Startups often benefit from continuous budgets as they allow real-time adjustments reflecting rapid market changes, unlike annual budgets which are fixed and may quickly become outdated. Continuous budgeting enables ongoing financial planning, improving resource allocation and responsiveness to unexpected opportunities or challenges. This dynamic approach supports startups in maintaining agility and optimizing cash flow management throughout the fiscal year.

Table of Comparison

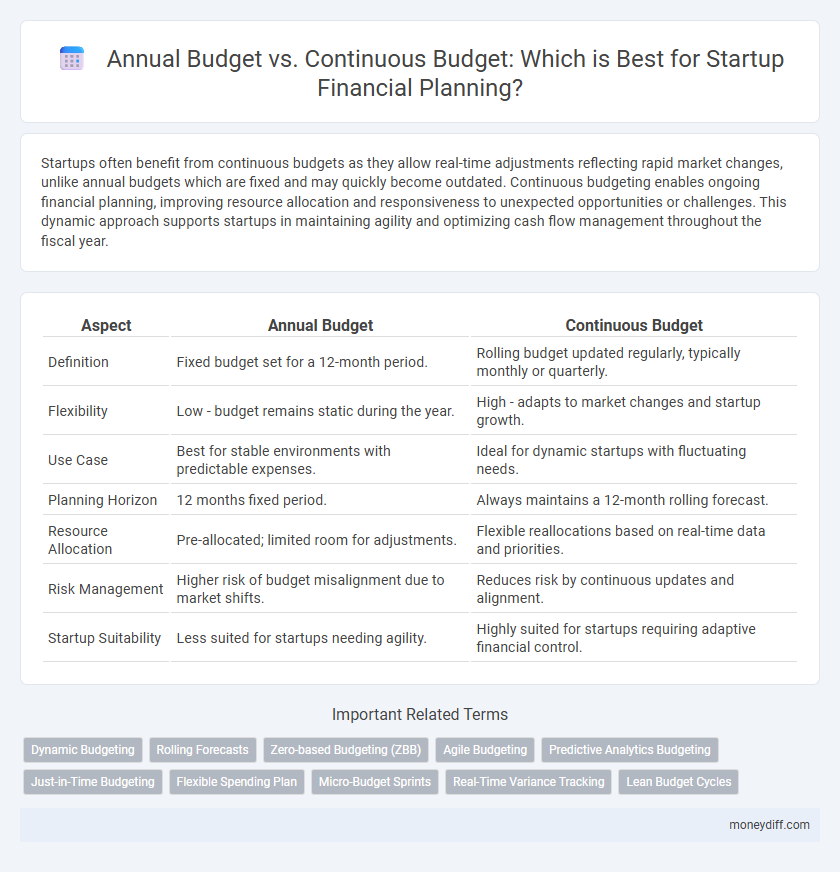

| Aspect | Annual Budget | Continuous Budget |

|---|---|---|

| Definition | Fixed budget set for a 12-month period. | Rolling budget updated regularly, typically monthly or quarterly. |

| Flexibility | Low - budget remains static during the year. | High - adapts to market changes and startup growth. |

| Use Case | Best for stable environments with predictable expenses. | Ideal for dynamic startups with fluctuating needs. |

| Planning Horizon | 12 months fixed period. | Always maintains a 12-month rolling forecast. |

| Resource Allocation | Pre-allocated; limited room for adjustments. | Flexible reallocations based on real-time data and priorities. |

| Risk Management | Higher risk of budget misalignment due to market shifts. | Reduces risk by continuous updates and alignment. |

| Startup Suitability | Less suited for startups needing agility. | Highly suited for startups requiring adaptive financial control. |

Understanding Annual and Continuous Budgets

Annual budgets provide startups with a fixed financial plan for a 12-month period, helping to set clear spending limits and revenue goals aligned with strategic objectives. Continuous budgets, updated monthly or quarterly, offer greater flexibility by allowing startups to adjust forecasts based on real-time market conditions and operational performance. Understanding the differences between these budgeting methods enables startups to balance long-term planning with agility, improving financial management and resource allocation.

Key Differences Between Annual and Continuous Budgeting

Annual budgets set fixed financial targets for a 12-month period, providing startups with a solid framework for resource allocation and performance evaluation. Continuous budgeting updates projections regularly, typically monthly or quarterly, allowing startups to adapt quickly to market changes and operational shifts. The key differences lie in flexibility and responsiveness, with annual budgets offering stability and continuous budgets enabling real-time financial agility.

Advantages of Annual Budgets for Startups

Annual budgets provide startups with a clear financial framework, enabling precise allocation of resources and efficient cost management. They facilitate goal-setting and performance evaluation by establishing fixed targets for revenue, expenses, and cash flow throughout the fiscal year. By offering predictability and structured financial planning, annual budgets support strategic decision-making and investor confidence during critical growth phases.

Benefits of Continuous Budgets for Agile Startups

Continuous budgets offer agile startups enhanced flexibility by allowing frequent adjustments based on real-time market data and operational changes. This budgeting approach supports iterative planning and faster response to uncertainties, which improves resource allocation and minimizes financial risks. Startups benefit from continuous budgeting through better alignment of financial goals with evolving business strategies and growth trajectories.

Financial Planning Accuracy: Static vs. Dynamic Approaches

Annual budgets provide startups with a fixed financial plan based on projected revenues and expenses for the entire year, offering clear targets but limited adaptability to market changes. Continuous budgets update financial forecasts regularly, allowing startups to respond dynamically to real-time data and shifting conditions, enhancing accuracy in financial planning. Startups benefit from combining static annual budgets with dynamic continuous budgeting to maintain strategic direction while optimizing flexibility and responsiveness.

