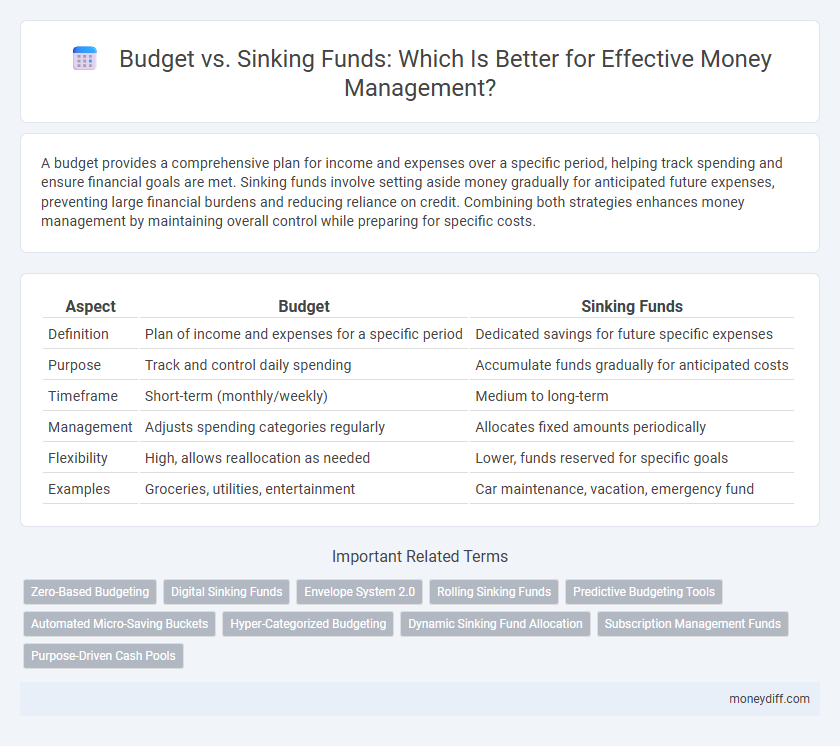

A budget provides a comprehensive plan for income and expenses over a specific period, helping track spending and ensure financial goals are met. Sinking funds involve setting aside money gradually for anticipated future expenses, preventing large financial burdens and reducing reliance on credit. Combining both strategies enhances money management by maintaining overall control while preparing for specific costs.

Table of Comparison

| Aspect | Budget | Sinking Funds |

|---|---|---|

| Definition | Plan of income and expenses for a specific period | Dedicated savings for future specific expenses |

| Purpose | Track and control daily spending | Accumulate funds gradually for anticipated costs |

| Timeframe | Short-term (monthly/weekly) | Medium to long-term |

| Management | Adjusts spending categories regularly | Allocates fixed amounts periodically |

| Flexibility | High, allows reallocation as needed | Lower, funds reserved for specific goals |

| Examples | Groceries, utilities, entertainment | Car maintenance, vacation, emergency fund |

Understanding Budgeting: The Basics

A budget tracks income and expenses to help allocate funds efficiently, ensuring essential costs are covered while identifying surplus for savings or investment. Sinking funds, a subset of budgeting, involve setting aside money regularly for specific future expenses, preventing financial strain when large payments arise. Mastering these techniques boosts financial control and supports long-term money management goals.

What Are Sinking Funds?

Sinking funds are savings accounts reserved for specific future expenses, allowing individuals to spread out large costs over time instead of accumulating debt. Unlike a general budget that tracks income and expenditures, sinking funds provide a targeted strategy for managing upcoming financial obligations such as car repairs, vacations, or holiday gifts. This approach promotes disciplined saving and prevents financial strain by allocating money systematically toward predetermined goals.

Key Differences Between Budgets and Sinking Funds

Budgets allocate income to various expenses and savings categories to manage cash flow over a specific period, ensuring daily and monthly financial stability. Sinking funds are specialized savings accounts designed for accumulating money over time for large, planned future expenses, separate from regular budget categories. The key difference lies in budgets controlling ongoing spending while sinking funds focus on targeted, goal-oriented savings.

Why Both Tools Matter for Financial Health

Budgeting provides a clear overview of income and expenses, enabling effective cash flow management and preventing overspending. Sinking funds allocate savings for specific future expenses, reducing reliance on credit and avoiding financial stress. Combining budgets with sinking funds ensures disciplined spending and prepares individuals for both routine and unexpected costs, fostering long-term financial stability.

Pros and Cons of Traditional Budgeting

Traditional budgeting offers a clear framework for managing monthly income and expenses, helping individuals track spending and set financial goals. However, it often lacks flexibility, making it challenging to accommodate unexpected costs or variable expenses without causing budget shortfalls. This rigidity may lead to overspending or under-saving, unlike sinking funds, which allocate money gradually for specific future expenses.

Advantages of Using Sinking Funds

Sinking funds offer precise financial discipline by allocating specific amounts of money for upcoming expenses, ensuring funds are readily available without resorting to credit. This method reduces financial stress by breaking down large expenses into manageable, scheduled savings, promoting consistent money management habits. Unlike general budgets that track income and expenses, sinking funds provide targeted savings goals, enhancing clarity and control over future financial obligations.

