Auto insurance provides traditional vehicle coverage based on fixed premiums determined by factors such as driving history, age, and vehicle type. Telematics insurance offers dynamic pricing, using real-time data from a vehicle's telematics device to assess driving behavior and adjust premiums accordingly. This personalized approach can reward safe driving habits with lower costs, making telematics insurance a flexible alternative to standard auto insurance policies.

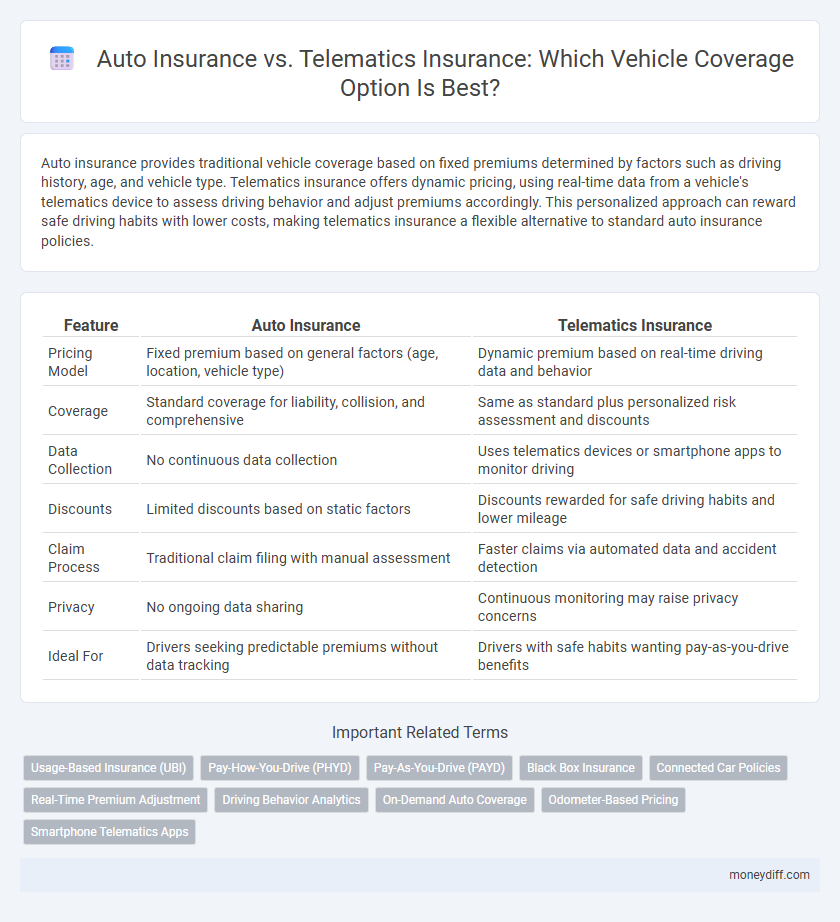

Table of Comparison

| Feature | Auto Insurance | Telematics Insurance |

|---|---|---|

| Pricing Model | Fixed premium based on general factors (age, location, vehicle type) | Dynamic premium based on real-time driving data and behavior |

| Coverage | Standard coverage for liability, collision, and comprehensive | Same as standard plus personalized risk assessment and discounts |

| Data Collection | No continuous data collection | Uses telematics devices or smartphone apps to monitor driving |

| Discounts | Limited discounts based on static factors | Discounts rewarded for safe driving habits and lower mileage |

| Claim Process | Traditional claim filing with manual assessment | Faster claims via automated data and accident detection |

| Privacy | No ongoing data sharing | Continuous monitoring may raise privacy concerns |

| Ideal For | Drivers seeking predictable premiums without data tracking | Drivers with safe habits wanting pay-as-you-drive benefits |

Understanding Auto Insurance Basics

Auto insurance provides traditional vehicle coverage based on fixed factors such as driver history, vehicle type, and location, offering predictable premiums with standard protection against accidents, theft, and liability. Telematics insurance uses real-time data collected from a vehicle's telematics device to monitor driving behavior, allowing insurers to tailor premiums to individual risk profiles, potentially lowering costs for safe drivers. Understanding these basics helps consumers choose between conventional coverage and usage-based insurance models that reward responsible driving habits.

