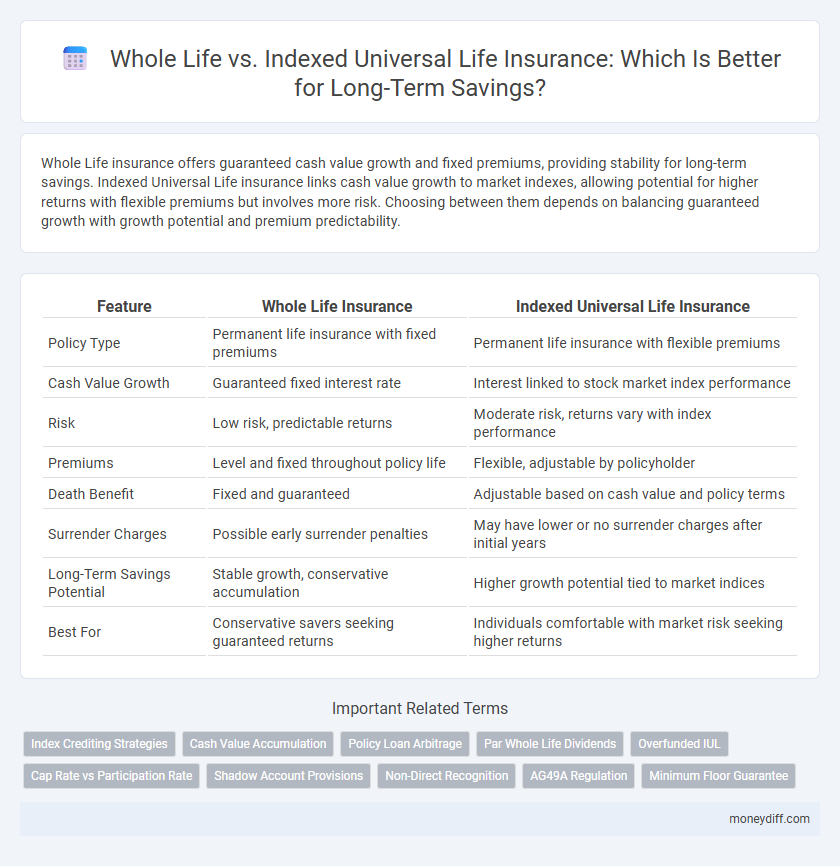

Whole Life insurance offers guaranteed cash value growth and fixed premiums, providing stability for long-term savings. Indexed Universal Life insurance links cash value growth to market indexes, allowing potential for higher returns with flexible premiums but involves more risk. Choosing between them depends on balancing guaranteed growth with growth potential and premium predictability.

Table of Comparison

| Feature | Whole Life Insurance | Indexed Universal Life Insurance |

|---|---|---|

| Policy Type | Permanent life insurance with fixed premiums | Permanent life insurance with flexible premiums |

| Cash Value Growth | Guaranteed fixed interest rate | Interest linked to stock market index performance |

| Risk | Low risk, predictable returns | Moderate risk, returns vary with index performance |

| Premiums | Level and fixed throughout policy life | Flexible, adjustable by policyholder |

| Death Benefit | Fixed and guaranteed | Adjustable based on cash value and policy terms |

| Surrender Charges | Possible early surrender penalties | May have lower or no surrender charges after initial years |

| Long-Term Savings Potential | Stable growth, conservative accumulation | Higher growth potential tied to market indices |

| Best For | Conservative savers seeking guaranteed returns | Individuals comfortable with market risk seeking higher returns |

Understanding Whole Life and Indexed Universal Life Insurance

Whole Life Insurance offers guaranteed cash value growth and fixed premiums, providing financial stability and predictable long-term savings. Indexed Universal Life Insurance ties cash value growth to stock market indexes, allowing for potentially higher returns with some risk and flexible premium payments. Both policies serve as effective tools for retirement planning, but choosing between them depends on your risk tolerance and savings goals.

