Traditional budgeting methods rely on manual tracking and often lack real-time insights, making it challenging to adjust spending quickly. Digital budgeting apps offer automated expense tracking, personalized alerts, and seamless integration with bank accounts, enhancing accuracy and user convenience. The increased accessibility and data-driven features of digital tools provide more efficient and informed money management compared to conventional budget approaches.

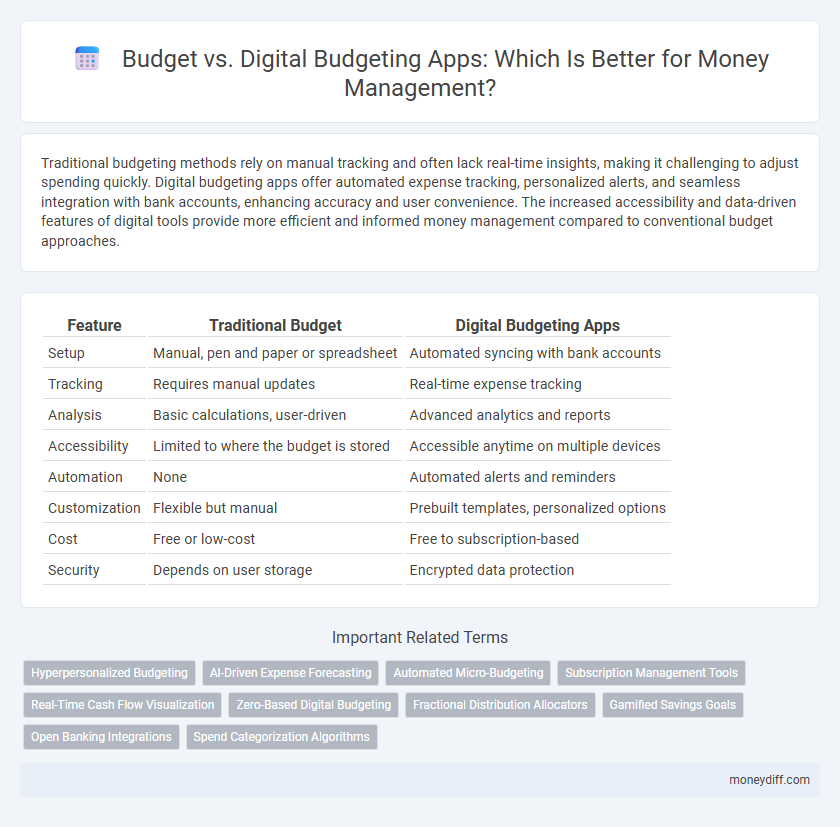

Table of Comparison

| Feature | Traditional Budget | Digital Budgeting Apps |

|---|---|---|

| Setup | Manual, pen and paper or spreadsheet | Automated syncing with bank accounts |

| Tracking | Requires manual updates | Real-time expense tracking |

| Analysis | Basic calculations, user-driven | Advanced analytics and reports |

| Accessibility | Limited to where the budget is stored | Accessible anytime on multiple devices |

| Automation | None | Automated alerts and reminders |

| Customization | Flexible but manual | Prebuilt templates, personalized options |

| Cost | Free or low-cost | Free to subscription-based |

| Security | Depends on user storage | Encrypted data protection |

Traditional Budgeting: An Overview

Traditional budgeting involves manually tracking income and expenses using pen and paper or spreadsheets, offering a straightforward method for managing finances without relying on technology. This approach emphasizes personal control and customization but can be time-consuming and prone to human error. Despite digital alternatives, many users prefer traditional budgeting for its simplicity and tangible engagement with financial planning.

Rise of Digital Budgeting Apps

The rise of digital budgeting apps has revolutionized traditional budget management by offering real-time expense tracking, automated categorization, and personalized financial insights. These apps leverage advanced algorithms and cloud technology to enhance accuracy and accessibility compared to manual budgeting methods. As a result, users experience improved financial discipline and goal achievement through intuitive interfaces and data-driven recommendations.

Ease of Use: Paper vs. Apps

Paper budgeting offers simplicity and direct control, requiring no technical skills and allowing users to quickly jot down expenses or plan finances. Digital budgeting apps provide automated tracking, real-time updates, and personalized insights, enhancing convenience and accuracy in money management. While paper methods limit analytical depth, apps support detailed reports and alerts that help optimize spending and savings habits.

Tracking Expenses: Manual vs. Automated

Manual budgeting requires individuals to record expenses by hand, which can lead to errors and inconsistent tracking. Digital budgeting apps automate expense tracking by syncing with bank accounts and categorizing transactions in real-time, providing accurate and up-to-date financial insights. Automated tracking helps users spot spending patterns faster and adjust budgets efficiently compared to manual methods.

Accuracy and Error Reduction

Traditional budgeting methods often involve manual calculations prone to human errors and misestimations, reducing overall accuracy in financial tracking. Digital budgeting apps utilize automated algorithms and real-time data synchronization to minimize mistakes, ensuring precise expense categorization and up-to-date budget adjustments. Enhanced accuracy through these apps leads to better financial insights, improved decision-making, and effective money management.

