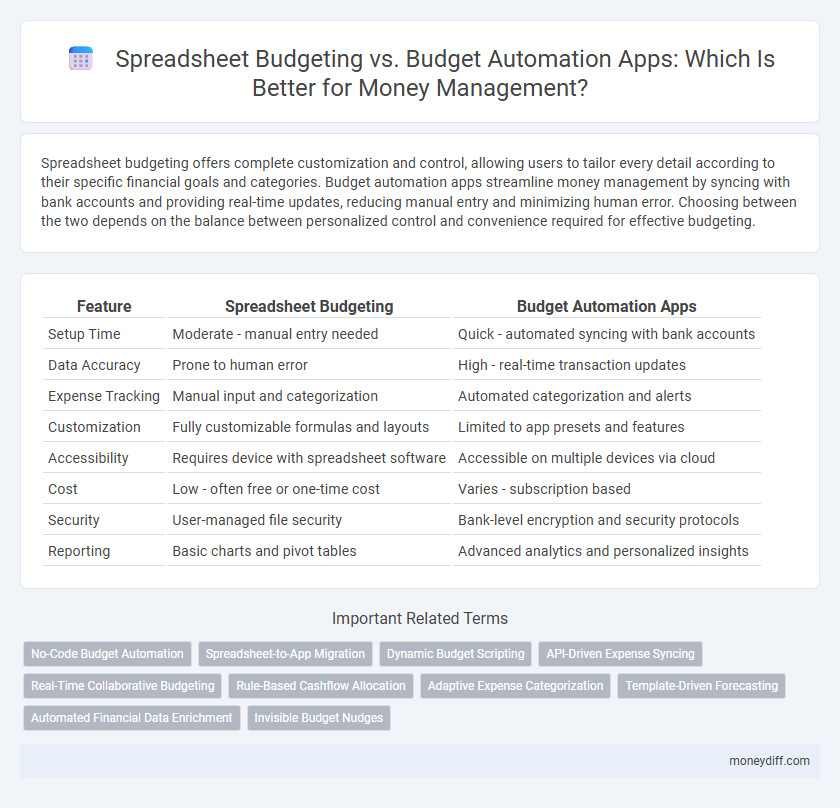

Spreadsheet budgeting offers complete customization and control, allowing users to tailor every detail according to their specific financial goals and categories. Budget automation apps streamline money management by syncing with bank accounts and providing real-time updates, reducing manual entry and minimizing human error. Choosing between the two depends on the balance between personalized control and convenience required for effective budgeting.

Table of Comparison

| Feature | Spreadsheet Budgeting | Budget Automation Apps |

|---|---|---|

| Setup Time | Moderate - manual entry needed | Quick - automated syncing with bank accounts |

| Data Accuracy | Prone to human error | High - real-time transaction updates |

| Expense Tracking | Manual input and categorization | Automated categorization and alerts |

| Customization | Fully customizable formulas and layouts | Limited to app presets and features |

| Accessibility | Requires device with spreadsheet software | Accessible on multiple devices via cloud |

| Cost | Low - often free or one-time cost | Varies - subscription based |

| Security | User-managed file security | Bank-level encryption and security protocols |

| Reporting | Basic charts and pivot tables | Advanced analytics and personalized insights |

Understanding Spreadsheet Budgeting Basics

Spreadsheet budgeting enables detailed customization and complete control over financial data, supporting personalized categories and manual entry of income and expenses. It requires a solid grasp of functions like SUM, IF, and conditional formatting to effectively track budgets and forecast cash flow. Mastery of these basics enhances accuracy and provides a flexible platform for monitoring financial goals without recurring subscription costs.

What Are Budget Automation Apps?

Budget automation apps are digital tools that automatically track and categorize expenses, income, and financial goals, providing real-time insights into spending patterns. These apps integrate with bank accounts and credit cards to update budgets without manual entry, reducing errors and saving time compared to traditional spreadsheet budgeting. Features often include alerts for overspending, customizable budget categories, and visual reports that enhance decision-making for effective money management.

Key Features of Spreadsheet Budgets

Spreadsheet budgets offer customizable templates with flexible cell formulas, enabling detailed tracking of income, expenses, and savings goals. Users benefit from manual data entry that provides granular control over categories and personalized financial modeling. Core features include conditional formatting for visual cues, pivot tables for dynamic data analysis, and compatibility with various file formats for easy sharing and backup.

Advantages of Budget Automation Apps

Budget automation apps streamline money management by automatically syncing bank transactions and categorizing expenses in real time, reducing manual data entry errors. These apps provide instant budget insights and alerts, enabling proactive financial decisions based on accurate, up-to-date information. Enhanced integration with other financial tools and customizable reporting features offer greater flexibility and comprehensive tracking compared to traditional spreadsheet budgeting methods.

Manual Control vs. Automated Tracking

Spreadsheet budgeting offers manual control, allowing users to customize categories, formulas, and data entries for precise financial oversight. Budget automation apps provide real-time tracking by syncing with bank accounts and credit cards, reducing errors and saving time on data entry. Choosing between spreadsheets and automation depends on the preference for hands-on management versus seamless, automated updates in money management.

Customization: Spreadsheets vs. Apps

Spreadsheets offer unparalleled customization through flexible formulas and layout adjustments, allowing users to tailor their budgeting systems precisely to their financial goals. Budget automation apps provide built-in templates and automated tracking features, but customization options are often limited by predefined categories and rules. Choosing between spreadsheets and apps depends on whether personalized control or ease of use and automation are the priority for effective money management.

