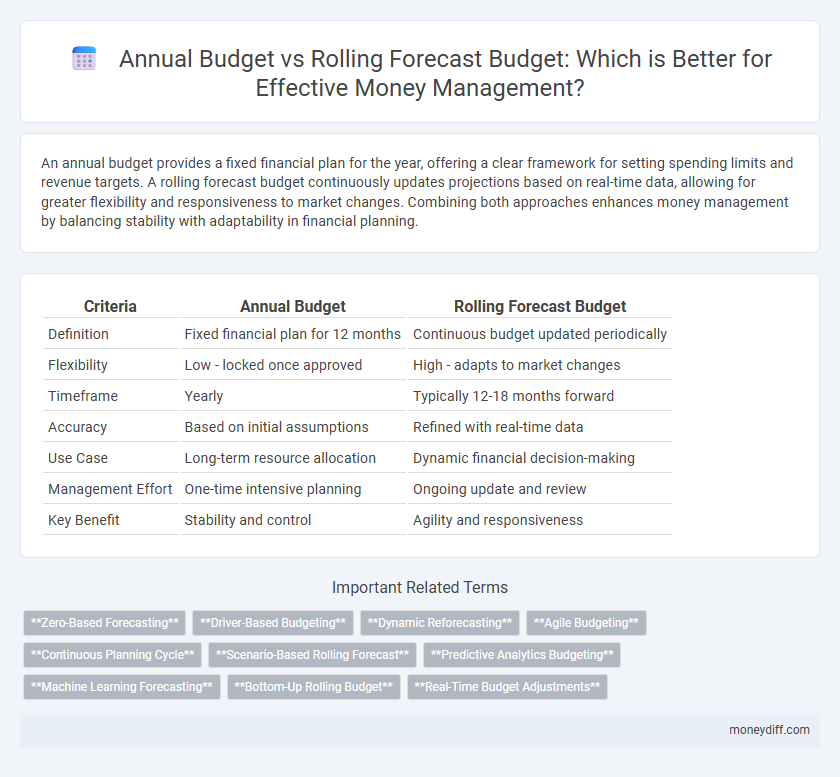

An annual budget provides a fixed financial plan for the year, offering a clear framework for setting spending limits and revenue targets. A rolling forecast budget continuously updates projections based on real-time data, allowing for greater flexibility and responsiveness to market changes. Combining both approaches enhances money management by balancing stability with adaptability in financial planning.

Table of Comparison

| Criteria | Annual Budget | Rolling Forecast Budget |

|---|---|---|

| Definition | Fixed financial plan for 12 months | Continuous budget updated periodically |

| Flexibility | Low - locked once approved | High - adapts to market changes |

| Timeframe | Yearly | Typically 12-18 months forward |

| Accuracy | Based on initial assumptions | Refined with real-time data |

| Use Case | Long-term resource allocation | Dynamic financial decision-making |

| Management Effort | One-time intensive planning | Ongoing update and review |

| Key Benefit | Stability and control | Agility and responsiveness |

Overview of Annual Budgets and Rolling Forecasts

Annual budgets establish a fixed financial plan for a specific fiscal year, outlining expected revenues and expenditures based on historical data and strategic goals. Rolling forecasts continuously update budget projections, typically every month or quarter, to reflect real-time operational changes and market conditions. Companies use rolling forecasts to enhance agility in money management, allowing dynamic adjustments compared to the static nature of annual budgets.

Key Differences Between Annual and Rolling Budgets

Annual budgets set fixed financial targets for a 12-month period, providing a static framework for expense control and revenue projections. Rolling forecast budgets continuously update financial estimates by adding a new period as the current one ends, enabling more dynamic and flexible money management. Key differences include adaptability to market changes in rolling budgets versus the rigid structure of annual budgets, with rolling forecasts offering real-time insights for better decision-making.

Advantages of Annual Budgeting for Money Management

Annual budgeting provides a clear financial framework by setting fixed spending limits and revenue targets for the entire fiscal year, enhancing long-term financial discipline. It facilitates strategic planning by aligning resource allocation with organizational goals and enables easier performance evaluation against predetermined benchmarks. The stability of annual budgets supports effective cash flow management and simplifies forecasting for fixed expenses and capital investments.

Benefits of Rolling Forecasting in Financial Planning

Rolling forecasts enhance financial planning by providing continuous updates on revenue and expense projections, allowing for more agile money management compared to the static nature of annual budgets. They incorporate real-time data and market changes, improving accuracy and enabling proactive adjustments to cash flow, cost control, and investment decisions. This dynamic approach supports better resource allocation, risk mitigation, and long-term financial stability.

Limitations of Annual Budgets in Dynamic Environments

Annual budgets often lack flexibility, making it difficult to adapt to market volatility and unexpected financial changes. In dynamic environments, rigid annual budgets can lead to outdated financial plans, causing misallocation of resources and missed opportunities. Rolling forecast budgets address these limitations by providing continuous updates and more accurate cash flow projections that enhance money management decisions.

Flexibility of Rolling Forecasts for Adaptive Strategy

Rolling forecasts provide greater flexibility compared to annual budgets by continuously updating financial projections based on real-time data and market changes. This adaptive approach enables organizations to respond swiftly to economic fluctuations, resource shifts, and emerging opportunities without being constrained by rigid annual budget cycles. Enhanced accuracy and dynamic resource allocation improve decision-making and support a more resilient financial strategy.

