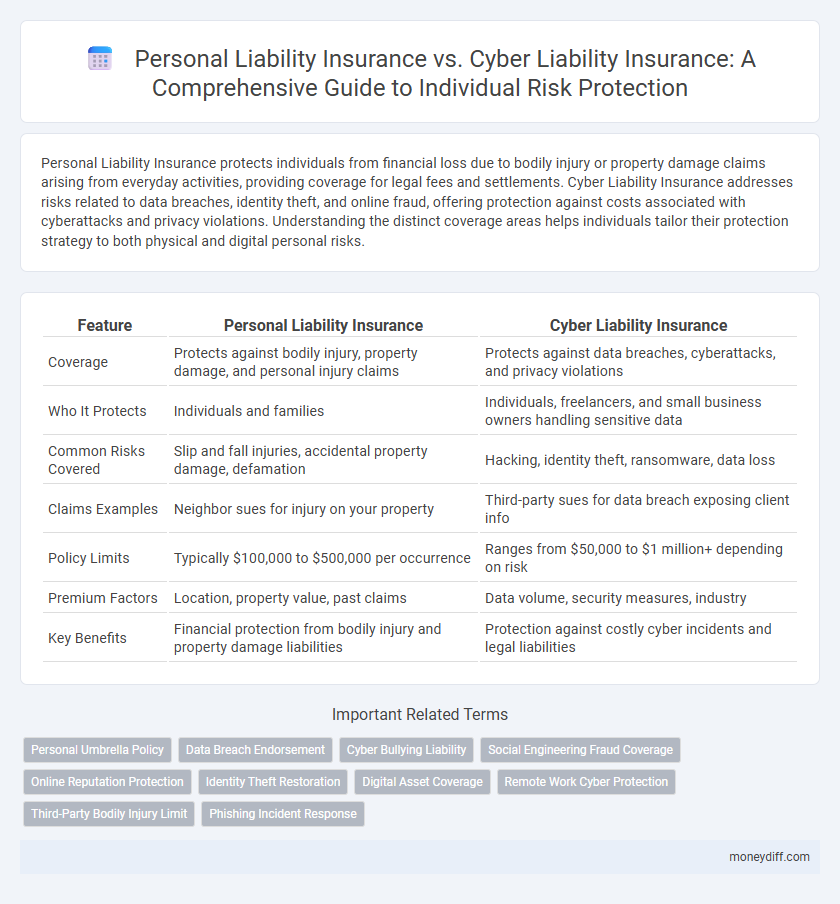

Personal Liability Insurance protects individuals from financial loss due to bodily injury or property damage claims arising from everyday activities, providing coverage for legal fees and settlements. Cyber Liability Insurance addresses risks related to data breaches, identity theft, and online fraud, offering protection against costs associated with cyberattacks and privacy violations. Understanding the distinct coverage areas helps individuals tailor their protection strategy to both physical and digital personal risks.

Table of Comparison

| Feature | Personal Liability Insurance | Cyber Liability Insurance |

|---|---|---|

| Coverage | Protects against bodily injury, property damage, and personal injury claims | Protects against data breaches, cyberattacks, and privacy violations |

| Who It Protects | Individuals and families | Individuals, freelancers, and small business owners handling sensitive data |

| Common Risks Covered | Slip and fall injuries, accidental property damage, defamation | Hacking, identity theft, ransomware, data loss |

| Claims Examples | Neighbor sues for injury on your property | Third-party sues for data breach exposing client info |

| Policy Limits | Typically $100,000 to $500,000 per occurrence | Ranges from $50,000 to $1 million+ depending on risk |

| Premium Factors | Location, property value, past claims | Data volume, security measures, industry |

| Key Benefits | Financial protection from bodily injury and property damage liabilities | Protection against costly cyber incidents and legal liabilities |

Understanding Personal Liability Insurance

Personal Liability Insurance covers individuals against claims of bodily injury or property damage caused to others, providing financial protection for legal fees and settlements. It typically responds to incidents occurring at home or in daily life, such as accidents involving guests or pet-related injuries. Understanding this coverage helps individuals evaluate gaps that Cyber Liability Insurance addresses, which focuses on risks related to data breaches, cyberattacks, and online identity theft.

