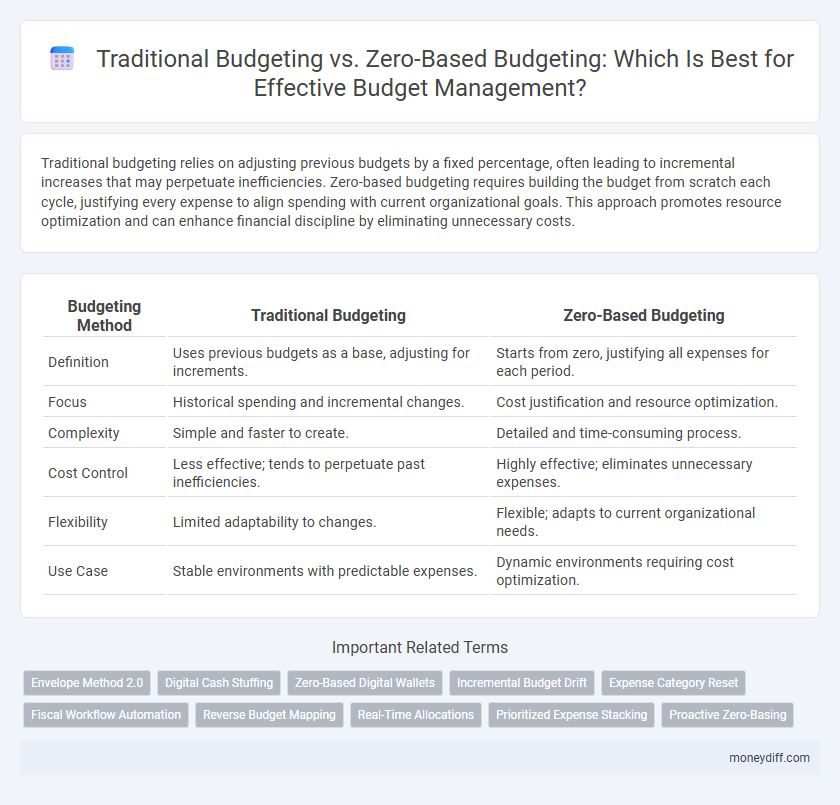

Traditional budgeting relies on adjusting previous budgets by a fixed percentage, often leading to incremental increases that may perpetuate inefficiencies. Zero-based budgeting requires building the budget from scratch each cycle, justifying every expense to align spending with current organizational goals. This approach promotes resource optimization and can enhance financial discipline by eliminating unnecessary costs.

Table of Comparison

| Budgeting Method | Traditional Budgeting | Zero-Based Budgeting |

|---|---|---|

| Definition | Uses previous budgets as a base, adjusting for increments. | Starts from zero, justifying all expenses for each period. |

| Focus | Historical spending and incremental changes. | Cost justification and resource optimization. |

| Complexity | Simple and faster to create. | Detailed and time-consuming process. |

| Cost Control | Less effective; tends to perpetuate past inefficiencies. | Highly effective; eliminates unnecessary expenses. |

| Flexibility | Limited adaptability to changes. | Flexible; adapts to current organizational needs. |

| Use Case | Stable environments with predictable expenses. | Dynamic environments requiring cost optimization. |

Understanding Traditional Budgeting

Traditional budgeting allocates funds based on historical spending patterns, adjusting previous budgets by a fixed percentage to forecast future expenses. This method simplifies planning and provides consistency but often perpetuates inefficiencies by assuming past expenditures are justified. Despite its widespread use, traditional budgeting can limit organizational agility and responsiveness to changing financial priorities.

What Is Zero-Based Budgeting?

Zero-Based Budgeting (ZBB) is a financial planning method that starts from a "zero base," requiring every expense to be justified for each new budget period, rather than relying on previous budgets. This approach promotes cost-efficiency by evaluating all expenses and prioritizing resources based on current needs and objectives. Compared to traditional budgeting, which adjusts prior budgets incrementally, ZBB helps organizations identify unnecessary expenditures and allocate funds more strategically.

Key Differences Between Traditional and Zero-Based Budgeting

Traditional budgeting allocates funds based on historical expenditures with incremental adjustments, often perpetuating inefficiencies. Zero-based budgeting requires justifying every expense from scratch, promoting resource optimization and eliminating redundant costs. The key difference lies in the budgeting approach: traditional emphasizes continuity, whereas zero-based focuses on rationale and necessity for each budget item.

Pros and Cons of Traditional Budgeting

Traditional budgeting allows organizations to build on previous budgets, making it easier to plan and forecast based on historical data and predictable expenses, which streamlines the budgeting process. However, this method can perpetuate inefficiencies and limit flexibility since it often assumes past expenditures are necessary, potentially leading to overspending or misallocation of resources. Despite its simplicity and established structure, traditional budgeting may hinder innovation by discouraging regular critical evaluation of all budget items.

Advantages and Drawbacks of Zero-Based Budgeting

Zero-Based Budgeting (ZBB) offers advantages such as enhanced cost control by requiring justification for every expense, which promotes efficient resource allocation and reduces waste. However, ZBB can be time-consuming and complex to implement, often demanding significant management effort and detailed analysis compared to Traditional Budgeting methods. While Traditional Budgeting relies on incremental adjustments from prior budgets, ZBB encourages a fresh evaluation of all expenditures, which may disrupt established processes but drives more strategic financial planning.

