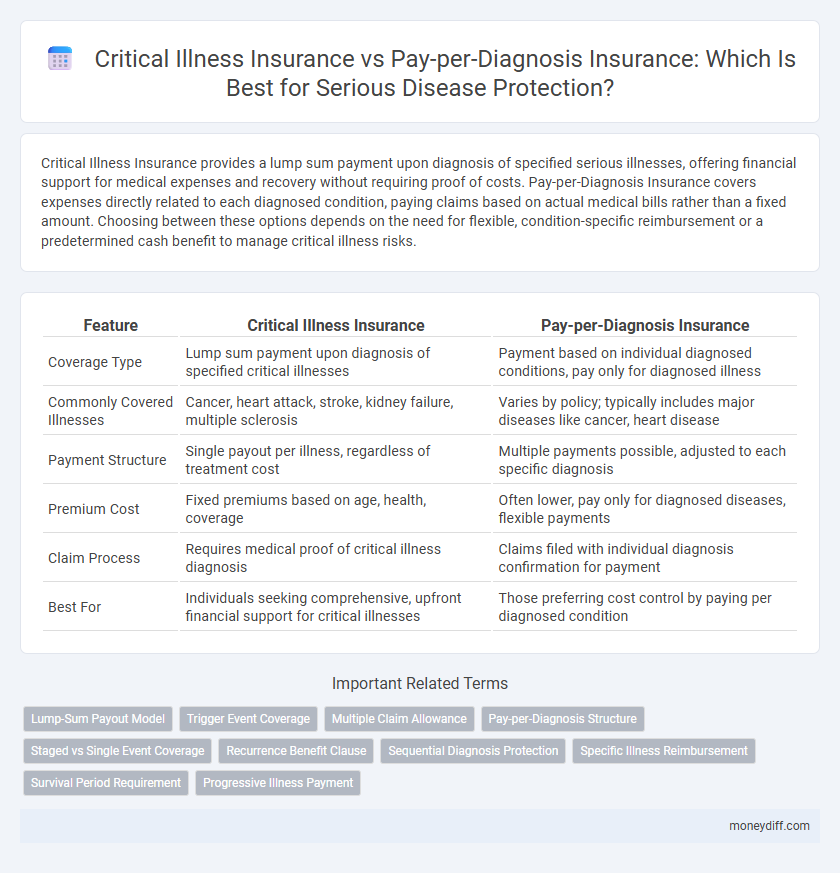

Critical Illness Insurance provides a lump sum payment upon diagnosis of specified serious illnesses, offering financial support for medical expenses and recovery without requiring proof of costs. Pay-per-Diagnosis Insurance covers expenses directly related to each diagnosed condition, paying claims based on actual medical bills rather than a fixed amount. Choosing between these options depends on the need for flexible, condition-specific reimbursement or a predetermined cash benefit to manage critical illness risks.

Table of Comparison

| Feature | Critical Illness Insurance | Pay-per-Diagnosis Insurance |

|---|---|---|

| Coverage Type | Lump sum payment upon diagnosis of specified critical illnesses | Payment based on individual diagnosed conditions, pay only for diagnosed illness |

| Commonly Covered Illnesses | Cancer, heart attack, stroke, kidney failure, multiple sclerosis | Varies by policy; typically includes major diseases like cancer, heart disease |

| Payment Structure | Single payout per illness, regardless of treatment cost | Multiple payments possible, adjusted to each specific diagnosis |

| Premium Cost | Fixed premiums based on age, health, coverage | Often lower, pay only for diagnosed diseases, flexible payments |

| Claim Process | Requires medical proof of critical illness diagnosis | Claims filed with individual diagnosis confirmation for payment |

| Best For | Individuals seeking comprehensive, upfront financial support for critical illnesses | Those preferring cost control by paying per diagnosed condition |

Understanding Critical Illness Insurance

Critical Illness Insurance provides a lump sum payment upon diagnosis of specified serious diseases such as cancer, heart attack, or stroke, offering financial support for treatment and recovery costs. Unlike Pay-per-Diagnosis Insurance, which pays only for specific diagnoses reimbursed individually, Critical Illness Insurance covers a broader range of predefined conditions with a one-time benefit. This type of insurance ensures policyholders have immediate funds to manage medical expenses and lifestyle adjustments during critical health events.