When to Choose Budgeting Over Sinking Funds

Choose budgeting over sinking funds when managing day-to-day expenses and irregular monthly costs that require flexible allocation of funds. Budgets provide a comprehensive overview of income and expenses, allowing adjustments to spending habits and cash flow throughout the month. Use budgeting for short-term financial goals and routine expense tracking rather than preset saving targets for specific future purchases.

How to Set Up Effective Sinking Funds

To set up effective sinking funds, identify specific future expenses and allocate fixed amounts regularly to separate savings accounts dedicated to each goal. Calculate the total estimated cost and divide it by the number of months until the expense is due, ensuring consistent contributions that prevent financial strain. Tracking progress monthly and adjusting contributions based on changes in timing or cost improves financial discipline and prevents reliance on credit.

Integrating Sinking Funds Into Your Budget

Integrating sinking funds into your budget enhances financial planning by allocating specific amounts toward future expenses, preventing large, unexpected financial burdens. By systematically setting aside money in sinking funds for items such as car maintenance, holidays, or insurance premiums, you ensure consistent savings aligned with scheduled payments. This method improves cash flow management and increases financial stability by matching budget categories with anticipated costs over time.

Finding the Right Money Management Strategy for You

Balancing a budget helps track regular income and expenses to maintain financial stability, while sinking funds allocate money gradually for specific future purchases or emergencies. Choosing between budgeting and sinking funds depends on your personal financial goals, spending habits, and long-term planning needs. Combining both strategies often provides a comprehensive approach to managing cash flow effectively and preparing for planned and unexpected expenses.

Related Important Terms

Zero-Based Budgeting

Zero-based budgeting allocates every dollar of income to specific expenses, savings, and debt repayment, ensuring no funds are left unassigned, which contrasts sinking funds that reserve money for future large expenses over time. This method enhances financial control and prioritization by requiring justification for all expenditures, promoting disciplined money management and reducing unnecessary spending.

Digital Sinking Funds

Digital sinking funds offer a strategic advantage over traditional budgeting by enabling automatic, goal-specific savings through dedicated sub-accounts or apps, improving financial discipline and reducing the risk of overspending. Unlike general budgets, digital sinking funds provide precise tracking and allocation for future expenses, ensuring funds are readily available when needed without disrupting overall cash flow.

Envelope System 2.0

Budgeting with the Envelope System 2.0 enhances money management by allocating funds into specific categories, ensuring disciplined spending while sinking funds accumulate for future expenses. This method optimizes cash flow control by combining real-time budget tracking with strategic saving, reducing financial stress and preventing overspending.

Rolling Sinking Funds

Rolling sinking funds enhance budget management by allowing consistent, scheduled contributions toward future expenses, preventing financial strain from large, infrequent costs. This method optimizes cash flow and improves expense tracking by spreading savings obligations evenly across monthly budgets.

Predictive Budgeting Tools

Predictive budgeting tools enhance money management by analyzing spending patterns and forecasting future expenses, allowing users to allocate funds more accurately between budget categories and sinking funds. These tools improve financial planning by dynamically adjusting budgets based on predictive insights, ensuring sufficient reserves for anticipated large purchases or irregular bills.

Automated Micro-Saving Buckets

Automated micro-saving buckets enable precise allocation of funds within a budget, offering a structured alternative to sinking funds by automating small, frequent transfers toward specific financial goals. This method enhances disciplined money management by reducing manual tracking while ensuring steady progress in savings without disrupting overall budget flow.

Hyper-Categorized Budgeting

Hyper-categorized budgeting breaks down expenses into detailed subcategories, enabling precise allocation of funds and easier tracking, while sinking funds specifically set aside money for future large expenses, preventing budget overextension. Combining hyper-categorized budgeting with sinking funds optimizes cash flow management by aligning short-term spending control with long-term financial goals.

Dynamic Sinking Fund Allocation

Dynamic sinking fund allocation enhances traditional budgeting by allowing flexible, prioritized contributions to multiple financial goals, optimizing cash flow management and reducing the risk of overspending. This method adapts to changing expenses and income fluctuations, ensuring timely availability of funds and more efficient long-term financial planning.

Subscription Management Funds

Subscription management funds require precise allocation to avoid overspending, making sinking funds more effective than traditional budgets for setting aside money over time. Sinking funds allow users to accumulate smaller amounts regularly, ensuring sufficient coverage for recurring subscription fees without disrupting monthly cash flow.

Purpose-Driven Cash Pools

Budgeting establishes a structured plan to allocate monthly income toward expenses and savings, ensuring overall financial discipline, while sinking funds create purpose-driven cash pools set aside for specific future expenses, minimizing debt and financial stress. Utilizing sinking funds alongside a budget allows for targeted savings that cover anticipated costs like car repairs or vacations without disrupting regular cash flow.

Budget vs Sinking Funds for money management. Infographic

moneydiff.com

moneydiff.com