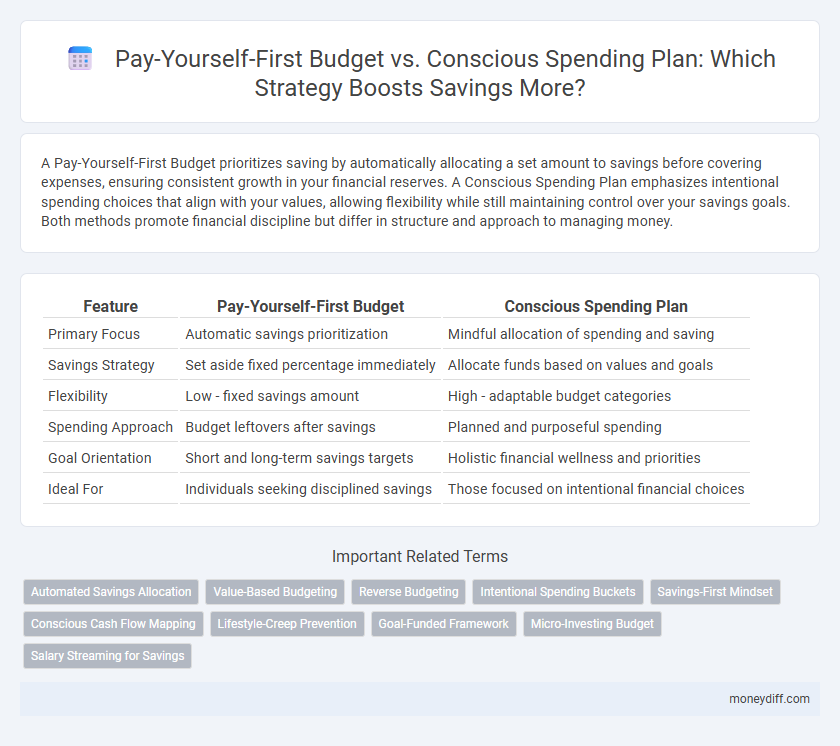

A Pay-Yourself-First Budget prioritizes saving by automatically allocating a set amount to savings before covering expenses, ensuring consistent growth in your financial reserves. A Conscious Spending Plan emphasizes intentional spending choices that align with your values, allowing flexibility while still maintaining control over your savings goals. Both methods promote financial discipline but differ in structure and approach to managing money.

Table of Comparison

| Feature | Pay-Yourself-First Budget | Conscious Spending Plan |

|---|---|---|

| Primary Focus | Automatic savings prioritization | Mindful allocation of spending and saving |

| Savings Strategy | Set aside fixed percentage immediately | Allocate funds based on values and goals |

| Flexibility | Low - fixed savings amount | High - adaptable budget categories |

| Spending Approach | Budget leftovers after savings | Planned and purposeful spending |

| Goal Orientation | Short and long-term savings targets | Holistic financial wellness and priorities |

| Ideal For | Individuals seeking disciplined savings | Those focused on intentional financial choices |

Introduction to Modern Savings Strategies

The Pay-Yourself-First Budget prioritizes setting aside a fixed savings amount before any other expenses, ensuring consistent wealth accumulation. The Conscious Spending Plan emphasizes aligning expenditures with personal values, promoting mindful financial decisions to maximize satisfaction and savings. Both strategies offer modern approaches to building savings by balancing automatic discipline with intentional spending.

What Is the Pay-Yourself-First Budget?

The Pay-Yourself-First budget is a savings strategy that prioritizes setting aside a predetermined amount of money for savings immediately after receiving income. This method ensures consistent saving by treating savings as a non-negotiable expense before covering other expenditures. Unlike a Conscious Spending Plan, which adjusts spending based on personal values and priorities, Pay-Yourself-First emphasizes disciplined automatic saving to build financial security.

Understanding the Conscious Spending Plan

A Conscious Spending Plan prioritizes mindful allocation of income, ensuring essential expenses are covered while intentionally directing funds toward savings and personal values. This approach contrasts with the Pay-Yourself-First Budget, which emphasizes automatic savings deposits before any spending. By aligning spending habits with financial goals, the Conscious Spending Plan enhances control over discretionary purchases and promotes sustainable savings growth.

Key Differences Between the Two Approaches

The Pay-Yourself-First Budget prioritizes automatic savings by setting aside a fixed amount before any expenses, ensuring consistent wealth accumulation and financial discipline. The Conscious Spending Plan emphasizes intentional spending aligned with personal values, promoting mindful allocation of funds towards priorities rather than strict budgeting categories. Key differences include the Pay-Yourself-First method's focus on saving as a non-negotiable expense versus the Conscious Spending Plan's emphasis on optimizing every dollar spent for greater life satisfaction.

Benefits of Pay-Yourself-First Budgeting

Pay-Yourself-First budgeting ensures consistent savings by prioritizing automatic transfers to savings accounts before any expenses occur, fostering disciplined financial habits. This approach reduces the temptation to overspend by allocating funds for future goals upfront, enhancing long-term wealth accumulation. Compared to Conscious Spending Plans, it streamlines money management, minimizing decision fatigue and reinforcing a savings-first mindset.

Advantages of a Conscious Spending Plan

A Conscious Spending Plan enhances savings by aligning expenditures with personal values, promoting mindful financial decisions that reduce impulsive purchases. It offers flexibility to adjust budgets based on evolving priorities, unlike rigid Pay-Yourself-First budgets that allocate fixed savings amounts. This approach fosters long-term financial discipline through intentional spending, resulting in more sustainable and satisfying saving habits.

