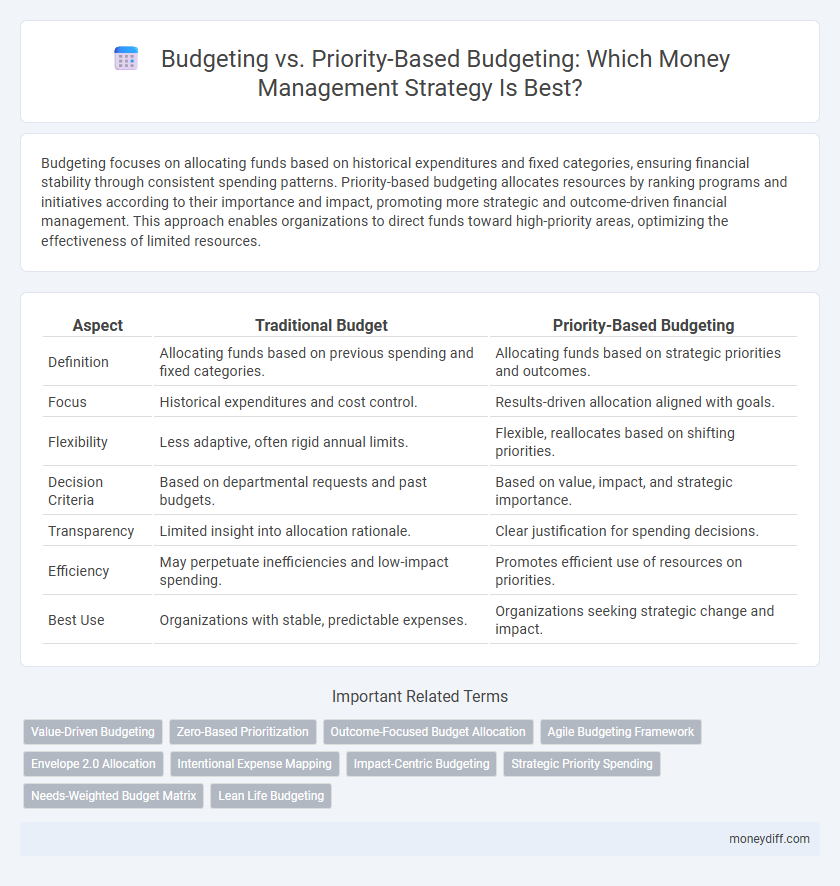

Budgeting focuses on allocating funds based on historical expenditures and fixed categories, ensuring financial stability through consistent spending patterns. Priority-based budgeting allocates resources by ranking programs and initiatives according to their importance and impact, promoting more strategic and outcome-driven financial management. This approach enables organizations to direct funds toward high-priority areas, optimizing the effectiveness of limited resources.

Table of Comparison

| Aspect | Traditional Budget | Priority-Based Budgeting |

|---|---|---|

| Definition | Allocating funds based on previous spending and fixed categories. | Allocating funds based on strategic priorities and outcomes. |

| Focus | Historical expenditures and cost control. | Results-driven allocation aligned with goals. |

| Flexibility | Less adaptive, often rigid annual limits. | Flexible, reallocates based on shifting priorities. |

| Decision Criteria | Based on departmental requests and past budgets. | Based on value, impact, and strategic importance. |

| Transparency | Limited insight into allocation rationale. | Clear justification for spending decisions. |

| Efficiency | May perpetuate inefficiencies and low-impact spending. | Promotes efficient use of resources on priorities. |

| Best Use | Organizations with stable, predictable expenses. | Organizations seeking strategic change and impact. |

Understanding Traditional Budgeting Methods

Traditional budgeting methods allocate funds based on historical spending patterns without directly linking expenditures to organizational goals. This approach often relies on fixed line-item budgets that prioritize controlling costs over strategic resource allocation. While straightforward, it can limit flexibility and hinder effective prioritization of critical projects or services.

Defining Priority-Based Budgeting

Priority-Based Budgeting (PBB) is a strategic approach to money management that allocates resources based on program priorities rather than historical spending patterns. Unlike traditional budgeting, PBB evaluates the effectiveness and alignment of each expense with the organization's core goals, promoting efficient resource distribution. This method helps decision-makers focus on funding initiatives that deliver the highest value and impact.

Key Differences Between Budgeting Approaches

Budgeting focuses on allocating funds within set limits to control expenses, while priority-based budgeting allocates resources according to the importance and impact of programs or projects. Traditional budgeting often emphasizes past expenditures and incremental changes, whereas priority-based budgeting uses criteria such as outcomes, strategic goals, and cost-effectiveness to optimize fund allocation. This approach shifts the focus from cutting costs to maximizing value and aligning spending with organizational priorities.

Advantages of Traditional Budgeting

Traditional budgeting offers clear advantages such as straightforward planning, predictable financial allocation, and easy monitoring of expenditures against fixed limits. It simplifies cash flow management by establishing consistent expense guidelines, making it easier for organizations to control costs and avoid overspending. This method also supports long-term financial stability by setting defined spending caps aligned with historical data and expected revenue.

Benefits of Priority-Based Budgeting

Priority-Based Budgeting aligns financial resources with organizational goals, ensuring funds are allocated to initiatives that deliver the highest impact. This approach enhances transparency, enabling decision-makers to evaluate spending effectiveness and adjust priorities in real-time. By focusing on critical priorities, it promotes efficient use of limited resources and drives strategic outcomes, reducing waste and improving overall fiscal responsibility.

