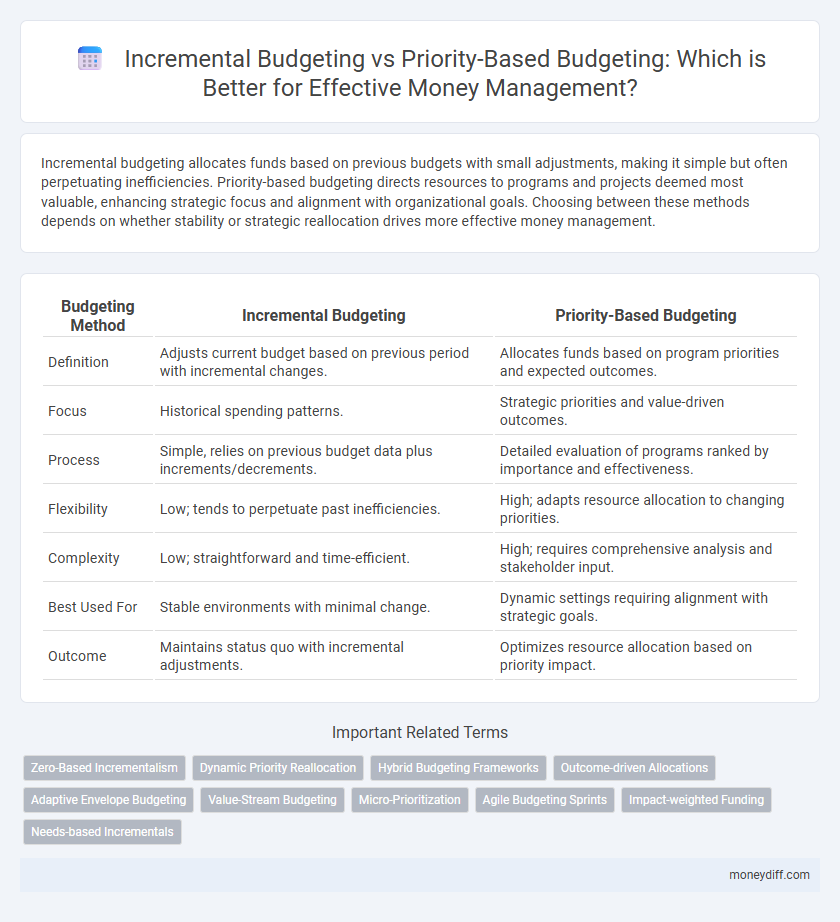

Incremental budgeting allocates funds based on previous budgets with small adjustments, making it simple but often perpetuating inefficiencies. Priority-based budgeting directs resources to programs and projects deemed most valuable, enhancing strategic focus and alignment with organizational goals. Choosing between these methods depends on whether stability or strategic reallocation drives more effective money management.

Table of Comparison

| Budgeting Method | Incremental Budgeting | Priority-Based Budgeting |

|---|---|---|

| Definition | Adjusts current budget based on previous period with incremental changes. | Allocates funds based on program priorities and expected outcomes. |

| Focus | Historical spending patterns. | Strategic priorities and value-driven outcomes. |

| Process | Simple, relies on previous budget data plus increments/decrements. | Detailed evaluation of programs ranked by importance and effectiveness. |

| Flexibility | Low; tends to perpetuate past inefficiencies. | High; adapts resource allocation to changing priorities. |

| Complexity | Low; straightforward and time-efficient. | High; requires comprehensive analysis and stakeholder input. |

| Best Used For | Stable environments with minimal change. | Dynamic settings requiring alignment with strategic goals. |

| Outcome | Maintains status quo with incremental adjustments. | Optimizes resource allocation based on priority impact. |

Introduction to Incremental and Priority-Based Budgeting

Incremental budgeting involves adjusting previous budgets by a fixed percentage to allocate resources, emphasizing simplicity and historical data for forecasting. Priority-based budgeting allocates funds based on strategic goals and program effectiveness, ensuring resources align with organizational priorities and outcomes. Both methods offer distinct advantages for efficient money management, tailoring resource distribution to either historical trends or future priorities.

