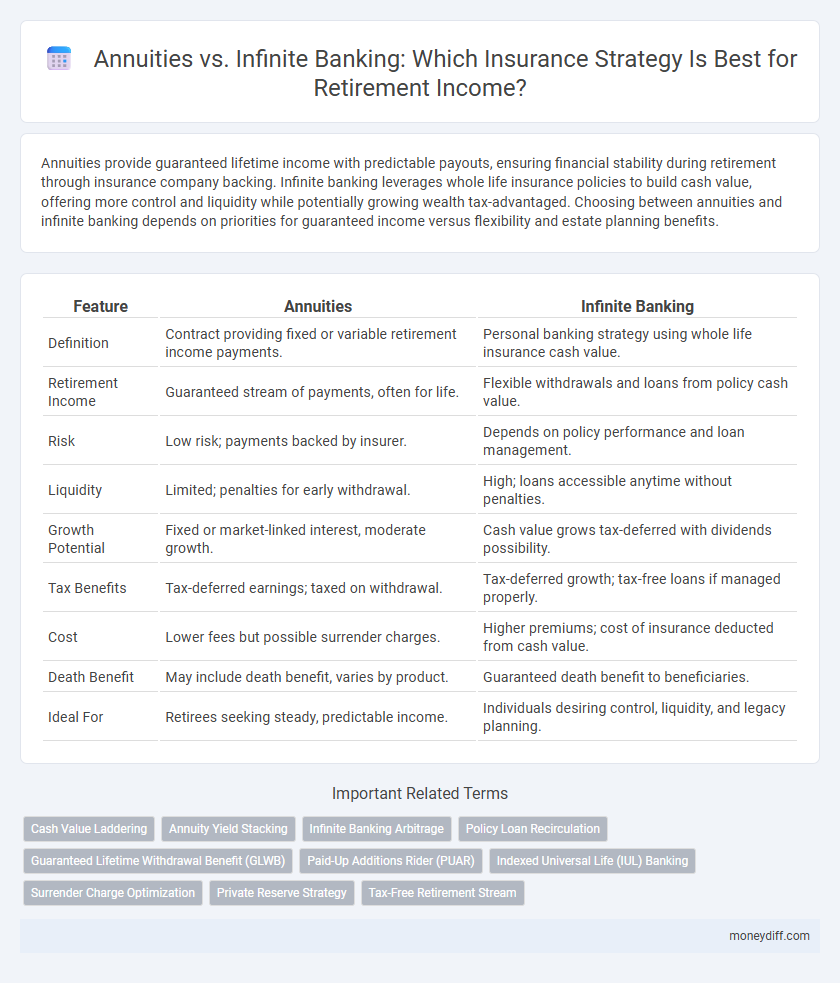

Annuities provide guaranteed lifetime income with predictable payouts, ensuring financial stability during retirement through insurance company backing. Infinite banking leverages whole life insurance policies to build cash value, offering more control and liquidity while potentially growing wealth tax-advantaged. Choosing between annuities and infinite banking depends on priorities for guaranteed income versus flexibility and estate planning benefits.

Table of Comparison

| Feature | Annuities | Infinite Banking |

|---|---|---|

| Definition | Contract providing fixed or variable retirement income payments. | Personal banking strategy using whole life insurance cash value. |

| Retirement Income | Guaranteed stream of payments, often for life. | Flexible withdrawals and loans from policy cash value. |

| Risk | Low risk; payments backed by insurer. | Depends on policy performance and loan management. |

| Liquidity | Limited; penalties for early withdrawal. | High; loans accessible anytime without penalties. |

| Growth Potential | Fixed or market-linked interest, moderate growth. | Cash value grows tax-deferred with dividends possibility. |

| Tax Benefits | Tax-deferred earnings; taxed on withdrawal. | Tax-deferred growth; tax-free loans if managed properly. |

| Cost | Lower fees but possible surrender charges. | Higher premiums; cost of insurance deducted from cash value. |

| Death Benefit | May include death benefit, varies by product. | Guaranteed death benefit to beneficiaries. |

| Ideal For | Retirees seeking steady, predictable income. | Individuals desiring control, liquidity, and legacy planning. |

Understanding Annuities and Infinite Banking

Annuities provide a guaranteed income stream during retirement by converting a lump sum into periodic payments, often backed by insurance companies with fixed, variable, or indexed options. Infinite Banking utilizes whole life insurance policies to create a personal banking system, allowing policyholders to borrow against cash value for tax-advantaged growth and flexible retirement income. Comparing both, annuities offer predictability and reduced market risk, while infinite banking emphasizes control, liquidity, and legacy planning benefits.

