Travel insurance offers comprehensive coverage tailored to specific trip risks, providing flexibility and protection against trip cancellations, medical emergencies, and lost belongings. Embedded insurance integrates coverage directly into travel bookings or products, streamlining the purchase process and enhancing customer convenience by offering seamless protection without separate policies. Choosing between travel and embedded insurance depends on the need for customizable options versus ease of access and automatic coverage.

Table of Comparison

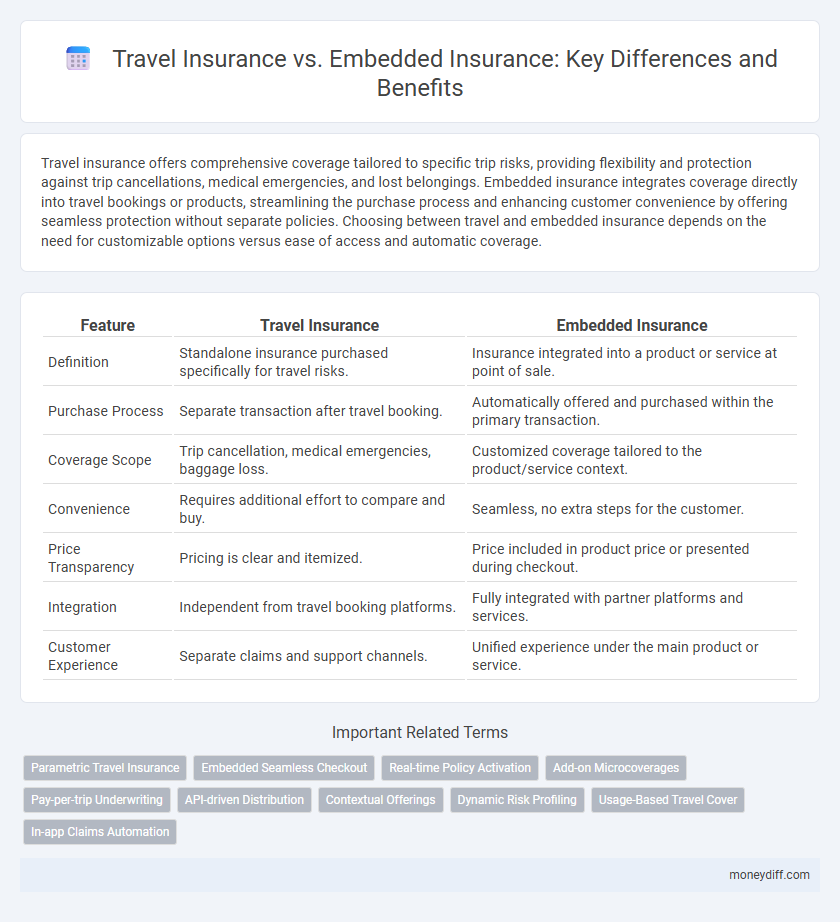

| Feature | Travel Insurance | Embedded Insurance |

|---|---|---|

| Definition | Standalone insurance purchased specifically for travel risks. | Insurance integrated into a product or service at point of sale. |

| Purchase Process | Separate transaction after travel booking. | Automatically offered and purchased within the primary transaction. |

| Coverage Scope | Trip cancellation, medical emergencies, baggage loss. | Customized coverage tailored to the product/service context. |

| Convenience | Requires additional effort to compare and buy. | Seamless, no extra steps for the customer. |

| Price Transparency | Pricing is clear and itemized. | Price included in product price or presented during checkout. |

| Integration | Independent from travel booking platforms. | Fully integrated with partner platforms and services. |

| Customer Experience | Separate claims and support channels. | Unified experience under the main product or service. |

Understanding Travel Insurance: Key Features and Benefits

Travel insurance provides coverage tailored to unexpected events such as trip cancellations, medical emergencies, and lost luggage, ensuring financial protection during travel. Embedded insurance integrates travel coverage directly into the booking process, offering seamless protection without separate policy purchases. Key benefits of travel insurance include comprehensive risk mitigation, peace of mind, and access to emergency assistance services worldwide.

What Is Embedded Insurance? A Modern Approach Explained

Embedded insurance integrates coverage directly into the purchase of travel services, streamlining protection without requiring separate policy acquisition. This approach leverages partnerships between insurers and travel providers, delivering tailored insurance products at the point of sale, enhancing customer convenience and reducing friction. By embedding travel insurance, companies optimize risk management and improve user experience through seamless, contextualized coverage options.

Core Differences: Travel Insurance vs. Embedded Insurance

Travel insurance typically offers standalone policies that cover trip cancellations, medical emergencies, and lost luggage, purchased independently before or during travel. Embedded insurance integrates coverage seamlessly within travel services such as flights or hotel bookings, providing automatic protection without separate purchases. The core difference lies in the delivery method: travel insurance is an optional, separate product, whereas embedded insurance is built into other travel offerings for instant, convenient coverage.

Cost Comparison: Which Insurance Option Saves You More?

Travel insurance typically involves higher upfront costs due to standalone policy fees and coverage for diverse risks, while embedded insurance integrates coverage within travel services, often resulting in lower premiums and added convenience. Embedded insurance reduces administrative expenses and bundling discounts, making it a cost-effective option for frequent travelers seeking seamless protection. Choosing embedded insurance can save up to 20-30% compared to traditional travel insurance, depending on the provider and coverage scope.