Challenges in Implementing Each Method

Budgeting challenges arise with traditional budgeting as it often relies on historical data, leading to rigidity and misalignment with current organizational goals. Priority-based budgeting faces difficulties in accurately ranking projects and programs due to conflicting stakeholder interests and limited data on potential impact. Both methods require overcoming resistance to change and ensuring transparent communication to effectively allocate resources.

Assessing Personal Financial Priorities

Budgeting involves tracking income and expenses to maintain financial control, while priority-based budgeting allocates funds according to the importance of personal financial goals. Assessing personal financial priorities requires identifying essential expenses, savings targets, and discretionary spending to ensure money management aligns with long-term objectives. This approach improves financial decision-making by focusing on what matters most, such as emergency funds, debt repayment, or retirement planning.

Adapting Budget Strategies for Financial Goals

Budget strategies like traditional incremental budgeting focus on past expenditures, while priority-based budgeting allocates funds based on the importance of programs aligned with financial goals. Adapting budget strategies involves assessing organizational priorities, evaluating program outcomes, and redistributing resources to maximize impact and efficiency. Effective money management leverages priority-based budgeting to ensure financial resources support strategic objectives and long-term sustainability.

Choosing the Best Budgeting Method for You

Budgeting methods vary significantly, with traditional budget allocation focusing on fixed financial limits while priority-based budgeting aligns expenditures with organizational goals and outcomes. Choosing the best budgeting method depends on factors like financial flexibility, clarity of priorities, and the need for strategic resource allocation. Priority-based budgeting enhances decision-making by directing funds toward high-impact areas, making it ideal for dynamic financial environments seeking optimized money management.

Tools and Resources for Effective Budget Management

Budget management tools like spreadsheets and budgeting software enhance accuracy and tracking efficiency, while priority-based budgeting frameworks allocate funds based on organizational goals, ensuring resource optimization. Integrating digital platforms with real-time data analytics enables dynamic adjustments and better financial decision-making aligned with strategic priorities. Access to customizable templates and training resources supports both methodologies, empowering users to effectively manage budgets and prioritize expenditures.

Related Important Terms

Value-Driven Budgeting

Value-driven budgeting prioritizes allocating funds based on outcomes that maximize organizational impact and align with strategic goals, unlike traditional budgeting which often focuses on fixed line items. This approach ensures resources are directed toward high-priority initiatives, optimizing financial efficiency and enhancing overall value creation.

Zero-Based Prioritization

Zero-Based Prioritization reallocates funds by evaluating every expense from zero, ensuring resources directly align with strategic goals and eliminating redundant expenditures. This approach contrasts with traditional budgeting by prioritizing high-impact projects, driving efficient money management and maximizing organizational value.

Outcome-Focused Budget Allocation

Outcome-focused budget allocation in priority-based budgeting directs funds to initiatives with measurable impacts, enhancing resource efficiency compared to traditional allocation methods. This approach aligns spending with strategic goals, ensuring financial resources drive targeted results and optimize fiscal performance.

Agile Budgeting Framework

Agile Budgeting Framework emphasizes adaptability by continuously aligning budget allocations with evolving organizational priorities, contrasting with traditional Budget methods that often rigidly allocate funds based on fixed categories. Priority-Based Budgeting enhances financial efficiency by systematically directing resources to high-impact initiatives, enabling more responsive and strategic money management within dynamic business environments.

Envelope 2.0 Allocation

Envelope 2.0 Allocation replaces traditional budgeting by assigning funds directly to specific spending categories based on priority, enhancing control and reducing overspending. This method ensures money is allocated according to personal or organizational goals, optimizing financial discipline compared to generic budget limits.

Intentional Expense Mapping

Intentional Expense Mapping in Priority-Based Budgeting ensures each dollar aligns with key financial goals, contrasting traditional budgeting that often categorizes spending without strategic focus. This approach enhances resource allocation by targeting high-impact priorities, optimizing money management and financial outcomes.

Impact-Centric Budgeting

Impact-centric budgeting prioritizes allocating funds based on measurable outcomes rather than fixed categories, enabling organizations to maximize social and financial returns. This approach contrasts with traditional budget models by focusing resources on high-impact projects, improving transparency and accountability in money management.

Strategic Priority Spending

Strategic Priority Spending in Priority-Based Budgeting ensures funds are allocated directly to critical projects that align with organizational goals, maximizing impact and resource efficiency. Unlike traditional budgeting, this approach emphasizes funding initiatives based on their strategic importance rather than historical expenditure, driving more effective money management.

Needs-Weighted Budget Matrix

The Needs-Weighted Budget Matrix enhances money management by aligning budget allocations with prioritized needs, ensuring resources are distributed based on their critical impact rather than arbitrary percentages. This approach contrasts with traditional budgeting by systematically quantifying and weighting expenditures, leading to more efficient and goal-driven financial planning.

Lean Life Budgeting

Lean Life Budgeting emphasizes essential expenses and financial goals, streamlining money management by focusing on value-driven spending rather than traditional line-item allocations. This priority-based method enhances resource efficiency, aligning budget decisions with personal or organizational core priorities for optimized financial outcomes.

Budget vs Priority-Based Budgeting for money management. Infographic

moneydiff.com

moneydiff.com