How Annuities Work for Retirement Income

Annuities provide a steady stream of retirement income by converting a lump sum into periodic payments, either for a fixed period or for life, ensuring financial stability. These contracts with insurance companies offer options such as fixed, variable, and indexed annuities, allowing retirees to choose based on risk tolerance and growth potential. Annuities also often include features like guaranteed minimum income benefits, protecting retirees against market downturns and longevity risk.

The Infinite Banking Concept Explained

The Infinite Banking Concept utilizes whole life insurance policies to create a personal banking system that allows policyholders to borrow against their cash value for retirement income. Unlike traditional annuities, which provide fixed payouts and are often subject to market risks and fees, infinite banking offers tax-advantaged growth and flexible access to funds. This strategy empowers individuals to control their financial future by leveraging guaranteed dividends and loan options within their policy.

Key Benefits of Annuities

Annuities provide guaranteed lifetime income, protecting retirees from outliving their savings by offering predictable payment streams regardless of market fluctuations. They often include tax-deferred growth, allowing investments to compound without immediate tax liabilities, enhancing long-term retirement wealth accumulation. Additionally, certain annuity products offer death benefits and optional riders, providing financial security and flexibility tailored to individual retirement goals.

Advantages of Infinite Banking for Retirees

Infinite Banking allows retirees to build tax-advantaged cash value in whole life insurance policies, providing liquidity and control without market volatility. Policyholders can access funds through tax-free loans, supporting flexible retirement income and estate planning strategies. This approach offers guaranteed growth, protection from creditors, and the potential for legacy wealth transfer, outperforming traditional annuities in long-term financial autonomy.

Comparing Costs and Fees: Annuities vs Infinite Banking

Annuities typically involve higher upfront commissions, administrative fees, and surrender charges that reduce overall returns, while infinite banking relies on whole life insurance policies with fixed premiums and cash value accumulation, often resulting in lower ongoing costs. Annuities may impose mortality and expense risk fees, whereas infinite banking's costs are embedded within the policy structure, offering more transparency and potential tax advantages. Comparing long-term expenses, infinite banking can provide greater control over fees, but requires disciplined premium payments and understanding of policy mechanics.

Flexibility and Liquidity in Retirement Planning

Annuities provide guaranteed income streams but often limit access to funds, reducing liquidity and flexibility during retirement. Infinite Banking leverages whole life insurance policies, allowing policyholders to borrow against cash value tax-free, offering enhanced liquidity and control over retirement income. This flexibility supports dynamic financial needs and unexpected expenses, making Infinite Banking a versatile option for retirement planning.

Tax Implications: Annuities vs Infinite Banking

Annuities offer tax-deferred growth, with withdrawals taxed as ordinary income, potentially increasing your tax burden during retirement. Infinite banking leverages whole life insurance policies where cash value growth is tax-deferred and withdrawals or loans can be tax-free if properly structured, providing more control over tax liabilities. Understanding these tax implications is crucial for maximizing retirement income and ensuring efficient wealth transfer strategies.

Risks and Drawbacks of Each Strategy

Annuities carry risks such as market volatility exposure, inflation eroding fixed payouts, and potential high fees reducing net returns. Infinite Banking can present challenges including complex setup requirements, reliance on policy loan discipline, and the risk of policy lapses due to insufficient premium payments. Both strategies involve trade-offs between guaranteed income streams and control over assets that must be carefully evaluated for long-term retirement sustainability.

Which Approach Fits Your Retirement Goals?

Annuities provide guaranteed lifetime income with predictable payouts, ideal for retirees seeking stable cash flow and reduced market risk exposure. Infinite Banking leverages whole life insurance policies to build cash value that can be borrowed against, offering flexibility and control over funds but requiring disciplined financial management. Choosing between annuities and Infinite Banking depends on your risk tolerance, desire for liquidity, and long-term retirement income objectives.

