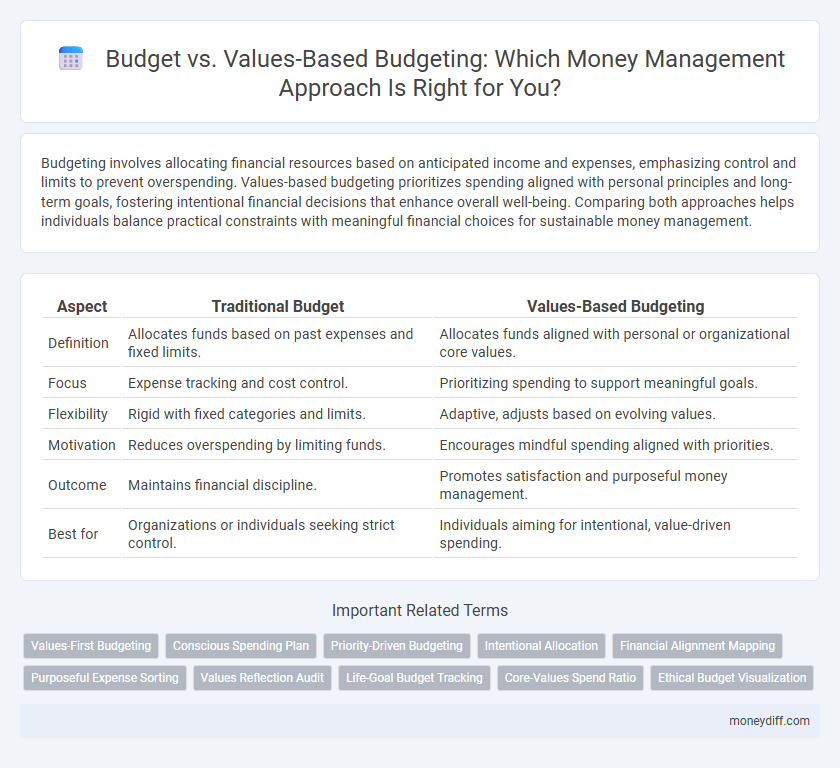

Budgeting involves allocating financial resources based on anticipated income and expenses, emphasizing control and limits to prevent overspending. Values-based budgeting prioritizes spending aligned with personal principles and long-term goals, fostering intentional financial decisions that enhance overall well-being. Comparing both approaches helps individuals balance practical constraints with meaningful financial choices for sustainable money management.

Table of Comparison

| Aspect | Traditional Budget | Values-Based Budgeting |

|---|---|---|

| Definition | Allocates funds based on past expenses and fixed limits. | Allocates funds aligned with personal or organizational core values. |

| Focus | Expense tracking and cost control. | Prioritizing spending to support meaningful goals. |

| Flexibility | Rigid with fixed categories and limits. | Adaptive, adjusts based on evolving values. |

| Motivation | Reduces overspending by limiting funds. | Encourages mindful spending aligned with priorities. |

| Outcome | Maintains financial discipline. | Promotes satisfaction and purposeful money management. |

| Best for | Organizations or individuals seeking strict control. | Individuals aiming for intentional, value-driven spending. |

Understanding Traditional Budgeting Methods

Traditional budgeting methods emphasize allocating fixed amounts of money to specific categories based on historical spending and projected income, aiming to control expenses and ensure financial stability. These methods rely heavily on quantitative data and rigid financial plans, often lacking flexibility to adapt to changing priorities or personal values. Understanding traditional budgeting involves recognizing its focus on numerical limits rather than aligning spending with individual or organizational core values.

What Is Values-Based Budgeting?

Values-based budgeting prioritizes financial decisions that align with personal or organizational core values rather than just limiting expenses or maximizing savings. This approach helps individuals or businesses allocate resources to areas that reflect their priorities, such as sustainability, education, or health. By focusing on meaningful expenditures, values-based budgeting promotes intentional spending that supports long-term goals and enhances overall satisfaction.

Key Differences Between Budgeting Styles

Traditional budgeting focuses on allocating fixed amounts to expense categories based on past spending and anticipated income, emphasizing control and adherence to limits. Values-based budgeting prioritizes aligning spending with personal or organizational core values and goals, promoting intentional and purposeful financial decisions. The key difference lies in traditional budgeting's focus on constraints and control versus values-based budgeting's emphasis on prioritization and meaningful allocation of resources.

Aligning Your Money with Your Values

Values-based budgeting prioritizes aligning financial decisions with personal beliefs and long-term goals, ensuring every dollar spent reflects core priorities. Unlike traditional budgeting, which often centers on limiting expenses and tracking categories, this approach emphasizes intentional spending to support what truly matters. By integrating values into budgeting, individuals can foster greater financial satisfaction and meaningful progress toward their life aspirations.

The Pros and Cons of Standard Budgeting

Standard budgeting offers clear spending limits and structured financial planning, making it easier to track expenses and avoid overspending. However, it often lacks flexibility and may not align with personal values or long-term goals, leading to frustration or reduced motivation to follow the plan. The rigidity of standard budgets can result in missed opportunities for meaningful spending that supports priorities beyond strict financial constraints.

