A surplus budget occurs when government revenues exceed expenditures, allowing for debt reduction or increased savings, which strengthens fiscal stability. In contrast, a deficit budget arises when expenditures surpass revenues, often leading to borrowing and increased national debt to finance the shortfall. Effective management of surplus and deficit budgets is crucial for sustainable economic growth and fiscal responsibility.

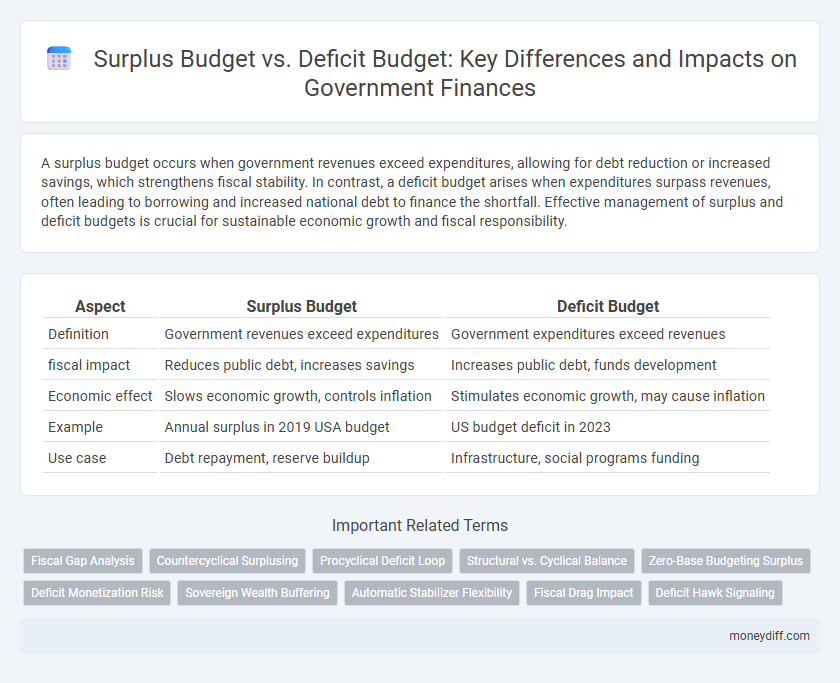

Table of Comparison

| Aspect | Surplus Budget | Deficit Budget |

|---|---|---|

| Definition | Government revenues exceed expenditures | Government expenditures exceed revenues |

| fiscal impact | Reduces public debt, increases savings | Increases public debt, funds development |

| Economic effect | Slows economic growth, controls inflation | Stimulates economic growth, may cause inflation |

| Example | Annual surplus in 2019 USA budget | US budget deficit in 2023 |

| Use case | Debt repayment, reserve buildup | Infrastructure, social programs funding |

Introduction to Government Budgets

A surplus budget occurs when government revenues exceed expenditures, indicating a positive fiscal balance that can be used to reduce debt or increase savings. In contrast, a deficit budget arises when spending surpasses income, requiring borrowing to finance the gap and potentially increasing national debt. Understanding these budget types is essential for analyzing government fiscal policy and its impact on economic stability.

Defining Surplus Budget and Deficit Budget

A surplus budget occurs when government revenues exceed expenditures, indicating positive fiscal health and allowing for debt reduction or increased savings. Conversely, a deficit budget arises when government spending surpasses income, often requiring borrowing to finance the gap. These budget types reflect different economic strategies and impact public debt levels and financial stability.

Key Differences Between Surplus and Deficit Budgets

A surplus budget occurs when government revenues exceed expenditures, indicating a positive fiscal balance, while a deficit budget happens when expenditures surpass revenues, resulting in negative fiscal balance. Surplus budgets allow for debt repayment and increased savings, whereas deficit budgets often require borrowing, increasing public debt. The choice between these budgets significantly impacts macroeconomic stability, inflation, and growth policies.

Causes of a Surplus Budget in Government Finance

A surplus budget in government finance occurs when revenue collections exceed expenditures, often driven by increased tax income from economic growth or effective fiscal policy measures. Reduced government spending, particularly on subsidies and welfare programs, also contributes to budget surpluses by limiting outflows. Additionally, one-time revenue sources, such as asset sales or higher-than-expected fees, can further enhance surplus budgets in a given fiscal period.

Factors Leading to a Deficit Budget

A deficit budget occurs when government expenditures exceed revenues due to factors such as economic downturns reducing tax income, increased public spending on social programs, or unexpected emergencies like natural disasters. Persistent deficits can arise from structural imbalances, including tax policy inefficiencies and rising costs of debt servicing. Understanding these factors is crucial for effective fiscal management and sustainable government finances.

Economic Impacts of Surplus Budgets

Surplus budgets in government finances lead to reduced public debt and lower interest payments, fostering economic stability and investor confidence. By allocating excess funds to infrastructure projects and social programs, governments can stimulate long-term growth and improve public welfare. Persistent budget surpluses may also create space for tax cuts or increased savings, enhancing fiscal flexibility during economic downturns.