What is Pay-per-Diagnosis Insurance?

Pay-per-Diagnosis Insurance provides coverage that pays out a predetermined amount specifically for each diagnosed serious illness, such as cancer, heart attack, or stroke, allowing policyholders to receive benefits tailored to the severity of their condition. Unlike Critical Illness Insurance, which offers a lump sum upon the first diagnosis of any covered disease, Pay-per-Diagnosis Insurance delivers payments based on multiple confirmed conditions, potentially extending financial support throughout varied stages of illness. This insurance model helps manage medical expenses directly related to specific diagnoses, enhancing personalized protection for individuals facing serious health concerns.

Key Differences Between Coverage Types

Critical Illness Insurance provides a lump sum payout upon diagnosis of specified serious illnesses, offering financial flexibility for treatment or living expenses without requiring cost itemization. Pay-per-Diagnosis Insurance reimburses policyholders based on actual diagnostic codes submitted, covering medical expenses directly related to the illness but often requiring detailed claims documentation. The key differences lie in payment structure, claim process, and financial predictability, with Critical Illness Insurance offering predefined benefits and Pay-per-Diagnosis Insurance aligning payouts with actual treatment costs.

How Each Policy Pays Out

Critical Illness Insurance provides a lump-sum payment upon the diagnosis of covered serious illnesses, offering immediate financial support regardless of treatment costs. Pay-per-Diagnosis Insurance disburses funds based on each specific diagnosis, allowing for tailored payouts that directly correspond to the severity and type of illness identified. Both policies prioritize timely financial relief but differ in payout structure and flexibility for managing serious disease expenses.

Serious Disease Protection: Which Policy Provides More Security?

Critical Illness Insurance offers comprehensive coverage by providing a lump-sum payment upon diagnosis of specified serious diseases, ensuring financial stability during extended treatment periods. Pay-per-Diagnosis Insurance, on the other hand, delivers targeted payouts strictly linked to the confirmed diagnosis, allowing for flexible, condition-specific financial support. For robust serious disease protection, Critical Illness Insurance generally provides more substantial security due to its broader disease coverage and lump-sum benefits that cover a wide range of treatment-related expenses.

Flexibility and Customization of Benefits

Critical Illness Insurance offers a fixed lump-sum payout upon diagnosis of covered conditions, providing straightforward financial support but limited flexibility in benefit use. Pay-per-Diagnosis Insurance allows policyholders to select specific illnesses and receive tailored payouts for each diagnosis, enabling personalized coverage that matches individual risk profiles. This customizable approach enhances financial planning by aligning benefits closely with actual health needs and treatment costs.

Cost Comparison: Premiums and Value for Money

Critical Illness Insurance typically requires higher premiums but offers lump-sum payouts upon diagnosis of covered diseases, providing comprehensive financial support. Pay-per-Diagnosis Insurance features lower premiums, charging only when a specific serious illness is diagnosed, which may result in cost savings if claims are infrequent. Evaluating the balance between premium affordability and the extent of coverage is essential to determine the best value based on individual health risk and financial priorities.

Claim Process and Payout Timelines

Critical Illness Insurance typically involves a streamlined claim process triggered by a formal diagnosis of covered illnesses, ensuring a lump-sum payout that supports immediate medical and living expenses. Pay-per-Diagnosis Insurance offers flexible claim options, with payouts made against specific diagnoses, often resulting in faster disbursement tailored to the severity of each condition. Both insurance types prioritize expedited claim approvals, but Pay-per-Diagnosis plans may provide quicker financial relief per diagnosis compared to traditional Critical Illness Insurance timelines.

Factors to Consider When Choosing Coverage

Critical illness insurance offers a lump-sum payout upon diagnosis of specified diseases, while pay-per-diagnosis insurance provides coverage only for diagnosed conditions listed in the policy, often with variable payouts. Key factors to consider include the breadth of covered illnesses, payout structure, waiting periods, premium costs, and the policy's flexibility in adapting to changing health needs. Evaluating potential claim scenarios against personal health risks and financial goals ensures optimal protection for serious disease expenses.

Which Policy is Right For Your Money Management Plan?