Potential Drawbacks of Each Method

The Pay-Yourself-First Budget may lead to inflexibility, as rigidly allocating funds to savings before expenses can cause cash flow challenges during unexpected costs. In contrast, the Conscious Spending Plan risks underfunding savings if discretionary spending is not carefully controlled, since it emphasizes mindful spending without preset savings targets. Both methods require balancing discipline and adaptability to effectively build savings without compromising financial stability.

Ideal Users for Each Savings Strategy

The Pay-Yourself-First Budget suits individuals who prefer automatic savings and prioritizing financial discipline by setting aside a fixed amount before other expenses. Conscious Spending Plan appeals to those who value mindful allocation of funds, focusing on aligning spending with personal values and goals. Ideal users for Pay-Yourself-First often seek structure and simplicity, while Conscious Spending Plan fits those who want flexibility and intentional control over their finances.

How to Choose the Right Approach for You

Choosing between a Pay-Yourself-First budget and a Conscious Spending Plan depends on your financial goals and spending habits. If building savings quickly and consistently is your priority, the Pay-Yourself-First method allocates a fixed portion of income to savings before any expenses. Alternatively, the Conscious Spending Plan requires tracking and aligning spending with personal values, ideal for those seeking flexibility while maintaining mindful saving.

Conclusion: Maximizing Savings with the Best Fit

Choosing between the Pay-Yourself-First Budget and the Conscious Spending Plan depends on individual cash flow habits and financial goals. Pay-Yourself-First ensures consistent savings by prioritizing deposits before expenses, while the Conscious Spending Plan tailors spending categories to align with personal values for more mindful financial control. Maximizing savings requires selecting the approach that best suits one's discipline and lifestyle, balancing automatic saving with intentional spending.

Related Important Terms

Automated Savings Allocation

Automated savings allocation in a Pay-Yourself-First budget ensures a fixed percentage of income is transferred directly to savings, promoting consistent wealth building. In contrast, a Conscious Spending Plan relies on intentional, flexible spending categories, requiring manual adjustments for savings that may lead to less consistent automation.

Value-Based Budgeting

Value-based budgeting prioritizes saving by allocating a fixed percentage of income to essentials, savings, and discretionary spending, ensuring financial goals align with personal values; the Pay-Yourself-First method automates savings to build wealth efficiently, while a Conscious Spending Plan emphasizes mindful expenses that reflect individual priorities for maximizing satisfaction. Both approaches integrate value-driven decisions, but Pay-Yourself-First enforces discipline through pre-allocated savings, whereas Conscious Spending Plan encourages intentional spending choices to optimize financial wellness.

Reverse Budgeting

Reverse budgeting prioritizes savings by allocating funds to pay yourself first before any other expenses, ensuring disciplined accumulation of wealth. In contrast, a conscious spending plan allocates money based on values and priorities but may delay or dilute automatic savings, making reverse budgeting more effective for consistent financial growth.

Intentional Spending Buckets

Pay-Yourself-First Budget prioritizes automatic savings by allocating a fixed amount before any expenses, ensuring disciplined wealth building through dedicated savings buckets. Conscious Spending Plan divides income into intentional spending buckets aligned with personal values, balancing financial goals with mindful expenditure to enhance overall monetary control.

Savings-First Mindset

A Pay-Yourself-First Budget prioritizes allocating a fixed amount to savings immediately upon receiving income, ensuring consistent wealth building and financial security. In contrast, a Conscious Spending Plan emphasizes mindful allocation of funds towards both needs and discretionary expenses, fostering deliberate savings by aligning spending with personal values.

Conscious Cash Flow Mapping

Conscious Cash Flow Mapping in a Conscious Spending Plan prioritizes aligning income and expenses with personal values to optimize savings and financial well-being. Unlike the rigid Pay-Yourself-First Budget, this approach enhances intentional money management by identifying spending patterns and reallocating funds toward meaningful goals.

Lifestyle-Creep Prevention

Pay-Yourself-First Budget enforces automatic savings at the start of each month, effectively preventing lifestyle creep by prioritizing savings before discretionary spending. Conscious Spending Plan emphasizes mindful expense choices aligned with personal values, helping to control lifestyle inflation by ensuring funds are allocated intentionally rather than reactively.

Goal-Funded Framework

The Pay-Yourself-First Budget prioritizes automatically allocating a fixed percentage of income to savings, ensuring consistent progress toward financial goals within the Goal-Funded Framework. In contrast, the Conscious Spending Plan emphasizes intentional spending aligned with core values while funding goals flexibly, optimizing both savings and lifestyle satisfaction.

Micro-Investing Budget

Pay-yourself-first budget prioritizes automatically allocating a fixed percentage of income to micro-investing accounts, ensuring consistent growth of savings through small, regular contributions. Conscious spending plans optimize micro-investing by aligning discretionary expenses with long-term financial goals, maximizing investment potential without compromising essential needs.

Salary Streaming for Savings

Pay-Yourself-First Budget prioritizes automatically allocating a fixed percentage of salary into savings before any expenses, ensuring consistent wealth accumulation through salary streaming. Conscious Spending Plan emphasizes mindful allocation of salary toward both essential expenses and savings goals, promoting a balanced approach to managing income streams for financial growth.

Pay-Yourself-First Budget vs Conscious Spending Plan for savings. Infographic

moneydiff.com

moneydiff.com