Spreadsheet budgets require manual data entry and constant updates, increasing the risk of errors and inefficiencies in tracking expenses and income. AI-powered budgets use machine learning algorithms to automatically categorize transactions, predict spending patterns, and provide personalized financial insights. This technology enhances accuracy, saves time, and helps users make smarter money management decisions.

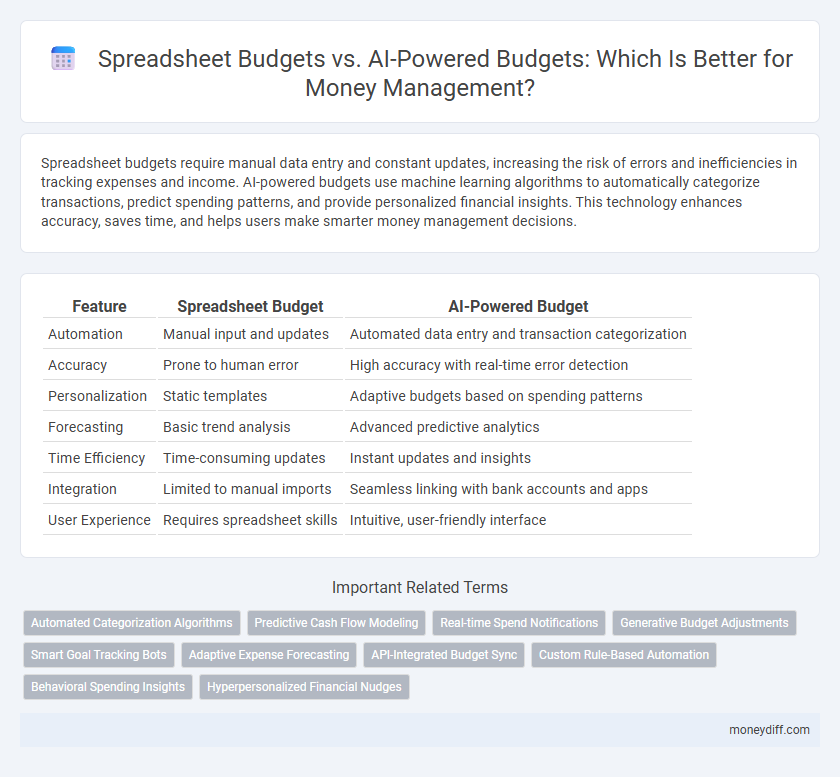

Table of Comparison

| Feature | Spreadsheet Budget | AI-Powered Budget |

|---|---|---|

| Automation | Manual input and updates | Automated data entry and transaction categorization |

| Accuracy | Prone to human error | High accuracy with real-time error detection |

| Personalization | Static templates | Adaptive budgets based on spending patterns |

| Forecasting | Basic trend analysis | Advanced predictive analytics |

| Time Efficiency | Time-consuming updates | Instant updates and insights |

| Integration | Limited to manual imports | Seamless linking with bank accounts and apps |

| User Experience | Requires spreadsheet skills | Intuitive, user-friendly interface |

Introduction to Spreadsheet and AI-Powered Budgeting

Spreadsheet budgets offer a straightforward approach to money management by organizing income and expenses into customizable cells for detailed tracking and analysis. AI-powered budgeting leverages machine learning algorithms to predict spending patterns, automate categorization, and provide personalized financial insights for proactive decision-making. Integrating AI enhances traditional spreadsheet methods by increasing accuracy, efficiency, and adaptability to changing financial situations.

Core Differences: Spreadsheet vs AI-Powered Budget Tools

Spreadsheet budget tools rely on manual data entry and simple formulas, offering full customization but limited automation and real-time insights. AI-powered budget tools automate expense tracking through machine learning algorithms, providing predictive analytics and personalized financial recommendations. The core difference lies in automation and intelligence, with AI tools enhancing accuracy and decision-making beyond static spreadsheet models.

Setup and Usability Comparison

Spreadsheet budgets require manual data entry, formula setup, and regular updates, demanding significant time and expertise for accurate tracking. AI-powered budgets automate expense categorization, provide real-time insights, and adapt dynamically to spending patterns, streamlining the setup process. Usability is enhanced by intuitive interfaces and predictive analytics in AI solutions, whereas spreadsheets offer flexibility but often overwhelm users with complexity.

Automation Capabilities: Manual vs Intelligent Budgeting

Spreadsheet budgets require manual data entry and formula updates, leading to time-consuming and error-prone processes. AI-powered budgets utilize machine learning algorithms to automatically categorize expenses, predict spending patterns, and adjust allocations in real-time for more accurate financial management. Intelligent budgeting enhances automation capabilities by reducing human intervention and increasing precision in money management tasks.

Real-Time Tracking and Insights

Spreadsheet budgets offer basic organization for expenses and income but often lack real-time updates and dynamic data analysis. AI-powered budget tools provide real-time tracking by automatically syncing with financial accounts, enabling instant insights into spending patterns and cash flow trends. Enhanced by machine learning algorithms, these platforms deliver predictive analytics and personalized recommendations that improve money management efficiency and financial decision-making.

