibility in sum assured and policy duration for long-term risk mitigation. Parametric insurance delivers flexible payouts based on predefined triggers such as weather events or natural disasters, enabling rapid and objective claims settlement without the need for loss adjustment. This customization in parametric insurance supports precise risk management strategies by aligning coverage with specific hazard parameters, enhancing overall resilience.

Use Cases: Who Should Choose Life or Parametric Insurance?

Life insurance is ideal for individuals seeking financial protection for dependents against death or disability, ensuring long-term income replacement and estate planning. Parametric insurance suits businesses and communities exposed to specific measurable risks like natural disasters, providing rapid payouts based on predefined event triggers rather than actual loss assessments. Choosing between life and parametric insurance depends on the insured's risk profile--life insurance addresses personal financial security, while parametric insurance offers efficient coverage for event-driven risks.

Risk Management Strategies: Integrating Both Insurances

Life insurance provides financial security by compensating beneficiaries upon the policyholder's death, serving as a traditional risk mitigation tool for income loss. Parametric insurance offers rapid payouts based on predefined triggers like weather events, enhancing coverage for specific, measurable risks. Integrating life insurance with parametric insurance creates a robust risk management strategy, combining long-term financial protection with swift compensation for quantifiable losses.

Future Trends in Insurance: Evolving Risk Mitigation Approaches

Future trends in insurance highlight a shift toward integrating parametric insurance alongside traditional life insurance to enhance risk mitigation strategies. Parametric insurance leverages real-time data triggers and automated payouts, offering faster, more transparent compensation for specific events compared to conventional life insurance claims processes. Advancements in IoT, AI, and blockchain technology are driving the adoption of hybrid models that combine life insurance's financial security with parametric solutions' agility and precision.

Related Important Terms

Parametric Trigger Points

Parametric insurance uses predefined trigger points based on measurable data such as weather conditions, seismic activity, or crop yields, enabling rapid claim payouts without the need for traditional loss assessments. This data-driven approach contrasts with life insurance, which relies on individual health and mortality risk evaluations, highlighting parametric insurance's efficiency in mitigating risks tied to quantifiable external events.

Indemnity-Based Payout

Life insurance provides indemnity-based payouts that compensate policyholders based on actual financial losses from death or disability, ensuring personalized risk coverage. In contrast, parametric insurance offers preset payouts triggered by predefined events, lacking indemnity flexibility but enabling faster claims processing.

Basis Risk

Life insurance provides financial protection based on actual loss events, whereas parametric insurance offers payouts triggered by predefined parameters such as weather data, which can expose policyholders to basis risk if the event measurement does not perfectly correlate with the loss experienced. Mitigating basis risk in parametric insurance requires precise calibration of triggers and data accuracy, ensuring alignment between the insured risk and the payout mechanism.

Automated Claims Settlement

Life insurance provides financial protection through traditional claim assessment processes, whereas parametric insurance offers automated claims settlement based on predefined triggers such as weather data or seismic activity, ensuring faster payouts. Parametric insurance reduces claims processing time significantly by eliminating the need for loss verification, thereby enhancing risk mitigation efficiency.

Micro Parametric Cover

Micro parametric insurance provides rapid payouts based on predefined triggers such as weather data, offering efficient risk mitigation for small-scale risks compared to traditional life insurance, which relies on claims processing and underwriting. This innovative approach reduces administrative costs and improves accessibility for low-income populations, enhancing financial resilience through automated, event-driven compensation mechanisms.

Hybrid Life-Parametric Policy

Hybrid Life-Parametric policies integrate the traditional death benefit of life insurance with the rapid, index-based payouts of parametric insurance, enhancing risk mitigation by addressing both mortality risk and specific event triggers such as natural disasters. These hybrid policies optimize financial resilience by providing predetermined coverage amounts upon verified parameters, reducing claim processing time and improving beneficiary certainty.

Smart Contract Insurance

Life insurance offers traditional payout based on assessed loss or death events, while parametric insurance leverages smart contract technology to trigger automatic, predefined payouts upon specific parameters like natural disasters, enhancing speed and transparency in risk mitigation. Smart contract insurance reduces claim processing time and operational costs by executing blockchain-verified conditions without human intervention, providing a reliable alternative for managing disaster-related financial risks efficiently.

Index-Based Risk Transfer

Life insurance provides financial protection through death benefits, while parametric insurance, especially index-based risk transfer, offers rapid payouts triggered by specific measurable events such as weather indices or seismic activity, enhancing transparency and reducing claim processing time. Index-based parametric insurance improves risk mitigation by linking compensation directly to quantifiable metrics rather than loss assessments, making it highly effective for managing risks in agriculture, natural disasters, and climate-related events.

Event-Driven Payouts

Life insurance offers financial protection based on the policyholder's lifespan, providing death benefits upon the occurrence of insured events, while parametric insurance delivers event-driven payouts triggered by predefined parameters like weather conditions or natural disasters. Parametric insurance enables faster claims settlement without loss assessments, making it ideal for mitigating risks related to uncertain and measurable events.

Digital Insurance Underwriting

Life insurance provides traditional risk mitigation through fixed indemnity payouts based on assessed mortality risk, while parametric insurance offers faster, data-driven claims settlements triggered by predefined event parameters such as weather or natural disasters. Digital insurance underwriting leverages real-time data analytics and AI algorithms to improve accuracy and efficiency, enabling parametric models to reduce claim settlement times and enhance customer experience compared to conventional life insurance underwriting processes.

Life Insurance vs Parametric Insurance for risk mitigation. Infographic

moneydiff.com

moneydiff.com