What Is Telematics Insurance?

Telematics insurance uses a device or smartphone app to monitor driving behavior, including speed, braking patterns, and mileage, allowing insurers to tailor premiums based on real-time data. This type of auto insurance promotes safer driving habits by rewarding low-risk behavior with potential discounts. It provides a personalized approach compared to traditional auto insurance policies that rely on general risk factors such as age, location, and driving history.

Key Differences Between Auto and Telematics Insurance

Auto insurance offers fixed premiums based on general risk factors such as age, driving history, and vehicle type, while telematics insurance calculates rates using real-time data from a vehicle's GPS and onboard diagnostics to monitor driving behavior. Telematics insurance promotes safer driving habits by rewarding low-risk drivers with discounts and can provide detailed reports on speed, braking patterns, and mileage. The personalized nature of telematics insurance leads to potential cost savings and enhanced risk assessment compared to traditional auto insurance.

Cost Comparison: Premiums and Savings

Telematics insurance often offers lower premiums compared to traditional auto insurance by using real-time driving data to tailor rates based on individual behavior, rewarding safe drivers with significant savings. Traditional auto insurance premiums are generally fixed and based on broad factors like age, location, and vehicle type, which can result in higher costs for average drivers. Choosing telematics-based coverage can lead to cost-effective benefits, especially for low-mileage or cautious drivers seeking personalized premium adjustments.

How Telematics Devices Monitor Driver Behavior

Telematics insurance relies on devices installed in vehicles to monitor driver behavior, collecting data such as speed, braking patterns, acceleration, and mileage. This real-time information allows insurers to assess risk more accurately and offer personalized premiums based on actual driving habits. Unlike traditional auto insurance, which uses general factors like age and location, telematics provides dynamic monitoring that promotes safer driving and cost savings.

Privacy Concerns with Telematics Insurance

Telematics insurance collects detailed driving data through GPS and onboard sensors, raising significant privacy concerns among vehicle owners. This data includes location history, speed, and driving behavior, potentially exposing sensitive personal information if not securely managed. Insurers must implement robust data protection policies to address privacy risks and maintain customer trust in telematics-based auto insurance.

Eligibility and Requirements for Both Policies

Auto insurance typically requires a valid driver's license, proof of vehicle ownership, and a clean driving record for eligibility, whereas telematics insurance mandates the installation of a monitoring device or app to track driving behavior. Eligibility for telematics policies often favors drivers who exhibit safe driving habits, as premiums are adjusted based on real-time data such as speed, braking, and mileage. Both insurance types require vehicle registration and compliance with state-specific regulations, but telematics insurance uniquely relies on data transparency and consent for continuous monitoring.

Pros and Cons of Traditional Auto Insurance

Traditional auto insurance offers predictable premiums and broad coverage options, making it suitable for various driver profiles and vehicle types. However, fixed rates may not reward safe driving habits, potentially leading to higher costs for low-risk drivers. The lack of real-time monitoring can result in less personalized pricing and slower claims processing compared to telematics-based policies.

Advantages and Drawbacks of Telematics Insurance

Telematics insurance offers personalized premiums based on real-time driving data, leading to potential cost savings for safe drivers and enhanced risk assessment accuracy. It encourages responsible driving habits through feedback mechanisms, but concerns include privacy issues and potential data misuse. Traditional auto insurance provides predictable costs without data tracking, while telematics may impose premiums influenced by variable driving behavior and technological reliability.

Choosing the Right Coverage for Your Needs

Auto insurance provides standard coverage based on general risk factors such as driving history and vehicle type, while telematics insurance uses real-time data from installed devices to personalize premiums according to actual driving behavior. Choosing the right coverage involves evaluating your driving patterns, vehicle usage, and preference for potentially lower costs through monitored driving habits. Telematics insurance can offer savings and tailored risk assessment but requires willingness to share driving data for comprehensive vehicle coverage.

