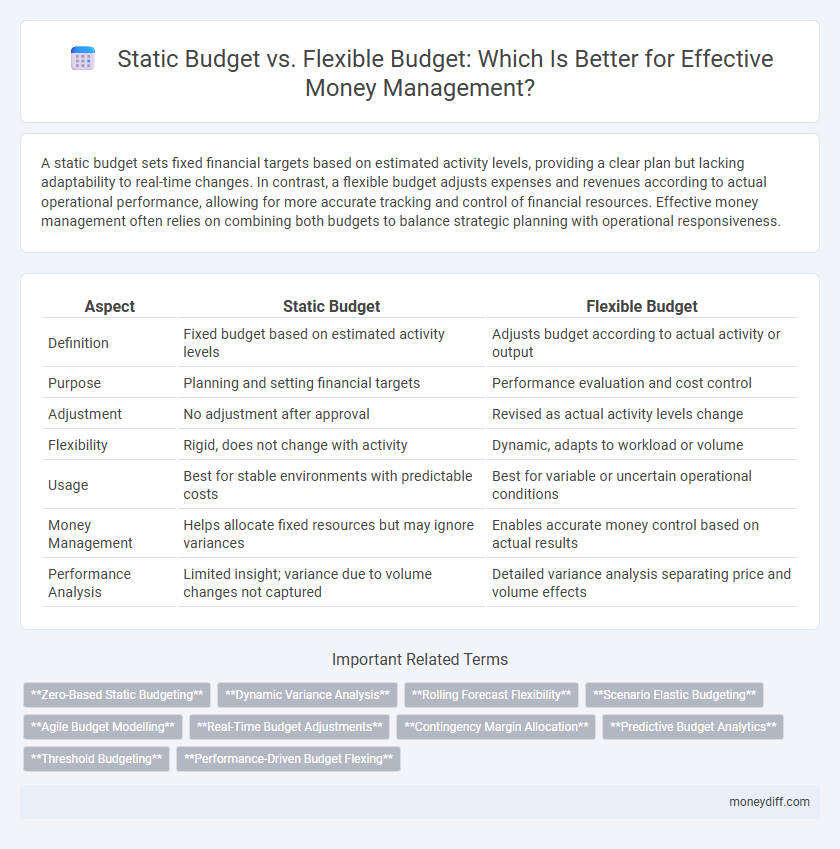

A static budget sets fixed financial targets based on estimated activity levels, providing a clear plan but lacking adaptability to real-time changes. In contrast, a flexible budget adjusts expenses and revenues according to actual operational performance, allowing for more accurate tracking and control of financial resources. Effective money management often relies on combining both budgets to balance strategic planning with operational responsiveness.

Table of Comparison

| Aspect | Static Budget | Flexible Budget |

|---|---|---|

| Definition | Fixed budget based on estimated activity levels | Adjusts budget according to actual activity or output |

| Purpose | Planning and setting financial targets | Performance evaluation and cost control |

| Adjustment | No adjustment after approval | Revised as actual activity levels change |

| Flexibility | Rigid, does not change with activity | Dynamic, adapts to workload or volume |

| Usage | Best for stable environments with predictable costs | Best for variable or uncertain operational conditions |

| Money Management | Helps allocate fixed resources but may ignore variances | Enables accurate money control based on actual results |

| Performance Analysis | Limited insight; variance due to volume changes not captured | Detailed variance analysis separating price and volume effects |

Introduction to Static and Flexible Budgets

Static budgets set predefined financial targets based on fixed assumptions, maintaining consistent revenue and expense levels regardless of actual activity changes. Flexible budgets adjust projections dynamically according to real-time business volume or operational conditions, allowing for more accurate expense control and performance evaluation. Comparing static and flexible budgets enhances decision-making by aligning financial planning with actual operational variations for effective money management.

Key Differences Between Static and Flexible Budgets

Static budgets allocate a fixed amount of money regardless of changes in activity levels, making them ideal for organizations with predictable expenses. Flexible budgets adjust expenditures based on actual activity, allowing for better responsiveness to varying financial conditions. Key differences include adaptability to volume changes, variance analysis accuracy, and suitability for dynamic versus stable business environments.

Benefits of Using a Static Budget in Personal Finance

A static budget provides a fixed financial plan that helps individuals maintain strict control over their income and expenses, promoting disciplined spending habits. It simplifies money management by setting clear expectations and limits for each budget category, making it easier to track deviations and avoid overspending. This approach is especially beneficial for those with stable incomes and predictable expenses, ensuring financial stability and effective long-term savings.

Advantages of a Flexible Budget for Money Management

A flexible budget allows for adjustments based on actual activity levels, providing more accurate financial control and better variance analysis. It helps managers respond promptly to changing business conditions, improving resource allocation and cost efficiency. This adaptability supports more realistic forecasting and enhances decision-making in dynamic financial environments.

Situational Suitability: When to Use Each Budget Type

A static budget is best suited for organizations with stable, predictable expenses and revenues, such as government agencies or fixed-cost manufacturing processes, where deviations from the budget are minimal. Flexible budgets excel in dynamic environments like retail or hospitality, where sales volume and costs fluctuate, allowing real-time adjustments aligned with actual performance. Selecting between static and flexible budgets depends on the degree of variability in operational activities and the need for responsive financial planning.