Critical Illness Insurance provides a lump-sum payment upon diagnosis of covered conditions, offering financial stability for treatment and recovery, while Pay-per-Diagnosis Insurance pays only for specific diagnosed illnesses, potentially lowering premiums but limiting coverage scope. Evaluating your health risks, budget, and financial goals helps determine which policy aligns best with your money management plan. Investors prioritizing comprehensive coverage may favor Critical Illness Insurance, whereas those seeking cost-effective options with targeted protection might prefer Pay-per-Diagnosis Insurance.

Related Important Terms

Lump-Sum Payout Model

Critical Illness Insurance provides a fixed lump-sum payout upon diagnosis of a covered serious disease, offering financial flexibility to cover medical expenses, lost income, or rehabilitation costs. Pay-per-Diagnosis Insurance pays specific amounts linked to each diagnosed condition, potentially limiting overall coverage but aligning payouts closely with treatment needs for individual illnesses.

Trigger Event Coverage

Critical Illness Insurance provides a lump sum payout upon diagnosis of covered serious illnesses, activating coverage once a predefined trigger event like cancer, stroke, or heart attack occurs. Pay-per-Diagnosis Insurance offers flexible, claim-based payments that correspond directly to specific disease diagnoses, allowing targeted financial support aligned with individual medical conditions.

Multiple Claim Allowance

Critical Illness Insurance typically offers a multiple claim allowance, enabling policyholders to receive benefits for different unrelated illnesses covered under the plan, enhancing long-term financial protection. In contrast, Pay-per-Diagnosis Insurance usually limits claims to one per diagnosed condition, which can restrict coverage flexibility for multiple serious diseases.

Pay-per-Diagnosis Structure

Pay-per-Diagnosis Insurance provides coverage by paying a fixed benefit upon diagnosis of specific serious illnesses, ensuring precise financial support tailored to each condition. This structure minimizes premium costs by limiting payouts to predefined diseases, offering targeted protection without covering multiple or unrelated health issues.

Staged vs Single Event Coverage

Critical Illness Insurance provides staged coverage with multiple payouts for different phases or severity levels of a diagnosed illness, ensuring ongoing financial support throughout treatment. Pay-per-Diagnosis Insurance offers single event coverage, delivering a lump sum benefit upon initial diagnosis, which is ideal for immediate expenses but lacks continued compensation for subsequent stages.

Recurrence Benefit Clause

Critical Illness Insurance typically includes a Recurrence Benefit Clause, providing policyholders with additional payouts if the same illness reoccurs after a specified waiting period, ensuring continued financial protection. In contrast, Pay-per-Diagnosis Insurance often lacks this clause, offering coverage only for distinct, separate diagnoses without benefits for relapse or recurrence of the same condition.

Sequential Diagnosis Protection

Critical Illness Insurance provides a lump-sum payout upon the first confirmed diagnosis of a covered serious illness, offering immediate financial relief, while Pay-per-Diagnosis Insurance delivers incremental benefits as each new illness is diagnosed, supporting ongoing treatment costs. Sequential Diagnosis Protection in Pay-per-Diagnosis plans enhances coverage by allowing multiple claims for distinct illnesses over time, ensuring sustained financial support throughout a patient's health journey.

Specific Illness Reimbursement

Critical Illness Insurance provides a lump sum payout upon diagnosis of covered illnesses, offering comprehensive financial support for treatment and recovery costs. Pay-per-Diagnosis Insurance reimburses policyholders based on the specific illness diagnosed, allowing tailored coverage but potentially resulting in varied benefit amounts depending on the condition.

Survival Period Requirement

Critical Illness Insurance typically requires a survival period of 14 to 30 days after diagnosis to qualify for a payout, ensuring the condition is genuine and stable. Pay-per-Diagnosis Insurance often eliminates or shortens the survival period, providing faster access to funds upon diagnosis, which can be crucial for immediate medical expenses.

Progressive Illness Payment

Critical illness insurance provides a lump-sum payment upon diagnosis of covered serious diseases, while pay-per-diagnosis insurance offers multiple progressive illness payments as the severity of the condition increases. Progressive illness payment features in pay-per-diagnosis plans help cover ongoing treatment costs and financial needs by releasing funds at various stages of disease progression.

Critical Illness Insurance vs Pay-per-Diagnosis Insurance for serious disease protection. Infographic

moneydiff.com

moneydiff.com