Customization and Flexibility in Budgeting

Spreadsheet budgets offer a high degree of customization, allowing users to create tailored categories and formulas specific to their financial goals. AI-powered budgets enhance flexibility by automatically adapting to spending patterns and providing personalized recommendations in real time. This dynamic adjustment capability enables more responsive money management compared to static spreadsheet models.

Error Reduction: Human Input vs AI Assistance

Spreadsheet budgets often suffer from human errors such as data entry mistakes and formula miscalculations, leading to inaccurate financial tracking. AI-powered budgets leverage machine learning algorithms to automatically detect anomalies and correct inconsistencies, ensuring higher accuracy and reliability. This error reduction significantly enhances money management by minimizing costly manual oversights and improving decision-making precision.

Security and Data Privacy Concerns

Spreadsheet budgets rely heavily on manual data entry and local storage, exposing sensitive financial information to risks like unauthorized access and data loss due to inadequate security protocols. AI-powered budgeting tools implement advanced encryption methods and continuous monitoring to protect user data, significantly reducing vulnerabilities associated with cyberattacks. These intelligent systems also ensure compliance with privacy regulations such as GDPR, enhancing overall data security and user trust.

Cost Efficiency: Free Tools vs Subscription Services

Spreadsheet budgets offer cost efficiency by utilizing free or low-cost tools such as Google Sheets or Excel, allowing users to customize and control expenses without recurring fees. AI-powered budget solutions often require subscription services, which may increase costs but provide advanced features like automated expense tracking, predictive analytics, and personalized financial insights. Choosing between spreadsheet budgets and AI-powered services depends on balancing upfront savings with potential long-term benefits from enhanced money management capabilities.

Which Budgeting Method is Right for You?

Spreadsheet budgets offer customizable tracking with full control over categories and data, ideal for users who prefer hands-on management and detailed financial analysis. AI-powered budgets leverage machine learning to automatically categorize expenses, forecast spending patterns, and provide personalized savings recommendations, suited for those seeking convenience and real-time insights. Choosing the right budgeting method depends on your comfort with technology, need for automation, and desire for tailored financial guidance.

Related Important Terms

Automated Categorization Algorithms

AI-powered budget tools leverage automated categorization algorithms to analyze transaction data, accurately grouping expenses into predefined categories for improved financial insights. Spreadsheet budgets require manual input and categorization, increasing the risk of errors and time consumption compared to AI's efficient, real-time expense tracking.

Predictive Cash Flow Modeling

Spreadsheet budgets rely on static data entry and historical trends, limiting accuracy in forecasting future expenses and income. AI-powered budgets utilize predictive cash flow modeling, analyzing real-time financial data and patterns to provide dynamic, precise projections that enhance money management decisions.

Real-time Spend Notifications

Traditional spreadsheet budgets require manual updates and lack real-time spend notifications, often leading to delayed awareness of overspending. AI-powered budgets leverage real-time spend notifications to instantly track expenses, enabling proactive money management and improved financial control.

Generative Budget Adjustments

Generative budget adjustments in AI-powered money management offer dynamic, real-time updates based on spending patterns, outperforming traditional spreadsheet budgets that require manual revisions. AI algorithms analyze transaction data to provide personalized budgeting insights, enhancing accuracy and financial control.

Smart Goal Tracking Bots

AI-powered budgets leverage Smart Goal Tracking Bots to analyze spending patterns and automatically adjust financial plans, enhancing accuracy and efficiency beyond traditional spreadsheet budgets. These bots provide real-time insights and personalized recommendations, enabling proactive money management and improved goal achievement.

Adaptive Expense Forecasting

AI-powered budgets leverage adaptive expense forecasting to analyze historical spending patterns and predict future expenses with high accuracy, outperforming traditional spreadsheet budgets that rely on static data entry and manual updates. This advanced forecasting capability enables dynamic adjustments based on real-time financial changes, enhancing long-term money management and proactive budgeting strategies.

API-Integrated Budget Sync

Spreadsheet budgets require manual entry and lack real-time data updates, often leading to outdated financial insights. AI-powered budgets with API-integrated budget sync enable automatic synchronization across multiple accounts, providing dynamic, accurate money management and personalized financial forecasts.

Custom Rule-Based Automation

Spreadsheet budgets provide manual control but often require extensive time and effort for rule setup and updates, limiting scalability in personalized money management. AI-powered budgets leverage custom rule-based automation to dynamically adjust spending categories and savings goals, improving accuracy and efficiency in financial planning.

Behavioral Spending Insights

Spreadsheet budgets offer basic tracking of expenses but lack dynamic analysis of spending habits, making it difficult to identify behavioral patterns. AI-powered budgets leverage machine learning to provide personalized behavioral spending insights, enabling users to optimize money management by predicting trends and suggesting tailored financial decisions.

Hyperpersonalized Financial Nudges

Spreadsheet budgets require manual data entry and lack real-time insights, limiting their ability to provide hyperpersonalized financial nudges. AI-powered budgets leverage machine learning algorithms to analyze spending patterns dynamically, delivering tailored recommendations that optimize money management and promote smarter financial decisions.

Spreadsheet budget vs AI-powered budget for money management. Infographic

moneydiff.com

moneydiff.com