What Is Cyber Liability Insurance?

Cyber Liability Insurance protects individuals against risks related to data breaches, identity theft, and cyberattacks, offering coverage for financial losses and legal fees arising from these incidents. Unlike Personal Liability Insurance, which covers bodily injury or property damage to third parties, Cyber Liability Insurance specifically addresses digital threats and online vulnerabilities. This policy is crucial for individuals who store sensitive information electronically or engage in frequent online transactions, ensuring protection against cyber risks.

Key Differences Between Personal and Cyber Liability Insurance

Personal Liability Insurance covers claims related to bodily injury or property damage caused by the insured's negligence in everyday activities, protecting assets from lawsuits in home or social settings. Cyber Liability Insurance specifically addresses risks associated with data breaches, cyberattacks, and online identity theft, offering coverage for expenses like notification costs, legal fees, and credit monitoring. The key difference lies in the scope: personal liability focuses on physical harm or property damage, while cyber liability targets digital threats and associated financial losses due to cyber incidents.

Coverage: What Personal Liability Insurance Protects

Personal Liability Insurance protects individuals against claims of bodily injury, property damage, and legal expenses arising from accidents or negligence occurring on their property or caused by their actions. This coverage typically includes incidents such as slip-and-fall injuries, damage caused by pets, and personal lawsuits related to accidents outside the home. It does not extend to data breaches or cyberattacks, which fall under the scope of Cyber Liability Insurance.

Coverage: What Cyber Liability Insurance Protects

Cyber Liability Insurance protects individuals from financial losses related to data breaches, cyberattacks, and identity theft, covering costs such as legal fees, notification expenses, and credit monitoring services. It also covers liabilities arising from unauthorized access to sensitive personal information and cyber extortion attempts. Unlike Personal Liability Insurance, which primarily covers physical injury or property damage, Cyber Liability Insurance specifically addresses risks associated with digital assets and online activities.

Who Needs Personal Liability Insurance?

Personal liability insurance is essential for individuals who want protection against claims of bodily injury or property damage caused to others, covering legal fees and settlements. Homeowners, renters, and anyone with assets to protect need this coverage to shield personal finances from unexpected lawsuits. Unlike cyber liability insurance, which focuses on data breaches and online threats, personal liability insurance addresses everyday risks related to physical accidents and negligence.

Who Needs Cyber Liability Insurance?

Individuals who frequently use digital devices for personal or professional purposes need cyber liability insurance to protect against risks like data breaches, identity theft, and online fraud. Unlike personal liability insurance, which covers bodily injury and property damage caused to others, cyber liability insurance specifically addresses financial losses and legal expenses arising from cyber incidents. Homeowners, freelancers, and remote employees handling sensitive information benefit significantly from the specialized coverage cyber liability insurance provides.

Cost Comparison: Personal vs Cyber Liability Insurance

Personal liability insurance typically costs between $100 and $300 annually, offering protection against bodily injury or property damage claims. Cyber liability insurance premiums for individuals range more widely, often from $500 to $1,500 per year, reflecting the complexity and elevated risk of data breaches and cyberattacks. The higher cost of cyber liability insurance accounts for specialized coverage such as identity restoration, cyber extortion, and data recovery services.

Choosing the Right Liability Insurance for Individuals

Personal Liability Insurance covers bodily injury and property damage claims arising from everyday incidents, protecting individuals from financial loss due to accidents at home or personal negligence. Cyber Liability Insurance addresses risks related to data breaches, identity theft, and online fraud, safeguarding individuals against cybersecurity threats and digital exposure. Selecting the right liability insurance depends on evaluating personal risk factors, such as online activity levels and physical interactions, to ensure comprehensive protection against both traditional and digital liabilities.

Tips for Managing Risk: Combining Personal and Cyber Liability Protection

Combining personal liability insurance with cyber liability insurance enhances overall individual risk management by covering both physical damages and digital threats. Personal liability insurance safeguards against accidental injuries or property damage, while cyber liability insurance protects against identity theft, data breaches, and online fraud. Integrating these policies ensures comprehensive protection for an individual's assets and reputation in both real-world and digital environments.