How to Implement Traditional Budgeting

To implement traditional budgeting, organizations start by reviewing the previous fiscal year's budget and adjusting line items based on projected revenue changes and inflation rates. Departments submit expenditure requests reflecting historical spending patterns, allowing finance teams to compile a consolidated budget aligned with overall financial goals. Regular monitoring and variance analysis are essential to ensure spending stays within approved limits and to identify areas for potential cost control.

Steps to Adopt Zero-Based Budgeting

Zero-Based Budgeting requires organizations to justify every expense from scratch, starting with a blank slate for each budgeting period. The steps to adopt this method include identifying key decision units, defining decision packages with detailed cost-benefit analysis, and ranking these packages based on their necessity and impact. This approach ensures resource allocation aligns closely with organizational priorities, enabling more efficient and transparent financial planning compared to traditional incremental budgeting.

When to Choose Traditional Budgeting

Traditional budgeting is most effective for organizations with stable operations and predictable expenses, allowing for simpler adjustments based on historical data. It suits departments with consistent funding needs, such as routine maintenance or administrative costs, where incremental changes suffice. This method supports long-term financial planning by providing a clear baseline for forecasting future budgets.

Ideal Scenarios for Zero-Based Budgeting

Zero-Based Budgeting is ideal for organizations undergoing significant changes or cost-cutting initiatives, as it requires justifying every expense from scratch rather than relying on historical budgets. It works best in scenarios where resource allocation needs to be tightly aligned with current business priorities and efficiency improvements are critical. This approach is particularly effective in dynamic industries or startups where budgets must be highly adaptable and scrutinized for value generation.

Which Budgeting Method Is Right for You?

Traditional budgeting relies on historical data to allocate resources, making it effective for organizations with stable expenses and predictable revenue streams. Zero-based budgeting starts from zero each period, requiring justification for all expenses, which suits businesses aiming to optimize efficiency and cut unnecessary costs. The right budgeting method depends on your organization's financial goals, complexity, and need for cost control versus simplicity in planning.

Related Important Terms

Envelope Method 2.0

The Envelope Method 2.0 enhances traditional budgeting by allocating funds into digital envelopes based on spending categories, promoting precise control and real-time tracking. Unlike Zero-Based Budgeting, which requires justifying every expense from zero each period, this method streamlines allocation while maintaining disciplined financial management.

Digital Cash Stuffing

Traditional budgeting often relies on historical data and incremental adjustments, which can lead to inefficient allocation in digital cash stuffing methods; zero-based budgeting requires justifying every expense from scratch, promoting more precise digital envelope management and enhanced financial control. This approach aligns better with cash stuffing in digital formats by ensuring funds are allocated based on current priorities rather than past spending habits.

Zero-Based Digital Wallets

Zero-based digital wallets allocate funds by justifying every expense from scratch, improving financial discipline compared to traditional budgeting which relies on incremental adjustments. This approach enhances transparency and prioritization, driving more efficient resource management and reducing unnecessary expenditures.

Incremental Budget Drift

Incremental Budget Drift occurs in Traditional Budgeting as annual budgets are based on previous expenditures plus incremental adjustments, often leading to inefficiencies and inflated costs. Zero-Based Budgeting eliminates this drift by requiring justification for all expenses from a zero base, promoting more accurate and efficient allocation of resources.

Expense Category Reset

Traditional budgeting relies on previous budgets with incremental adjustments to expense categories, often leading to perpetuated inefficiencies. Zero-based budgeting requires each expense category to be justified and reset annually, promoting cost optimization and resource reallocation based on current priorities.

Fiscal Workflow Automation

Traditional budgeting relies on incremental adjustments based on previous fiscal periods, often leading to inefficiencies and overlooked expense optimizations, while zero-based budgeting requires justifying every expense from scratch, promoting more rigorous cost control and resource allocation. Fiscal workflow automation enhances both methods by streamlining approval processes, ensuring real-time data accuracy, and facilitating dynamic budget revisions to improve financial governance and operational agility.

Reverse Budget Mapping

Reverse Budget Mapping in Traditional Budgeting typically involves adjusting previous allocations based on incremental changes, which may perpetuate outdated spending patterns. In contrast, Zero-Based Budgeting employs Reverse Budget Mapping by evaluating every expense from a zero base, ensuring resource allocation aligns directly with current organizational priorities and strategic goals.

Real-Time Allocations

Traditional budgeting relies on historical data and incremental adjustments, which can delay real-time allocation responses, while zero-based budgeting requires justifying all expenses from scratch, enabling more dynamic and precise real-time budget adjustments. Real-time budget allocations under zero-based budgeting improve resource efficiency by aligning expenditures directly with current operational priorities and changing market conditions.

Prioritized Expense Stacking

Traditional budgeting allocates funds based on previous expenditures, often leading to incremental increases without thorough justification, whereas zero-based budgeting requires each expense to be prioritized and justified from scratch, promoting efficient resource allocation. Prioritized expense stacking in zero-based budgeting ensures critical projects receive funding first, eliminating unnecessary costs and optimizing budget utilization.

Proactive Zero-Basing

Zero-based budgeting requires each expense to be justified from scratch, eliminating reliance on previous budgets and enabling proactive resource allocation aligned with current organizational priorities. This proactive zero-basing approach enhances cost control and strategic flexibility, unlike traditional budgeting, which often perpetuates outdated expenditures based on historical data.

Traditional Budgeting vs Zero-Based Budgeting for Budget Infographic

moneydiff.com

moneydiff.com