Defining Incremental Budgeting in Money Management

Incremental budgeting in money management involves adjusting the previous period's budget by a fixed percentage to allocate funds for the new cycle, simplifying the planning process. This method focuses on small, incremental changes rather than a complete budget overhaul, making it efficient for stable organizations with predictable expenses. Incremental budgeting emphasizes continuity and ease of implementation but may lack the flexibility to address shifting priorities or inefficiencies.

Understanding Priority-Based Budgeting Strategies

Priority-Based Budgeting (PBB) allocates funds based on the strategic importance and impact of programs, ensuring resources address critical objectives efficiently. Unlike Incremental Budgeting, which adjusts previous budgets marginally, PBB evaluates each expenditure's value, promoting transparency and improved fiscal discipline. Implementing PBB leads to optimized resource distribution by aligning spending with organizational goals rather than historical patterns.

Key Differences Between Incremental and Priority-Based Budgeting

Incremental budgeting allocates funds based on previous budgets with slight adjustments, emphasizing stability and ease of implementation, whereas priority-based budgeting allocates funds according to the importance and impact of programs, focusing on outcomes and strategic goals. Incremental budgeting tends to perpetuate past spending patterns, while priority-based budgeting promotes resource reallocation to high-value activities. Key differences include the basis for fund allocation, flexibility in adjusting to changing priorities, and emphasis on performance measurement.

Advantages of Incremental Budgeting for Personal Finance

Incremental budgeting simplifies personal finance management by building upon previous budgets, ensuring stability and ease of forecasting expenses. This method reduces the time needed for budget preparation and allows for gradual adjustments based on historical spending patterns. Incremental budgeting also minimizes the risk of drastic financial changes, fostering consistent saving habits and controlled spending.

Benefits of Priority-Based Budgeting in Effective Money Management

Priority-Based Budgeting enhances money management by directing funds toward high-impact projects, ensuring efficient allocation of resources aligned with organizational goals. It improves transparency and accountability, allowing decision-makers to justify expenditures based on the importance of activities rather than historical spending. This approach fosters strategic financial planning, reduces waste, and maximizes the value derived from each dollar spent.

Challenges of Incremental Budgeting Methods

Incremental budgeting faces challenges such as perpetuating past inefficiencies by basing new budgets on previous allocations without thorough evaluation of current needs or performance outcomes. This method often leads to rigid financial planning, limiting flexibility and innovation, while failing to align resources with strategic priorities or changing organizational goals. The lack of emphasis on value and effectiveness reduces its suitability in environments demanding agile and results-driven budget management.

Drawbacks of Priority-Based Budgeting Approaches

Priority-based budgeting can lead to rigidity by focusing heavily on predetermined priorities, potentially neglecting emerging needs or unexpected expenses. This approach often requires extensive data collection and analysis, increasing administrative costs and complexity in decision-making. Limited flexibility in reallocating funds may hinder the organization's ability to adapt to changing financial conditions or strategic shifts.

Choosing the Right Budgeting Method for Your Financial Goals

Incremental budgeting allocates funds based on previous budgets with slight adjustments, ideal for stable organizations with predictable expenses, while priority-based budgeting focuses resources on high-impact areas aligned with strategic goals, enhancing financial efficiency. Choosing the right budgeting method depends on your financial goals, complexity of operations, and need for flexibility in resource allocation. Organizations aiming for growth and strategic investment benefit from priority-based budgeting's goal-oriented approach, whereas incremental budgeting suits entities prioritizing simplicity and consistency.

Practical Tips for Transitioning Between Budgeting Techniques

Transitioning from incremental budgeting to priority-based budgeting requires clear identification of organizational goals and prioritization criteria to allocate funds more effectively. Implementing pilot programs and involving cross-departmental teams can facilitate smoother adaptation and identify potential challenges early in the process. Regular performance reviews and feedback loops ensure continuous alignment between budget allocations and strategic priorities while minimizing disruption to ongoing operations.