Impact on Cash Flow Management

Annual budgets provide startups with a fixed financial framework for the year, offering clear targets but often lacking flexibility to adapt to cash flow fluctuations. Continuous budgets enable real-time adjustments, allowing startups to respond promptly to unexpected expenses or revenue changes, thereby improving liquidity management. Effective cash flow management through continuous budgeting minimizes the risk of shortfalls and supports sustained operational stability.

Flexibility in Responding to Market Changes

Annual budgets provide startups with a fixed financial framework, which may limit their ability to quickly adapt to unforeseen market shifts. Continuous budgets, updated regularly, offer enhanced flexibility, enabling startups to reallocate resources and adjust financial targets promptly in response to real-time market data. This dynamic approach supports agile decision-making and helps maintain competitive advantage in rapidly evolving industries.

Resource Allocation: Predictability vs. Adaptability

Annual budgets provide startups with a predictable framework for resource allocation, enabling clear financial targets and control over spending throughout the fiscal year. Continuous budgets offer adaptability, allowing startups to adjust resources dynamically in response to market changes and operational needs. Balancing predictability and flexibility helps startups optimize resource use for sustained growth and responsiveness.

Choosing the Right Budgeting Approach for Your Startup

Startups must evaluate the advantages of an annual budget, which provides a fixed financial framework for the year, against the flexibility of a continuous budget that allows ongoing adjustments based on real-time performance data and market changes. An annual budget offers clear targets and simplifies financial planning, while a continuous budget supports agile decision-making critical for rapidly evolving startup environments. Selecting the right budgeting approach depends on the startup's growth stage, industry volatility, and management's preference for predictability versus adaptability.

Best Practices for Implementing Effective Startup Budgets

Startups achieve better financial control by integrating annual and continuous budgeting strategies, using annual budgets to set clear revenue and expense targets while leveraging continuous budgets for real-time adjustments based on market changes. Best practices involve regularly reviewing key performance indicators (KPIs) such as burn rate and cash runway, and incorporating iterative forecasting tools like rolling forecasts to enhance accuracy. Emphasizing cross-functional collaboration between finance, sales, and operations teams improves budget alignment with strategic goals and agile decision-making.

Related Important Terms

Dynamic Budgeting

Dynamic budgeting offers startups a flexible alternative to traditional annual budgets by enabling continuous adjustments based on real-time financial data and market conditions. This adaptive approach enhances resource allocation efficiency and supports agile decision-making crucial for early-stage company growth.

Rolling Forecasts

Rolling forecasts provide startups with a dynamic alternative to traditional annual budgets by continuously updating financial projections based on real-time data, improving agility in resource allocation and strategic planning. This approach enhances accuracy in cash flow management and supports rapid decision-making essential for navigating the uncertainties in early-stage business environments.

Zero-based Budgeting (ZBB)

Startups leveraging Zero-Based Budgeting (ZBB) benefit from a continuous budget approach, enabling real-time allocation of resources based on current priorities rather than relying solely on an annual budget cycle. This method promotes financial agility by requiring justification for every expense, aligning expenditures closely with strategic goals and optimizing cash flow management in dynamic startup environments.

Agile Budgeting

Annual budgets provide startups with fixed financial plans for a 12-month period, limiting flexibility and responsiveness to market changes. Continuous budgeting supports Agile Budgeting by enabling startups to frequently update forecasts and allocate resources dynamically, fostering adaptability and better resource management in rapidly evolving environments.

Predictive Analytics Budgeting

Annual budgets provide startups with a fixed financial plan based on historical data, while continuous budgets leverage predictive analytics to dynamically adjust projections in real-time, enhancing financial agility and decision-making accuracy. Predictive analytics budgeting uses algorithms and data trends to forecast future financial needs more precisely, enabling startups to respond swiftly to market changes and optimize resource allocation.

Just-in-Time Budgeting

Annual budgets provide startups with a fixed financial framework for the year, but continuous budgets enable real-time adjustments based on market changes and operational demands, making them ideal for just-in-time budgeting. This approach minimizes waste and improves cash flow management by aligning budget allocation directly with immediate business needs and growth opportunities.

Flexible Spending Plan

Startups benefit from a continuous budget by enabling real-time adjustments based on market conditions and cash flow, enhancing financial agility compared to rigid annual budgets. Implementing a flexible spending plan within a continuous budget allows startups to allocate resources dynamically, optimize operational efficiency, and swiftly respond to growth opportunities or unexpected expenses.

Micro-Budget Sprints

Annual budgets provide startups with a fixed financial framework for the year, while continuous budgets enable dynamic adjustments based on real-time performance and market changes. Micro-budget sprints break down these budgets into short, focused periods, allowing startups to optimize cash flow, quickly pivot strategies, and enhance resource allocation efficiency.

Real-Time Variance Tracking

Startups benefit from Continuous Budgets by enabling real-time variance tracking, allowing immediate adjustments to financial plans based on actual performance data. In contrast, Annual Budgets often lack this flexibility, leading to delayed insights and reduced responsiveness to market changes.

Lean Budget Cycles

Lean budget cycles in startups emphasize continuous budget adjustments over rigid annual budgets, enhancing flexibility and responsiveness to market changes. Continuous budgeting fosters dynamic resource allocation, enabling startups to pivot strategies efficiently and optimize cash flow management.

Annual Budget vs Continuous Budget for startups. Infographic

moneydiff.com

moneydiff.com