Impact of Expense Variability on Budget Choice

Expense variability significantly influences the choice between static and flexible budgets in money management. A static budget remains fixed regardless of changes in actual activity levels, making it less effective in environments with high expense variability. Flexible budgets adapt to fluctuations in expenses, providing a more accurate tool for managing costs and optimizing financial performance when variable costs are prominent.

Adjusting Money Management Strategies with Flexible Budgets

Flexible budgets allow businesses to adjust money management strategies in real-time by accounting for changes in sales volume and operational conditions, unlike static budgets which remain fixed regardless of actual performance. This dynamic approach enables more accurate expense control and resource allocation, improving financial responsiveness and decision-making. Companies leveraging flexible budgets can better manage cash flow variances and optimize profitability through continuous budget recalibration.

Common Pitfalls of Static and Flexible Budgeting

Static budgets often fail to accommodate fluctuating business conditions, leading to inaccurate financial planning and overspending. Flexible budgets can be complex to create and interpret, potentially causing confusion and misallocation of resources. Both budgeting methods risk overlooking unexpected variables, resulting in ineffective money management and reduced financial control.

Tools and Techniques for Implementing Budgets

Static budgets establish fixed financial targets based on predetermined activity levels, providing a baseline for performance evaluation but lacking adaptability to changing conditions. Flexible budgets utilize variable cost structures adjusted for actual activity levels, offering dynamic financial control and enhanced accuracy in expense management. Tools such as variance analysis, cost-volume-profit models, and budgeting software facilitate the implementation and comparison of static versus flexible budgets, enabling precise financial planning and resource allocation.

Choosing the Right Budget for Your Financial Goals

Static budgets provide a fixed financial plan based on estimated revenues and expenses, ideal for organizations with predictable cash flows and stable operating conditions. Flexible budgets adjust according to actual activity levels, offering greater accuracy and control in dynamic environments where costs and revenues fluctuate. Selecting between static and flexible budgets depends on your financial goals, business model, and the degree of variability in your income and expenses.

Related Important Terms

Zero-Based Static Budgeting

Zero-based static budgeting requires justifying every expense from scratch, promoting precise cost control and eliminating unnecessary expenditures compared to flexible budgets. This approach enhances money management by aligning fixed allocations with organizational priorities, ensuring efficient resource utilization regardless of actual activity levels.

Dynamic Variance Analysis

Dynamic Variance Analysis in static budgets compares fixed projections with actual results, often overlooking changes in activity levels, whereas flexible budgets adjust for real-time operational fluctuations, providing a more accurate assessment of financial performance by isolating variances caused by efficiency, spending, and volume. This approach enhances money management by enabling precise control over costs and revenues, aligning budgeting processes with actual business conditions.

Rolling Forecast Flexibility

Static budgets provide a fixed financial plan based on predetermined assumptions, limiting adaptability to changing conditions, while flexible budgets adjust allocations according to actual activity levels, enhancing rolling forecast flexibility. Incorporating rolling forecasts in flexible budgeting enables continuous updates and more accurate financial management by accounting for real-time variances and shifting business dynamics.

Scenario Elastic Budgeting

Scenario Elastic Budgeting adapts the static budget by allowing adjustments based on actual activity levels, providing more accurate financial control and resource allocation. It enhances money management by dynamically aligning expenses and revenues with changing business conditions, reducing variance and improving forecasting precision.

Agile Budget Modelling

Agile Budget Modelling leverages flexible budget frameworks that adapt to real-time financial changes, unlike static budgets which remain fixed regardless of variance in actual performance. This dynamic approach enhances money management by allowing continuous budget adjustments aligned with shifting business priorities and market conditions.

Real-Time Budget Adjustments

Flexible budgets enable real-time budget adjustments by automatically recalibrating allocations based on actual financial performance and operational changes, enhancing responsiveness in money management. Static budgets lack this adaptability as they are fixed, often resulting in less accurate financial control and delayed corrective actions.

Contingency Margin Allocation

Static budgets allocate a fixed contingency margin based on projected expenses, limiting adaptability to unexpected cost variations, while flexible budgets adjust the contingency margin in response to actual activity levels, enhancing responsiveness and financial control in money management. Effective contingency margin allocation in flexible budgets ensures optimized resource use and mitigates risks of budget overruns.

Predictive Budget Analytics

Static budgets provide a fixed financial plan that does not change with actual activity levels, limiting adaptability in dynamic environments, while flexible budgets adjust according to real-time performance, enabling more accurate resource allocation. Predictive budget analytics leverages historical data and forecasting models to enhance the accuracy of flexible budgets, improving money management by anticipating financial outcomes and optimizing budgetary decisions.

Threshold Budgeting

Threshold budgeting establishes predefined limits for expenses within both static and flexible budgets, enabling organizations to control spending by setting specific thresholds that trigger managerial review when exceeded. Integrating threshold budgeting with static budgets provides fixed spending caps, while in flexible budgets it adjusts limits based on actual activity levels, enhancing adaptive financial management.

Performance-Driven Budget Flexing

Performance-driven budget flexing enhances money management by adjusting the static budget based on actual activity levels, enabling more accurate reflection of operational performance. Flexible budgets allocate resources dynamically, improving variance analysis and supporting real-time financial decision-making to optimize cost control and efficiency.

Static budget vs Flexible budget for money management. Infographic

moneydiff.com

moneydiff.com