Coverage Scope: Evaluating Protection in Travel and Embedded Insurance

Travel insurance typically offers comprehensive coverage specifically tailored for trip-related risks such as trip cancellations, medical emergencies abroad, and lost luggage. Embedded insurance integrates protection seamlessly within the purchase of travel services, often providing limited but convenient coverage focused on critical incidents like flight delays or baggage loss. Evaluating protection scope reveals that traditional travel insurance ensures broader, customizable policies, while embedded insurance offers streamlined, automatic safeguards aligned with specific travel products.

Convenience Factor: Seamless Experience with Embedded Insurance

Embedded insurance enhances convenience by integrating coverage directly into travel bookings, eliminating separate purchase steps and reducing friction for customers. Travelers benefit from a seamless experience as policies are activated automatically at checkout, ensuring instant protection without extra effort. This streamlined approach increases customer satisfaction and trust compared to traditional standalone travel insurance options.

Customization: Flexibility in Travel and Embedded Insurance Plans

Travel insurance offers high customization allowing travelers to select coverage based on trip duration, destination, and activities, enhancing protection tailored to individual needs. Embedded insurance integrates coverage directly into travel purchases like flights or accommodations, providing seamless protection but with limited flexibility and predefined terms. Choosing between the two depends on the desire for personalized options versus convenience and streamlined purchase experience.

Claims Process: Efficiency and Customer Experience Compared

Embedded insurance streamlines the claims process by integrating coverage directly into travel bookings, reducing documentation and accelerating approvals. Travel insurance often requires separate claims submissions and longer verification times, potentially delaying reimbursements. Customers benefit from embedded insurance through seamless, faster claims handling and improved overall satisfaction.

Suitability: Choosing the Right Insurance for Different Travelers

Travel insurance offers tailored coverage for short-term trips, making it suitable for occasional travelers seeking protection against trip cancellations, medical emergencies, and lost luggage. Embedded insurance integrates coverage directly within travel services, ideal for frequent travelers who benefit from seamless, automatic protection without separate policies. Selecting the right option depends on travel frequency, duration, and required coverage specificity to ensure optimal risk management.

Future Trends: The Evolving Landscape of Travel and Embedded Insurance

Future trends in travel insurance indicate a shift toward embedded insurance models that integrate coverage seamlessly into the booking process, enhancing customer convenience and personalization. Data-driven insights and AI technologies enable real-time risk assessment, offering tailored policies that adjust dynamically to travel conditions and individual behaviors. Collaboration between insurers, travel platforms, and technology providers will drive innovation, making embedded insurance the preferred solution for comprehensive and hassle-free travel protection.

Related Important Terms

Parametric Travel Insurance

Parametric travel insurance leverages predefined triggers such as flight delays or weather conditions to deliver rapid, automated claims settlements, reducing reliance on traditional embedded insurance models that often require complex underwriting. This approach enhances traveler experience by providing transparent, efficient coverage tailored to specific risk parameters without the need for extensive manual intervention.

Embedded Seamless Checkout

Embedded insurance offers a seamless checkout experience by integrating coverage options directly within the travel booking process, reducing friction and increasing conversion rates. This approach leverages real-time data and personalized offers, enhancing customer convenience and driving higher policy uptake compared to traditional stand-alone travel insurance purchases.

Real-time Policy Activation

Real-time policy activation in embedded insurance enables seamless coverage by integrating insurance purchase directly into the travel booking process, ensuring instant protection without separate transactions. In contrast, traditional travel insurance often involves delayed activation, requiring travelers to buy policies independently, potentially leaving gaps in coverage during critical moments.

Add-on Microcoverages

Add-on microcoverages in travel insurance offer flexible, targeted protection for specific risks such as lost baggage, trip cancellations, or medical emergencies, enhancing traditional policies with tailored benefits. Embedded insurance integrates these microcoverages directly into travel products, providing seamless, real-time coverage that simplifies the purchase process and increases customer convenience.

Pay-per-trip Underwriting

Pay-per-trip underwriting in travel insurance offers tailored coverage based on the duration and specifics of each trip, optimizing risk assessment and premium pricing for short-term travelers. Embedded insurance integrates pay-per-trip models directly within booking platforms, streamlining the purchase process and enhancing customer convenience by providing instant, context-aware coverage options.

API-driven Distribution

API-driven distribution in travel insurance enables seamless integration of coverage options directly into booking platforms, enhancing real-time policy issuance and personalized offerings. Embedded insurance within travel services leverages these APIs to streamline customer experiences by providing tailored protection exactly when and where travelers need it.

Contextual Offerings

Embedded insurance integrates coverage directly into travel bookings, providing seamless protection tailored to trip details like destination, duration, and activities. Travel insurance as a standalone product offers broader options but lacks the personalized, context-driven convenience of embedded solutions.

Dynamic Risk Profiling

Dynamic risk profiling in travel insurance leverages real-time data such as trip duration, destination risk levels, and traveler behavior to adjust coverage and premiums more accurately. Embedded insurance integrates this dynamic profiling directly into booking platforms, enabling seamless, personalized policy adjustments that enhance risk management and customer experience.

Usage-Based Travel Cover

Usage-based travel insurance leverages real-time data from travelers' devices to customize coverage and pricing, enhancing risk assessment and reducing unnecessary premiums. Embedded travel insurance integrates coverage directly into booking platforms, streamlining purchase but often lacking the personalized benefits of dynamic usage-based models.

In-app Claims Automation

In-app claims automation streamlines the customer experience for both travel and embedded insurance by enabling seamless, real-time processing within the user interface, reducing manual intervention and claim turnaround time. Travel insurance benefits from dynamic data integration like trip itineraries and delays, while embedded insurance leverages contextual data from partner platforms to facilitate instant claim validation and payouts.

Travel vs Embedded for insurance. Infographic

moneydiff.com

moneydiff.com