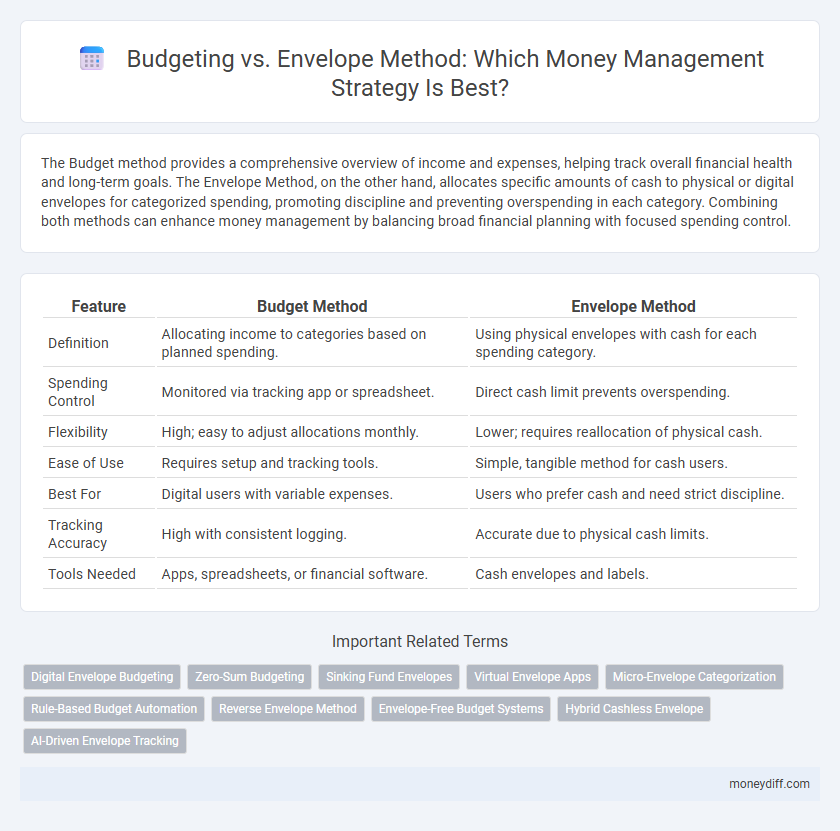

The Budget method provides a comprehensive overview of income and expenses, helping track overall financial health and long-term goals. The Envelope Method, on the other hand, allocates specific amounts of cash to physical or digital envelopes for categorized spending, promoting discipline and preventing overspending in each category. Combining both methods can enhance money management by balancing broad financial planning with focused spending control.

Table of Comparison

| Feature | Budget Method | Envelope Method |

|---|---|---|

| Definition | Allocating income to categories based on planned spending. | Using physical envelopes with cash for each spending category. |

| Spending Control | Monitored via tracking app or spreadsheet. | Direct cash limit prevents overspending. |

| Flexibility | High; easy to adjust allocations monthly. | Lower; requires reallocation of physical cash. |

| Ease of Use | Requires setup and tracking tools. | Simple, tangible method for cash users. |

| Best For | Digital users with variable expenses. | Users who prefer cash and need strict discipline. |

| Tracking Accuracy | High with consistent logging. | Accurate due to physical cash limits. |

| Tools Needed | Apps, spreadsheets, or financial software. | Cash envelopes and labels. |

Introduction to Budgeting Methods

The Budget method tracks income and expenses by assigning fixed amounts to different categories, promoting overall financial awareness and control. The Envelope Method divides cash into physical envelopes labeled for specific spending areas, preventing overspending by limiting funds to each envelope. Both methods aim to improve money management by offering structured ways to monitor and regulate personal finances.

What Is the Budget Method?

The budget method involves creating a detailed plan that allocates income to various expense categories, tracking spending against these predefined limits to maintain financial control. It uses historical spending data and future financial goals to set realistic spending caps for housing, groceries, utilities, and savings. This method emphasizes goal-oriented financial planning and continuous monitoring, differing from the envelope method which physically segregates cash for each expense category.

What Is the Envelope Method?

The Envelope Method is a cash-based money management system where funds are physically divided into labeled envelopes for specific spending categories, ensuring controlled expenses and preventing overspending. This method contrasts with traditional budgeting by emphasizing tangible allocation over digital tracking, which can enhance discipline and awareness of spending habits. Popular among users aiming for simplicity and accountability, the Envelope Method provides clear limits and promotes financial mindfulness.

Key Differences Between Budget and Envelope Method

The key differences between Budget and Envelope Method for money management lie in their approach and flexibility. A budget allocates income to various categories based on planned expenses, providing a broad financial overview and control. The Envelope Method uses physical or digital envelopes to separate cash for specific spending categories, promoting strict spending limits and preventing overspending in each category.

Pros and Cons of Traditional Budgeting

Traditional budgeting provides a clear framework for tracking income and expenses, promoting disciplined financial planning and long-term goal setting. However, its rigidity can lead to frustration when unexpected expenses arise, and it often requires frequent adjustments to stay realistic and effective. Unlike the Envelope Method, which allocates cash for specific spending categories, traditional budgeting relies heavily on estimates, making it less flexible for variable or impulsive spending patterns.