Related Important Terms

Cash Value Laddering

Cash value laddering in annuities and infinite banking maximizes retirement income by strategically accessing policy growth at different times to optimize tax advantages and liquidity. Utilizing cash value from whole life insurance policies in an infinite banking strategy offers flexible loan options, while annuities provide scheduled withdrawals with potential guaranteed lifetime income streams.

Annuity Yield Stacking

Annuity yield stacking maximizes retirement income by layering multiple annuity contracts with staggered maturity dates, enhancing cash flow predictability and compounding interest benefits. In contrast, infinite banking leverages whole life policies for tax-advantaged loans and liquidity but lacks the structured yield optimization inherent in annuity stacking strategies.

Infinite Banking Arbitrage

Infinite Banking Arbitrage leverages whole life insurance policies to create a tax-advantaged cash flow strategy that can outperform traditional annuities by allowing policyholders to borrow against their policy's cash value at low interest rates while the policy continues to earn dividends and guaranteed growth. This approach enhances retirement income sustainability through compounded returns and liquidity, making it a flexible alternative to fixed annuity payouts.

Policy Loan Recirculation

Annuities provide guaranteed retirement income through scheduled payments, but policy loan recirculation in infinite banking leverages whole life insurance cash value to create a self-financing strategy that minimizes loan interest costs and maximizes liquidity. This method allows policyholders to recycle loaned funds repeatedly, enhancing tax-advantaged growth and flexible access to retirement cash flow compared to the fixed structure of annuities.

Guaranteed Lifetime Withdrawal Benefit (GLWB)

Guaranteed Lifetime Withdrawal Benefit (GLWB) riders in annuities provide a reliable stream of retirement income by ensuring policyholders can withdraw a predetermined amount for life, regardless of market fluctuations. Infinite Banking strategies, while offering cash flow control and tax advantages, lack the explicit lifetime income guarantee that GLWB annuities deliver, making annuities a more secure option for retirees prioritizing stable, lifelong income.

Paid-Up Additions Rider (PUAR)

The Paid-Up Additions Rider (PUAR) enhances whole life insurance policies by allowing policyholders to contribute additional premiums that increase the cash value and death benefit, making it a powerful tool for Infinite Banking strategies in retirement income planning. Unlike traditional annuities, the PUAR offers tax-deferred growth with flexible access to cash value, providing both liquidity and legacy benefits without the income limitations and surrender charges common in annuity contracts.

Indexed Universal Life (IUL) Banking

Indexed Universal Life (IUL) Banking leverages cash value growth linked to a market index, offering tax-advantaged retirement income while maintaining policy flexibility and death benefit protection. Compared to traditional annuities, IUL Banking can provide higher liquidity, potential for greater returns, and the ability to borrow against cash value without triggering taxable events, making it a strategic alternative for long-term financial planning.

Surrender Charge Optimization

Surrender charge optimization plays a crucial role in maximizing retirement income when comparing annuities and infinite banking strategies, as minimizing penalties during early withdrawals enhances liquidity and overall returns. Infinite banking allows greater flexibility by avoiding surrender charges entirely, whereas annuities often impose substantial fees that reduce accessible funds during critical periods.

Private Reserve Strategy

The Private Reserve Strategy leverages whole life insurance to create a tax-advantaged cash value reservoir that functions similarly to infinite banking, providing predictable retirement income without market volatility. Annuities offer guaranteed lifetime payouts but often come with fees and limited liquidity, whereas the Private Reserve Strategy enhances financial flexibility and wealth transfer potential through permanent insurance policies.

Tax-Free Retirement Stream

Annuities provide a tax-deferred growth with potential tax-free income through qualified distributions, while Infinite Banking leverages whole life insurance policies to create a tax-free retirement income stream by borrowing against the policy's cash value. Utilizing policy loans in Infinite Banking allows for flexible, tax-free access to funds without triggering taxable events, offering a strategic advantage over traditional annuity distributions.

Annuities vs Infinite Banking for retirement income. Infographic

moneydiff.com

moneydiff.com