Related Important Terms

Zero-Based Incrementalism

Incremental budgeting allocates funds based on past budgets, adjusting amounts slightly to accommodate new needs, while priority-based budgeting reallocates resources according to strategic goals and priorities. Zero-based incrementalism combines these approaches by requiring justification of each budget item from zero, ensuring that every expense aligns with current organizational priorities rather than relying solely on historical increments.

Dynamic Priority Reallocation

Incremental budgeting allocates funds based on previous budgets with small adjustments, often limiting flexibility in responding to changing priorities. Priority-based budgeting enhances dynamic priority reallocation by continuously aligning resources with organizational goals, ensuring optimal allocation of funds to high-impact areas for effective money management.

Hybrid Budgeting Frameworks

Hybrid budgeting frameworks combine the structured, year-over-year adjustments of incremental budgeting with the strategic allocation focus of priority-based budgeting, enabling organizations to optimize resource distribution while maintaining financial continuity. This integrated approach enhances fiscal discipline by aligning incremental cost control with targeted investment in high-priority programs for more effective money management.

Outcome-driven Allocations

Incremental budgeting adjusts previous budgets by small amounts, often leading to inefficiencies and perpetuation of outdated spending patterns, whereas priority-based budgeting allocates funds based on strategic outcomes and organizational goals, ensuring resources directly support high-impact projects. Emphasizing outcome-driven allocations enhances financial transparency and accountability while promoting optimal use of available funds to achieve measurable results.

Adaptive Envelope Budgeting

Incremental Budgeting adjusts past budgets by small changes, often perpetuating inefficiencies, while Priority-Based Budgeting allocates resources according to strategic goals, enhancing financial alignment and responsiveness. Adaptive Envelope Budgeting combines the discipline of envelope budgeting with flexibility through real-time adjustments, optimizing cash flow management and improving budget adaptability in dynamic financial environments.

Value-Stream Budgeting

Value-Stream Budgeting allocates resources based on the value each stream delivers, enhancing efficiency compared to Incremental Budgeting, which adjusts previous budgets by fixed increments without evaluating impact. Unlike Priority-Based Budgeting that ranks projects by strategic importance, Value-Stream Budgeting directly ties budget allocation to measurable outcomes and value creation within business processes.

Micro-Prioritization

Incremental budgeting adjusts previous budgets by small amounts, often perpetuating inefficiencies, while priority-based budgeting allocates funds based on the specific value and impact of each expense, enhancing micro-prioritization. Micro-prioritization in priority-based budgeting allows organizations to allocate resources precisely to high-impact projects, optimizing financial management and improving overall budget effectiveness.

Agile Budgeting Sprints

Incremental budgeting allocates funds based on previous periods, often leading to inefficient resource use, while priority-based budgeting directs financial resources to high-impact initiatives, enhancing agility and responsiveness. Agile budgeting sprints integrate priority-based budgeting with iterative financial planning cycles, enabling rapid adjustments and optimal fund allocation aligned with organizational goals.

Impact-weighted Funding

Incremental budgeting allocates funds based on previous budgets, often overlooking impact-weighted outcomes, whereas priority-based budgeting directs resources according to strategic priorities and measurable impact, enhancing cost-effectiveness and funding efficiency. Emphasizing impact-weighted funding ensures that budget allocations align with high-value programs, driving better financial accountability and optimized resource utilization.

Needs-based Incrementals

Needs-based incremental budgeting allocates funds by adjusting previous budgets according to current organizational needs, ensuring resources are directed to essential functions without radical changes. Priority-based budgeting, however, ranks programs by importance and potential impact, reallocating funds to highest-priority areas, which may lead to significant shifts in spending patterns.

Incremental Budgeting vs Priority-Based Budgeting for money management. Infographic

moneydiff.com

moneydiff.com