Key Features of Whole Life Insurance

Whole Life Insurance offers guaranteed death benefits, fixed premiums, and a guaranteed cash value growth, making it a stable option for long-term savings. The policy's cash value grows tax-deferred and can be accessed through policy loans, providing liquidity without affecting the death benefit. Its predictability and built-in dividends contribute to financial security over the policyholder's lifetime.

Key Features of Indexed Universal Life Insurance

Indexed Universal Life (IUL) insurance offers flexible premium payments, adjustable death benefits, and the potential for cash value growth tied to a stock market index, providing a balance between risk and reward. The policy's cash value grows based on a credited interest rate linked to an equity index, with a guaranteed minimum floor to protect against market downturns. Tax-deferred growth, policy loans, and death benefit options make IUL a versatile choice for long-term savings and estate planning.

Cash Value Growth: Whole Life vs IUL

Whole Life insurance offers steady, guaranteed cash value growth through fixed premiums and dividends based on the insurer's performance, providing predictable accumulation over time. Indexed Universal Life (IUL) insurance links cash value growth to a stock market index, allowing potentially higher returns with a cap and floor to mitigate losses, making it more flexible but variable. The choice depends on risk tolerance and growth expectations, with Whole Life favoring stability and IUL offering growth potential tied to market performance.

Flexibility and Premium Options Compared

Whole Life insurance offers fixed premiums and guaranteed cash value growth, providing stability and predictability for long-term savings. Indexed Universal Life (IUL) insurance provides flexibility with adjustable premiums and death benefits, allowing policyholders to adapt coverage to changing financial needs while offering potential cash value growth tied to market indexes. The choice depends on whether a policyholder prioritizes the steady, guaranteed approach of Whole Life or the adaptable, market-linked potential of IUL for maximizing long-term savings.

Investment Strategies and Returns

Whole Life insurance offers guaranteed cash value growth with stable, predictable returns based on fixed interest rates and dividends, providing a conservative long-term savings strategy. Indexed Universal Life (IUL) insurance links cash value growth to market index performance, offering higher potential returns through exposure to equity markets while protecting principal from downside risk due to policy floors. When selecting between Whole Life and IUL for investment strategies, consider risk tolerance, desired premium flexibility, and return objectives to optimize long-term savings and retirement income.

Risk and Guarantees in WL and IUL Policies

Whole Life insurance offers guaranteed cash value growth and fixed premiums, providing stable, predictable long-term savings with minimal risk. Indexed Universal Life (IUL) policies link cash value growth to market indexes, offering higher upside potential but with exposure to caps, spreads, and participation rates that introduce variability and risk. The guarantees in IUL policies typically include a floor preventing cash value loss from market downturns, but they lack the guaranteed steady growth and premium stability inherent in Whole Life insurance.

Cost Comparison: Whole Life vs Indexed Universal Life

Whole Life insurance generally has higher fixed premiums due to guaranteed cash value growth and lifetime coverage, making it more expensive upfront compared to Indexed Universal Life (IUL) policies. Indexed Universal Life offers flexible premiums and potential for cash value growth tied to market indexes, often resulting in lower initial costs but variable long-term expenses depending on market performance and policy adjustments. Evaluating cost efficiency requires analyzing premium stability, fees, and projected cash value accumulation over an extended period under both policy types.

Suitability for Long-Term Savings Goals

Whole Life insurance offers guaranteed cash value growth and predictable premiums, making it suitable for conservative, long-term savings goals with stable financial planning. Indexed Universal Life (IUL) provides flexibility in premium payments and potential for higher returns linked to market indexes, appealing to those seeking growth with moderate risk tolerance over extended periods. Both options support long-term savings, but Whole Life suits risk-averse individuals prioritizing certainty, while IUL fits those aiming for growth potential aligned with market performance.

Deciding Which Policy Fits Your Financial Plan

Whole Life insurance offers guaranteed cash value growth and stable premiums, making it ideal for those seeking predictability in long-term savings. Indexed Universal Life provides flexibility with premium payments and potential for higher returns linked to stock market indexes but carries more risk. Assess your financial goals, risk tolerance, and need for policy flexibility to determine which option aligns with your retirement and estate planning strategy.