Accessibility and Convenience

Digital budgeting apps offer unparalleled accessibility by allowing users to track expenses and manage budgets anytime via smartphones or tablets. These apps provide real-time updates and automated notifications, enhancing convenience over traditional paper or spreadsheet budgets. Accessibility and seamless synchronization across devices make digital budgeting apps a preferred choice for efficient money management.

Customization Features Compared

Traditional budgets provide a fixed framework for allocating funds, often lacking flexibility to adapt to changing financial goals or unexpected expenses. Digital budgeting apps offer advanced customization features such as real-time expense tracking, personalized financial goal setting, and automated category adjustments based on spending patterns. These tools enhance user control and accuracy, enabling more dynamic and responsive money management compared to conventional budgeting methods.

Security and Privacy Concerns

Traditional budgets offer direct control over financial information without reliance on third-party platforms, minimizing exposure to data breaches and unauthorized access. Digital budgeting apps provide advanced encryption and multi-factor authentication, yet they introduce potential risks related to data sharing with app providers and third-party advertisers. Users must carefully evaluate the privacy policies and security features of digital tools to safeguard sensitive financial data effectively.

Long-Term Money Management Success

Traditional budgeting provides a foundational framework for tracking income and expenses but often lacks flexibility and real-time insights necessary for long-term money management success. Digital budgeting apps leverage advanced algorithms, automated tracking, and personalized analytics to optimize cash flow, monitor financial goals, and adapt to changing spending patterns. Utilizing features like predictive forecasting and integration with multiple accounts enhances sustained financial discipline and strategic wealth building over time.

Choosing the Right Budgeting Method

Selecting the right budgeting method depends on individual financial goals and daily money management habits. Traditional budgets provide a clear, manual overview of income and expenses, while digital budgeting apps offer automation, real-time tracking, and data analytics for smarter decisions. Evaluating factors such as user-friendliness, customization, and integration with bank accounts helps determine whether a conventional budget or a digital solution better supports effective money management.

Related Important Terms

Hyperpersonalized Budgeting

Hyperpersonalized budgeting leverages digital budgeting apps that analyze individual spending patterns, preferences, and financial goals to create tailored money management plans. These apps use AI algorithms and real-time data integration, providing more accurate forecasts and actionable insights than traditional budgeting methods.

AI-Driven Expense Forecasting

AI-driven expense forecasting in digital budgeting apps leverages machine learning algorithms to analyze spending patterns, predict future expenses, and optimize budget allocations with higher accuracy. Traditional budgeting lacks this dynamic adaptability, making AI-powered apps essential for precise financial planning and proactive money management.

Automated Micro-Budgeting

Automated micro-budgeting in digital budgeting apps enables precise tracking of daily expenses by categorizing small transactions in real-time, enhancing overall financial control compared to traditional budgets. This granular approach reduces human error and increases savings by automatically adjusting spending limits based on evolving income and expenditure patterns.

Subscription Management Tools

Subscription management tools within digital budgeting apps offer automated tracking, real-time expense categorization, and alerts for upcoming payments, enhancing control over recurring costs. These features streamline budget adjustments by providing precise insights into subscription spending, reducing the risk of overlooked charges and subscription creep.

Real-Time Cash Flow Visualization

Traditional budgeting often relies on static spreadsheets that lack real-time cash flow visualization, limiting users' ability to respond promptly to financial changes. Digital budgeting apps provide dynamic, real-time cash flow tracking, enabling immediate insights and more effective money management by continuously syncing with bank accounts and expenses.

Zero-Based Digital Budgeting

Zero-based digital budgeting apps enable precise allocation of every dollar by assigning income to specific expenses and savings categories, ensuring no money is left unassigned. This method enhances financial control and accountability compared to traditional budgeting by encouraging intentional spending and real-time tracking through user-friendly interfaces.

Fractional Distribution Allocators

Fractional Distribution Allocators in digital budgeting apps enable precise allocation of income into customizable categories, enhancing financial planning accuracy compared to traditional static budgets. Leveraging algorithms to automate percentage-based savings and expenditure allocations, these tools increase efficiency in money management and goal tracking.

Gamified Savings Goals

Gamified savings goals in digital budgeting apps enhance user engagement by turning money management into interactive challenges, leading to higher saving rates compared to traditional budget methods. These apps leverage rewards, progress tracking, and visual milestones to motivate consistent saving behavior and financial discipline.

Open Banking Integrations

Traditional budgets often lack real-time tracking and seamless updates, whereas digital budgeting apps equipped with open banking integrations automatically sync transactions from multiple accounts, providing accurate, up-to-date financial insights. These apps leverage open banking APIs to categorize spending, detect trends, and offer personalized recommendations, enhancing money management efficiency and user control.

Spend Categorization Algorithms

Spend categorization algorithms in digital budgeting apps use machine learning to automatically classify transactions into specific categories, improving accuracy and providing real-time insights for better financial decisions. Unlike traditional budgets that require manual entry and tracking, these algorithms streamline money management by detecting spending patterns and offering personalized recommendations.

Budget vs Digital Budgeting Apps for money management. Infographic

moneydiff.com

moneydiff.com