Decision-Making: When to Use Annual vs Rolling Budgets

Annual budgets provide a fixed financial plan based on projected revenues and expenses for a specific fiscal year, ideal for organizations with stable environments and predictable cash flows. Rolling forecast budgets continuously update financial projections, offering flexibility to adapt to market changes and unexpected variables, which supports more agile and informed decision-making. Businesses facing dynamic market conditions benefit from rolling forecasts, while those prioritizing long-term strategic goals may rely on annual budgets for disciplined financial control.

Impact on Cash Flow Management

Annual budgets provide fixed financial plans that set spending limits for a specific fiscal year, which can restrict responsiveness to cash flow changes. Rolling forecast budgets continuously update projections based on real-time data, enhancing cash flow management by allowing timely adjustments to expenses and revenues. Using rolling forecasts improves liquidity management, reduces the risk of cash shortages, and supports more accurate financial decision-making.

Tools and Techniques for Implementing Each Approach

Annual budgets rely on detailed financial planning software like Microsoft Excel templates and enterprise resource planning (ERP) systems, emphasizing fixed targets and variance analysis reports for performance tracking. Rolling forecasts utilize dynamic cloud-based platforms such as Adaptive Insights and Anaplan, enabling continuous data updates, scenario modeling, and real-time collaboration across departments. Techniques like driver-based forecasting and predictive analytics are integral to rolling forecasts, while zero-based budgeting and incremental budgeting are common in annual budget implementations.

Best Practices for Transitioning Between Budget Models

Implementing a seamless transition from an annual budget to a rolling forecast budget requires establishing clear data integration protocols and aligning key performance indicators (KPIs) across both models. Prioritizing real-time financial data updates enhances accuracy, while fostering cross-departmental collaboration ensures budget assumptions remain relevant and adaptive to market fluctuations. Regularly reviewing and adjusting forecasting methodologies supports continuous improvement and drives more informed money management decisions.

Related Important Terms

Zero-Based Forecasting

Zero-Based Forecasting integrates with both annual budget and rolling forecast budget methodologies by requiring all expenses to be justified from a zero base, enhancing accuracy in money management and eliminating inefficiencies. This approach optimizes resource allocation by continuously aligning financial plans with current business priorities and market conditions.

Driver-Based Budgeting

Driver-based budgeting enhances accuracy in both annual budgets and rolling forecast budgets by linking financial targets directly to key business drivers such as sales volume, production costs, and market demand; this dynamic approach allows organizations to quickly adjust forecasts based on real-time data, improving money management and resource allocation. Annual budgets establish fixed financial plans based on historical drivers, while rolling forecasts continuously update these drivers to reflect current business conditions, enabling more agile and responsive financial planning.

Dynamic Reforecasting

Dynamic reforecasting in rolling forecast budgets enables businesses to continuously update financial projections based on real-time data, improving accuracy and adaptability compared to the static nature of annual budgets. This approach supports proactive money management by allowing timely adjustments to spending and resource allocation throughout the fiscal year.

Agile Budgeting

Agile budgeting emphasizes flexibility by integrating rolling forecast budgets that update financial plans continuously based on real-time data, allowing organizations to adapt quickly to market changes. Unlike traditional annual budgets that fix resource allocation for a year, rolling forecasts enable dynamic money management and more accurate financial decision-making in uncertain environments.

Continuous Planning Cycle

The continuous planning cycle in money management is enhanced by rolling forecast budgets, which update financial projections regularly to reflect real-time changes and improve agility. Unlike annual budgets fixed for a year, rolling forecasts enable dynamic adjustments, ensuring more accurate resource allocation and proactive financial control.

Scenario-Based Rolling Forecast

Scenario-based rolling forecasts enhance money management by continuously adjusting budget projections based on real-time financial data and varying market conditions, unlike static annual budgets that rely on fixed assumptions. This dynamic approach enables organizations to anticipate cash flow needs and allocate resources more accurately, improving financial agility and risk mitigation.

Predictive Analytics Budgeting

Annual budgets set fixed financial targets for a specific fiscal year, limiting adaptability in dynamic markets, whereas rolling forecast budgets continuously update projections based on real-time data, enhancing predictive analytics for more accurate and agile money management. Leveraging predictive analytics in rolling forecasts enables organizations to anticipate cash flow changes, optimize resource allocation, and improve financial decision-making with forward-looking insights.

Machine Learning Forecasting

Annual budgets provide a fixed financial plan for a set period, while rolling forecast budgets adapt continuously based on real-time data, enhancing accuracy with machine learning forecasting techniques. Machine learning models analyze historical financial patterns and external variables to deliver dynamic budget adjustments, optimizing money management and reducing forecasting errors.

Bottom-Up Rolling Budget

Bottom-up rolling budgets enhance money management by continuously updating financial plans based on real-time data from all organizational levels, improving accuracy and responsiveness compared to static annual budgets. This approach fosters greater forecasting precision and resource allocation efficiency by incorporating ongoing operational feedback and market changes.

Real-Time Budget Adjustments

Rolling forecast budgets enable real-time budget adjustments by continuously updating financial projections based on actual performance and market changes, unlike annual budgets which fix allocations for a set period. This dynamic approach enhances money management accuracy, allowing organizations to respond promptly to financial variances and optimize resource allocation throughout the fiscal year.

Annual budget vs Rolling forecast budget for money management. Infographic

moneydiff.com

moneydiff.com