Benefits of Values-Based Budgeting

Values-Based Budgeting aligns spending with personal priorities, fostering intentional financial decisions that enhance satisfaction and long-term well-being. This method promotes disciplined money management by emphasizing meaningful goals over arbitrary limits, reducing unnecessary expenses. Integrating core values in budgeting increases motivation to save and invest, supporting financial resilience and growth.

How to Transition from Traditional to Values-Based Budgeting

Transitioning from traditional budgeting to values-based budgeting involves identifying core personal or organizational values and aligning spending priorities accordingly. Begin by categorizing expenses based on their alignment with these values, then adjust allocations to emphasize high-priority areas that reflect long-term goals and ethical considerations. Regularly reviewing and refining the budget ensures continued alignment with evolving values and maximizes purposeful financial management.

Common Mistakes in Money Management

Common mistakes in money management often stem from rigid traditional budgeting that ignores personal values and priorities. Values-based budgeting aligns spending with core beliefs, reducing impulsive expenses and fostering financial discipline. Ignoring emotional and psychological factors in budgeting leads to poor adherence and frequent overspending.

Practical Steps for Implementing Values-Based Budgeting

Establish clear personal or organizational core values to align spending priorities with what matters most. Categorize expenses based on these values, ensuring each allocation directly supports your fundamental principles. Regularly review and adjust budget categories, maintaining financial discipline while reflecting evolving priorities and long-term goals.

Choosing the Right Approach for Your Financial Goals

Selecting between traditional budgeting and values-based budgeting hinges on aligning money management with personal financial goals and priorities. Values-based budgeting emphasizes spending in areas that reflect core beliefs and long-term aspirations, fostering intentional financial decisions. This approach often results in improved financial satisfaction and goal achievement compared to conventional methods focused solely on balancing income and expenses.

Related Important Terms

Values-First Budgeting

Values-first budgeting aligns monthly expenses with core personal priorities, ensuring financial decisions reflect what matters most beyond simple numbers. This approach enhances money management by promoting intentional spending and long-term satisfaction rather than focusing solely on balancing income and expenses.

Conscious Spending Plan

A Conscious Spending Plan prioritizes aligning expenses with core values, optimizing financial decisions to enhance personal satisfaction and long-term goals rather than rigid budget limits. This values-based budgeting approach fosters mindful money management by tracking spending patterns and reallocating funds toward meaningful experiences and priorities.

Priority-Driven Budgeting

Priority-driven budgeting allocates financial resources based on core organizational values and strategic goals, ensuring funds support high-impact initiatives. This approach contrasts with traditional budgeting by emphasizing outcome-driven expenditure rather than strictly adhering to historical spending patterns.

Intentional Allocation

Budgeting allocates funds based on fixed categories and limits, while values-based budgeting prioritizes intentional allocation aligned with personal or organizational core values, ensuring financial decisions reflect long-term goals and meaningful spending. Intentional allocation in values-based budgeting promotes mindful resource distribution, enhancing financial well-being and purposeful money management.

Financial Alignment Mapping

Budgeting focuses on setting fixed spending limits based on income and expenses, whereas Values-Based Budgeting prioritizes aligning financial decisions with personal values and long-term goals to enhance motivation and discipline. Financial Alignment Mapping integrates these approaches by visually correlating expenditures with core values, ensuring money management supports both practical constraints and meaningful priorities.

Purposeful Expense Sorting

Budget focuses on allocating funds based on fixed categories and limits, while Values-Based Budgeting prioritizes expenses according to personal or organizational core values, ensuring each dollar spent aligns with meaningful goals. Purposeful Expense Sorting in Values-Based Budgeting enhances financial discipline by directing resources toward what truly matters, increasing satisfaction and long-term financial well-being.

Values Reflection Audit

A Values Reflection Audit in values-based budgeting helps individuals align spending with personal priorities by categorizing expenses according to core beliefs and long-term goals. This approach contrasts traditional budgeting by emphasizing intentional financial choices that enhance life satisfaction rather than merely tracking income and expenditures.

Life-Goal Budget Tracking

Life-goal budget tracking prioritizes values-based budgeting by aligning spending with personal priorities and long-term objectives, ensuring financial decisions reflect core life goals rather than arbitrary limits. This approach enhances money management by fostering intentional allocation of resources toward meaningful experiences and future aspirations, improving overall financial satisfaction and progress.

Core-Values Spend Ratio

Core-Values Spend Ratio measures the alignment between budget allocations and personal or organizational core values, enhancing financial discipline by prioritizing expenditures that reflect true priorities. This approach transforms traditional budgeting by integrating value-driven decision-making, fostering meaningful money management that supports long-term goals and ethical spending habits.

Ethical Budget Visualization

Ethical budget visualization enhances transparency and accountability by aligning spending with core values, ensuring every dollar reflects personal or organizational priorities rather than arbitrary limits. Values-based budgeting fosters mindful financial decisions that prioritize social impact and long-term sustainability over traditional cost-cutting approaches.

Budget vs Values-Based Budgeting for money management. Infographic

moneydiff.com

moneydiff.com