Related Important Terms

Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI), a subset of telematics insurance, leverages real-time driving data collected via GPS and onboard diagnostics to personalize auto insurance premiums based on individual driving behavior, promoting safer habits and cost savings. Traditional auto insurance relies on static factors like age and driving history, whereas UBI offers dynamic, usage-sensitive coverage that can reduce premiums for low-mileage or cautious drivers.

Pay-How-You-Drive (PHYD)

Pay-How-You-Drive (PHYD) telematics insurance uses real-time driving data such as speed, acceleration, and braking patterns to calculate personalized premiums, promoting safer driving habits and often resulting in lower costs compared to traditional auto insurance. Unlike conventional policies that rely on general risk factors, PHYD offers dynamic pricing based on actual driver behavior, enhancing fairness and encouraging risk reduction.

Pay-As-You-Drive (PAYD)

Auto insurance provides traditional vehicle coverage with fixed premiums based on general risk factors, while telematics insurance, specifically Pay-As-You-Drive (PAYD), uses real-time driving data to calculate personalized premiums reflecting actual mileage and driving behavior. PAYD encourages safer driving habits and cost savings by charging policyholders strictly for the miles they drive and their on-road conduct, leveraging GPS and sensor technology for precise monitoring.

Black Box Insurance

Black Box Insurance, a form of telematics insurance, uses a device installed in the vehicle to monitor driving behavior, enabling personalized premiums based on factors like speed, braking, and mileage. This contrasts with traditional auto insurance, which relies on demographic data and claims history for pricing, often resulting in less customized coverage and potentially higher costs for safe drivers.

Connected Car Policies

Connected car policies leverage telematics technology to provide personalized auto insurance rates based on real-time driving behavior, enhancing accuracy and cost-efficiency compared to traditional auto insurance. This approach enables usage-based coverage, incentivizing safer driving habits and offering dynamic premiums tailored to individual vehicle usage patterns.

Real-Time Premium Adjustment

Auto insurance typically offers fixed premiums based on estimated risk factors, while telematics insurance provides real-time premium adjustments by monitoring driving behavior through GPS and sensor data. This dynamic pricing model rewards safe driving habits with lower costs and allows insurers to more accurately assess risk on a continuous basis.

Driving Behavior Analytics

Telematics insurance leverages driving behavior analytics through real-time data collection on speed, acceleration, braking, and cornering patterns, enabling personalized premiums based on actual risk rather than generalized statistics used in traditional auto insurance. This approach enhances risk assessment accuracy, encouraging safer driving habits and potentially lowering costs for responsible drivers.

On-Demand Auto Coverage

On-demand auto coverage within telematics insurance leverages real-time driving data to offer personalized, pay-as-you-drive premiums, enhancing cost efficiency compared to traditional auto insurance policies with fixed rates. This dynamic approach reduces unnecessary expenses by billing only for actual road usage, catering to low-mileage or infrequent drivers seeking flexible vehicle protection.

Odometer-Based Pricing

Odometer-based pricing in auto insurance calculates premiums based on the actual miles driven, offering cost savings for low-mileage drivers by directly linking coverage costs to vehicle usage. Telematics insurance enhances this model with real-time data on driving behavior, enabling more personalized risk assessment and potentially greater discounts beyond simple mileage tracking.

Smartphone Telematics Apps

Smartphone telematics apps in auto insurance provide real-time driving behavior data such as speed, acceleration, and braking patterns, enabling insurers to offer personalized premiums based on actual risk profiles. This technology enhances traditional auto insurance by promoting safer driving habits and potentially lowering costs through continuous monitoring and data-driven policy adjustments.

Auto Insurance vs Telematics Insurance for vehicle coverage. Infographic

moneydiff.com

moneydiff.com