Advantages and Disadvantages of Envelope Method

The Envelope Method for money management offers clear advantages such as improved spending control and increased awareness of budget limits by allocating cash into physical envelopes for specific categories. Its main disadvantage lies in the practical challenges, including the need to carry cash and the lack of flexibility for unexpected expenses or digital transactions. While it enhances discipline and reduces overspending, it may not be suitable for users who prefer automated or app-based budgeting tools.

Which Method Encourages Better Financial Discipline?

The envelope method enforces stricter financial discipline by allocating cash into designated envelopes for specific spending categories, preventing overspending beyond set limits. In contrast, traditional budgeting often relies on digital tracking, which can be less tangible and easier to overlook, leading to potential overspending. Research shows users of the envelope method tend to develop stronger spending awareness and control, promoting more consistent adherence to financial goals.

Suitability: Who Should Use Each Method?

The Budget method suits individuals who prefer detailed tracking of income and expenses with flexibility in allocation, ideal for those comfortable using spreadsheets or apps to monitor financial goals. The Envelope Method benefits people who manage cash flow strictly and want to limit spending to preset categories, making it effective for those prone to overspending or who find visual, physical money management easier. Each approach caters to different spending habits and financial discipline levels, ensuring users choose based on personal budgeting preferences and control needs.

Combining Budget and Envelope Method for Maximum Effect

Combining the Budget and Envelope Method enhances money management by providing detailed financial planning alongside tangible spending limits, which improves control over discretionary expenses. Allocating funds within a budget and physically separating cash into envelopes for different categories ensures adherence to spending goals and reduces impulsive purchases. This hybrid approach leverages the strategic overview of a budget with the practical discipline of envelopes to optimize savings and expense tracking.

Choosing the Best Money Management Strategy for You

Selecting between the Budget and Envelope Method depends on personal financial goals and spending habits. The Budget Method offers a comprehensive overview by allocating funds to categories, enabling detailed tracking and adjustments. The Envelope Method emphasizes discipline through physical cash allocation, ideal for those who prefer tangible spending limits to avoid overspending.

Related Important Terms

Digital Envelope Budgeting

Digital envelope budgeting enhances traditional envelope methods by using apps to allocate funds into virtual envelopes for specific expenses, improving tracking and control without cash handling. This approach integrates real-time spending alerts, automated allocations, and seamless adjustments, making money management more efficient and adaptive than classic paper-based budgeting.

Zero-Sum Budgeting

Zero-sum budgeting allocates every dollar of income to specific expenses, savings, or debt payments, ensuring the total budget balances to zero at the end of each period. Unlike the envelope method, which physically separates cash into categorized envelopes, zero-sum budgeting emphasizes precise income allocation to maximize financial control and minimize waste.

Sinking Fund Envelopes

Sinking fund envelopes enhance financial planning by allocating funds for specific future expenses, preventing overspending and reducing debt accumulation compared to traditional budgeting methods. This approach segments money into defined categories, ensuring disciplined savings and improved cash flow management for anticipated costs.

Virtual Envelope Apps

Virtual envelope apps enhance money management by digitally allocating funds into categorized envelopes, mirroring the traditional envelope method but with real-time tracking and flexible adjustments. These apps improve budgeting accuracy by providing instant notifications and detailed spending analytics, helping users adhere to financial limits without carrying cash.

Micro-Envelope Categorization

Micro-envelope categorization enhances the traditional budget method by dividing expenses into highly specific subcategories, allowing for precise allocation of funds and real-time tracking of spending habits. This granular approach helps individuals maintain strict control over finances, reducing overspending and improving savings outcomes compared to the broader envelope method.

Rule-Based Budget Automation

Rule-based budget automation utilizes predefined spending categories and limits to streamline financial tracking, ensuring consistent adherence to personal financial goals without manual intervention. Unlike the envelope method, which relies on physically dividing cash into labeled compartments, rule-based automation leverages digital tools to automatically categorize transactions and enforce spending rules in real-time.

Reverse Envelope Method

The Reverse Envelope Method reallocates leftover funds from each spending category back into savings or debt repayment, enhancing financial discipline beyond traditional budgeting. This approach encourages active cash flow management by prioritizing saving gains rather than limiting expenditures like the standard Envelope Method.

Envelope-Free Budget Systems

Envelope-free budget systems prioritize digital tools and flexible spending categories, eliminating the need for physical cash envelopes while maintaining clear spending limits and financial goals. These systems enhance money management by integrating real-time tracking and automation, offering convenience and adaptability over traditional envelope methods.

Hybrid Cashless Envelope

The Hybrid Cashless Envelope method combines digital tracking with traditional budgeting by allocating funds into virtual envelopes, enhancing expense control without carrying physical cash. This approach leverages mobile apps and bank integrations to maintain real-time spending visibility while preserving the psychological benefits of envelope budgeting.

AI-Driven Envelope Tracking

AI-driven envelope tracking enhances traditional envelope methods by dynamically allocating funds to digital envelopes based on spending patterns and real-time financial data, ensuring optimal budget adherence. This approach surpasses static budget models by offering predictive analytics and automated adjustments, increasing financial discipline and reducing overspending risks.

Budget vs Envelope Method for money management. Infographic

moneydiff.com

moneydiff.com