Related Important Terms

Personal Umbrella Policy

Personal Umbrella Policies enhance Personal Liability Insurance by providing extended coverage beyond standard limits for incidents such as bodily injury or property damage, offering broad protection against lawsuits and claims. Unlike Cyber Liability Insurance, which specifically covers data breaches and online risks, Personal Umbrella Policies do not include cyber-related incidents but safeguard individuals from substantial financial loss due to personal liability exposure.

Data Breach Endorsement

Personal Liability Insurance typically covers bodily injury or property damage claims but excludes cyber incidents, making Data Breach Endorsements essential for protecting against financial losses from identity theft or data breaches. Cyber Liability Insurance specifically addresses risks related to data breaches, unauthorized access, and cyber extortion, offering comprehensive coverage for individual exposures in the digital environment.

Cyber Bullying Liability

Personal Liability Insurance typically covers bodily injury or property damage claims, but it often excludes cyberbullying incidents, leaving individuals exposed to online harassment risks. Cyber Liability Insurance specifically addresses cyberbullying liability by providing protection against claims related to online defamation, harassment, and privacy breaches, making it essential for managing individual digital risk.

Social Engineering Fraud Coverage

Personal Liability Insurance generally does not cover financial losses resulting from social engineering fraud, leaving individuals vulnerable to deceptive schemes that manipulate human trust. Cyber Liability Insurance for individuals specifically addresses these risks by providing coverage for damages from social engineering attacks such as phishing and impersonation scams, enhancing protection against modern cyber threats.

Online Reputation Protection

Personal Liability Insurance primarily covers bodily injury or property damage claims but typically excludes online reputation harm, whereas Cyber Liability Insurance specifically addresses risks like data breaches, cyberattacks, and online defamation, providing protection for personal reputation damage in the digital space. Individuals seeking comprehensive online reputation protection should prioritize Cyber Liability Insurance due to its tailored coverage for cyber-related threats and reputation management.

Identity Theft Restoration

Personal Liability Insurance typically covers bodily injury or property damage claims but does not extend to identity theft restoration, whereas Cyber Liability Insurance specifically addresses digital risks, including identity theft recovery and related expenses. Individuals seeking protection against identity theft should prioritize Cyber Liability Insurance as it offers targeted coverage for cybercrimes and personal data breaches that Personal Liability Insurance excludes.

Digital Asset Coverage

Personal Liability Insurance typically covers bodily injury and property damage claims but rarely extends to digital assets such as cryptocurrency wallets or online accounts, leaving gaps in protection against cyber threats. Cyber Liability Insurance specifically addresses risks related to digital asset breaches, data theft, and cyber extortion, offering tailored coverage for individuals vulnerable to online attacks.

Remote Work Cyber Protection

Personal Liability Insurance covers bodily injury and property damage claims but typically excludes cyber risks associated with remote work, making Cyber Liability Insurance essential for protecting against data breaches, ransomware, and online fraud targeting individuals working remotely. Remote work cyber protection requires specialized policies that address vulnerabilities such as unsecured home networks and phishing attacks, ensuring comprehensive coverage beyond traditional personal liability limits.

Third-Party Bodily Injury Limit

Personal Liability Insurance typically provides coverage for third-party bodily injury up to policy limits which often range from $100,000 to $500,000 per occurrence, protecting individuals from legal and medical expenses arising from accidents. Cyber Liability Insurance focuses on data breaches and cyber threats rather than physical injuries, thus it generally does not cover third-party bodily injury limits but instead covers costs related to data loss, notification, and cyber extortion.

Phishing Incident Response

Personal Liability Insurance typically covers physical injury or property damage caused by the insured, but it rarely includes protection against cyber threats such as phishing attacks. Cyber Liability Insurance specifically addresses individual risk related to phishing incident response by covering expenses like notification costs, credit monitoring, legal fees, and crisis management, ensuring comprehensive protection against cybercrime losses.

Personal Liability Insurance vs Cyber Liability Insurance for individual risk. Infographic

moneydiff.com

moneydiff.com