Data Security and Privacy Concerns

Spreadsheet budgeting offers users complete control over data storage, minimizing exposure to external breaches and ensuring sensitive financial information remains offline. Budget automation apps, while providing real-time syncing and ease of use, raise concerns over data encryption standards, third-party access, and potential vulnerabilities in cloud-based storage. Prioritizing platforms with robust security certifications and transparent privacy policies is essential to safeguard personal financial data in budget management.

Cost Comparison: Free vs. Paid Solutions

Spreadsheet budgeting offers a cost-effective solution with free templates widely available, making it ideal for users seeking zero-cost options. Budget automation apps often require a subscription or one-time fee but provide enhanced features like real-time syncing and smart expense tracking. Comparing costs, spreadsheets minimize upfront expenses while paid apps deliver convenience and efficiency at a higher price point.

Integrating Financial Accounts: Ease of Use

Spreadsheet budgeting provides manual control over data entry but requires users to link financial accounts individually, often leading to time-consuming reconciliation and potential errors. Budget automation apps streamline the integration of multiple bank accounts, credit cards, and investments through secure APIs, enabling real-time updates and accurate tracking without manual input. This ease of use enhances user experience by reducing administrative tasks and improving overall financial visibility.

Choosing the Right Tool for Your Money Goals

Spreadsheet budgeting offers customizable control and detailed tracking for users comfortable with manual data entry, making it ideal for those who prefer a hands-on approach. Budget automation apps utilize algorithms to sync accounts and categorize expenses automatically, providing real-time insights and time-saving features suited for busy individuals seeking convenience. Selecting the right tool depends on your money management goals, desired level of control, and willingness to invest time in setup versus the benefits of automated accuracy.

Related Important Terms

No-Code Budget Automation

No-code budget automation apps streamline money management by eliminating manual data entry and offering real-time expense tracking, improving accuracy and saving time compared to traditional spreadsheet budgeting. These tools integrate with bank accounts and financial services to provide dynamic, automated budgeting processes without requiring programming skills.

Spreadsheet-to-App Migration

Migrating from spreadsheet budgeting to budget automation apps streamlines money management by reducing manual data entry errors and enabling real-time expense tracking. Automated apps integrate bank feeds and generate dynamic reports, offering enhanced accuracy and timely financial insights compared to traditional spreadsheet methods.

Dynamic Budget Scripting

Dynamic budget scripting in spreadsheet budgeting allows for highly customizable financial models tailored to individual needs but requires advanced skills and manual updates. Budget automation apps leverage real-time data integration and AI-driven algorithms to simplify money management, offering automated adjustments and predictive insights without extensive user input.

API-Driven Expense Syncing

Spreadsheet budgeting offers manual tracking and high customization but lacks real-time updates, whereas budget automation apps leverage API-driven expense syncing to automatically import transactions from bank accounts, providing accurate, up-to-date financial data. This integration reduces errors, saves time, and enhances decision-making by delivering seamless, continuous expense tracking across multiple financial institutions.

Real-Time Collaborative Budgeting

Real-time collaborative budgeting in spreadsheet budgeting allows multiple users to edit and view updates simultaneously, enhancing transparency and joint decision-making for personal or business finances. Budget automation apps offer integrated syncing and instant updates across devices, streamlining expense tracking and financial planning with less manual input.

Rule-Based Cashflow Allocation

Rule-based cashflow allocation in spreadsheet budgeting requires manual entry and formula adjustments, increasing the risk of errors and time consumption. Budget automation apps streamline this process by dynamically categorizing expenses and allocating funds based on predefined rules, enhancing accuracy and efficiency in money management.

Adaptive Expense Categorization

Budget automation apps leverage adaptive expense categorization powered by machine learning algorithms that dynamically classify transactions for more accurate and personalized financial tracking, reducing manual input errors common in spreadsheet budgeting. This adaptive categorization enhances real-time budget adjustments and forecasting, offering superior control over money management compared to static, manual spreadsheet methods.

Template-Driven Forecasting

Template-driven forecasting in spreadsheet budgeting offers customizable, formula-based projections allowing users to tailor financial models manually, while budget automation apps leverage real-time data integration and machine learning algorithms to generate dynamic, accurate forecasts without extensive user input. Spreadsheet templates provide granular control but require ongoing updates, whereas automation tools enhance efficiency by continuously adjusting budgets based on spending patterns and predictive analytics.

Automated Financial Data Enrichment

Spreadsheet budgeting requires manual entry and updating of financial data, which can be time-consuming and prone to errors, while budget automation apps leverage automated financial data enrichment to seamlessly import transactions, categorize expenses, and provide real-time insights. These apps integrate with bank accounts and credit cards, ensuring accurate, up-to-date budgeting without constant user intervention, significantly enhancing efficiency and decision-making.

Invisible Budget Nudges

Invisible budget nudges integrated into budget automation apps enhance financial discipline by subtly guiding spending habits without user intervention, outperforming traditional spreadsheet budgeting's manual tracking and oversight. These automated systems leverage real-time data analytics and personalized alerts to optimize cash flow management and prevent overspending before it occurs.

Spreadsheet Budgeting vs Budget Automation Apps for money management. Infographic

moneydiff.com

moneydiff.com