Related Important Terms

Index Crediting Strategies

Indexed Universal Life insurance offers flexible index crediting strategies tied to market performance, enabling potential higher cash value growth compared to Whole Life's fixed, guaranteed interest rates. Whole Life policies emphasize stable, predictable accumulation through guaranteed dividends, whereas Indexed Universal Life leverages index-linked interest credits to optimize long-term savings growth.

Cash Value Accumulation

Whole Life insurance offers guaranteed cash value accumulation with fixed premiums, providing stable long-term savings growth through dividend payments and interest. Indexed Universal Life insurance links cash value growth to market indexes, allowing potential higher returns with flexible premiums but carrying greater risk tied to market performance.

Policy Loan Arbitrage

Whole Life insurance offers stable cash value growth with fixed interest, enabling predictable policy loan arbitrage through borrowing at lower loan rates while the cash value accrues dividends. Indexed Universal Life insurance allows cash value accumulation linked to market indexes, presenting opportunities for higher returns that may exceed loan interest rates, though policy loan arbitrage requires careful monitoring of index caps and participation rates.

Par Whole Life Dividends

Par Whole Life insurance offers guaranteed dividends that can be used to increase cash value, reduce premiums, or purchase additional coverage, providing steady growth and financial stability for long-term savings. Indexed Universal Life policies, while offering flexible premiums and potential for higher returns linked to market indices, lack the consistent dividend payouts that characterize Par Whole Life's reliable income stream.

Overfunded IUL

Overfunded Indexed Universal Life (IUL) insurance offers flexible premium payments and the potential for higher cash value growth linked to market indexes, making it a powerful vehicle for long-term savings compared to Whole Life policies, which provide fixed premiums and guaranteed cash value but limited growth. Indexed Universal Life allows policyholders to maximize contributions beyond the cost of insurance, enhancing tax-deferred accumulation and providing a tailored approach to wealth preservation and legacy planning.

Cap Rate vs Participation Rate

Whole Life insurance offers guaranteed cash value growth with a fixed interest rate, but generally lacks the upside potential of Indexed Universal Life (IUL) policies, which credit interest based on a stock market index subject to caps and participation rates. The cap rate limits the maximum return credited, while the participation rate determines the percentage of the index gain credited, making these two factors crucial in evaluating IUL's long-term savings potential compared to the stable but lower growth of Whole Life.

Shadow Account Provisions

Whole Life insurance offers guaranteed cash value growth with fixed premiums, while Indexed Universal Life (IUL) policies utilize shadow account provisions to track index performance without directly investing in the market, providing potential upside with downside protection. Shadow accounts in IUL policies enhance long-term savings by crediting interest based on index gains, subject to caps and participation rates, allowing policyholders to benefit from market-linked growth without risking principal loss.

Non-Direct Recognition

Whole Life insurance guarantees fixed cash value growth with non-direct recognition, ensuring dividends are paid even when policy loans exist, providing stable long-term savings. Indexed Universal Life offers potential for higher cash value accumulation tied to market indexes, but with non-direct recognition loans, loan interest is charged without impacting dividend credits, preserving growth potential.

AG49A Regulation

Whole Life insurance offers guaranteed cash value growth and fixed premiums, providing stability under AG49A Regulation, while Indexed Universal Life (IUL) policies link cash value growth to market indices, potentially yielding higher returns but with greater risk and cost variability. Compliance with AG49A mandates insurers to clearly disclose costs and guarantees, making Whole Life more suitable for conservative, predictable long-term savings and IUL appealing for policyholders seeking market-linked growth with flexible premiums.

Minimum Floor Guarantee

Whole Life insurance offers a guaranteed minimum floor on cash value growth, ensuring steady accumulation regardless of market fluctuations, while Indexed Universal Life (IUL) provides potential higher returns linked to stock market indices but only guarantees a floor of zero to protect against losses. For long-term savings, the minimum floor guarantee in Whole Life policies provides predictable security, whereas IUL's zero floor guards principal without the assurance of fixed growth.

Whole Life vs Indexed Universal Life for long-term savings. Infographic

moneydiff.com

moneydiff.com