Consequences of Running a Deficit Budget

Running a deficit budget in government finances increases public debt, leading to higher interest payments and potentially crowding out private investment. Persistent deficits can undermine investor confidence, raising borrowing costs and triggering inflationary pressures. Governments may be forced to cut essential public services or increase taxes to stabilize finances, impacting economic growth and social welfare.

Surplus vs Deficit: Fiscal Policy Tools

Surplus budgets occur when government revenues exceed expenditures, providing a fiscal policy tool to reduce national debt or increase savings. Deficit budgets arise when spending surpasses income, often utilized to stimulate economic growth through increased public investment and social programs. Effective management of surplus and deficit budgets enables governments to balance economic stability and growth by adjusting spending and taxation policies.

Long-Term Effects on National Debt

A surplus budget reduces the national debt by allowing the government to pay down existing liabilities, thereby lowering interest costs and improving fiscal sustainability over time. In contrast, a deficit budget increases national debt as the government borrows to finance expenditures, leading to higher interest payments and potential crowding out of private investment. Persistent deficits escalate debt levels, which can constrain future government spending and economic growth.

Choosing the Right Budget Approach for Sustainable Growth

A surplus budget occurs when government revenues exceed expenditures, providing funds for debt reduction and investment in infrastructure, which supports sustainable economic growth. In contrast, a deficit budget involves higher spending than income, often financed by borrowing, which can stimulate short-term growth but risks long-term fiscal instability. Choosing the right budget approach depends on balancing immediate economic needs with maintaining fiscal health to ensure sustainable development.

Related Important Terms

Fiscal Gap Analysis

Surplus budgets occur when government revenues exceed expenditures, reducing the fiscal gap and allowing debt repayment or increased reserves, while deficit budgets widen the fiscal gap, necessitating borrowing to cover shortfalls. Fiscal gap analysis quantitatively measures the long-term sustainability of government finances by comparing projected revenue streams with expected liabilities under both surplus and deficit scenarios.

Countercyclical Surplusing

Countercyclical surplusing occurs when a government runs a surplus budget during periods of economic growth, saving excess revenue to offset future deficits during downturns. This fiscal strategy stabilizes the economy by reducing inflationary pressures in booms and providing funds for stimulus spending in recessions, ensuring sustainable public finances.

Procyclical Deficit Loop

A procyclical deficit loop occurs when government budgets consistently run deficits during economic downturns, leading to increased borrowing that exacerbates fiscal imbalances and limits future spending capacity. Continuous deficit budgets reduce fiscal space, forcing cuts or tax hikes during recessions that further suppress economic growth and deepen the deficit cycle.

Structural vs. Cyclical Balance

A surplus budget occurs when government revenues exceed expenditures, reflecting a positive structural balance indicative of long-term fiscal health, while a deficit budget arises when spending surpasses income, often linked to a negative cyclical balance caused by short-term economic fluctuations. Structural balance measures the underlying fiscal position adjusted for the economic cycle, whereas cyclical balance captures temporary budget impacts driven by changes in GDP and economic activity.

Zero-Base Budgeting Surplus

Zero-Base Budgeting Surplus occurs when government expenses are rigorously evaluated from a zero base, ensuring every expense is justified and leading to efficient allocation of resources that produce a budget surplus. This approach contrasts with traditional deficit budgeting by minimizing unnecessary expenditures and enhancing fiscal discipline, ultimately strengthening government financial stability.

Deficit Monetization Risk

Deficit monetization occurs when governments finance budget deficits by printing money, leading to inflationary pressures and potential currency devaluation. This risk undermines economic stability by eroding purchasing power, increasing interest rates, and discouraging investment in government bonds.

Sovereign Wealth Buffering

A surplus budget enables governments to allocate excess revenue into sovereign wealth funds, enhancing fiscal buffers and enabling long-term economic stability. In contrast, a deficit budget often necessitates borrowing, which can deplete reserves and limit the capacity for sovereign wealth buffering during economic downturns.

Automatic Stabilizer Flexibility

A surplus budget occurs when government revenues exceed expenditures, strengthening automatic stabilizers by allowing increased savings or debt reduction during economic expansions. In contrast, a deficit budget arises when spending surpasses income, activating automatic stabilizers through higher government spending or lower taxes to support economic activity during downturns.

Fiscal Drag Impact

A surplus budget occurs when government revenues exceed expenditures, often leading to fiscal drag by reducing disposable income and slowing economic growth through higher tax burdens. In contrast, a deficit budget increases government spending beyond revenues, potentially easing fiscal drag by boosting aggregate demand and stimulating economic activity.

Deficit Hawk Signaling

Governments signaling a deficit hawk stance prioritize reducing budget deficits to maintain fiscal discipline and investor confidence, often by curbing spending or increasing revenues. This approach contrasts with accepting a surplus budget, which focuses on saving for future obligations but may limit immediate economic stimulus opportunities.

Surplus Budget vs Deficit Budget for government finances. Infographic

moneydiff.com

moneydiff.com