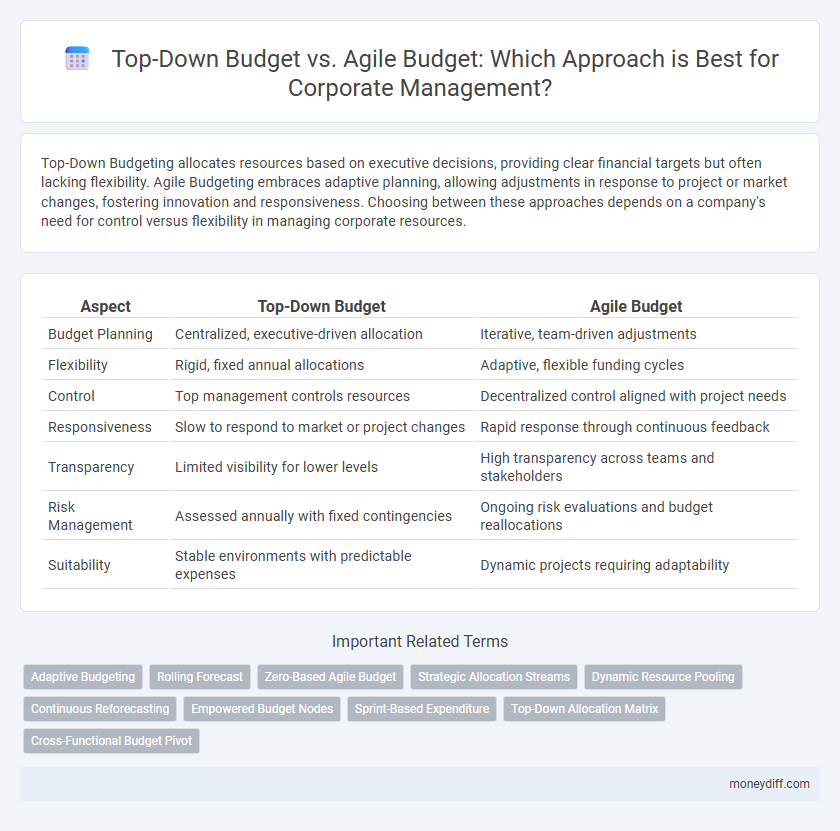

Top-Down Budgeting allocates resources based on executive decisions, providing clear financial targets but often lacking flexibility. Agile Budgeting embraces adaptive planning, allowing adjustments in response to project or market changes, fostering innovation and responsiveness. Choosing between these approaches depends on a company's need for control versus flexibility in managing corporate resources.

Table of Comparison

| Aspect | Top-Down Budget | Agile Budget |

|---|---|---|

| Budget Planning | Centralized, executive-driven allocation | Iterative, team-driven adjustments |

| Flexibility | Rigid, fixed annual allocations | Adaptive, flexible funding cycles |

| Control | Top management controls resources | Decentralized control aligned with project needs |

| Responsiveness | Slow to respond to market or project changes | Rapid response through continuous feedback |

| Transparency | Limited visibility for lower levels | High transparency across teams and stakeholders |

| Risk Management | Assessed annually with fixed contingencies | Ongoing risk evaluations and budget reallocations |

| Suitability | Stable environments with predictable expenses | Dynamic projects requiring adaptability |

Introduction to Corporate Budgeting Approaches

Top-Down Budgeting involves setting financial targets at the executive level and cascading them downward, promoting centralized control and alignment with strategic goals. Agile Budgeting emphasizes flexibility, iterative adjustments, and cross-departmental collaboration, allowing organizations to respond rapidly to market changes and uncertainties. Corporate management often balances these approaches to optimize resource allocation, control costs, and enhance adaptability in dynamic business environments.

Defining Top-Down Budgeting in Business

Top-Down Budgeting in business involves senior management setting the overall budget targets based on strategic priorities and financial goals, which are then allocated to departments for execution. This approach emphasizes centralized control and alignment with corporate objectives, ensuring resource distribution reflects top-level decision-making. It contrasts with Agile Budgeting by offering predictability and a clear framework, though it may lack the flexibility needed for rapid market changes.

Understanding Agile Budgeting Methodology

Agile budgeting methodology emphasizes flexibility by continuously aligning financial resources with evolving business priorities, enabling rapid adaptation to market changes. Unlike top-down budgeting, which sets fixed budgets from executive management, agile budgeting encourages iterative planning and collaboration across departments to optimize resource allocation. This approach improves responsiveness and supports innovation in corporate management by facilitating dynamic budget adjustments based on real-time feedback and performance data.

Key Differences: Top-Down vs Agile Budget

Top-Down Budgeting sets fixed financial targets determined by senior management, emphasizing control and alignment with strategic objectives. Agile Budgeting offers flexibility by allowing iterative adjustments based on real-time performance data and market conditions, promoting adaptability and responsiveness. While Top-Down Budgeting provides clear guidance and accountability, Agile Budgeting enhances innovation and rapid decision-making in corporate management.

Benefits of Top-Down Budgeting for Corporations

Top-Down Budgeting provides corporations with clear financial targets set by executive leadership, enabling streamlined decision-making and consistent alignment with strategic objectives. This approach enhances control over resource allocation and simplifies performance monitoring across departments. Corporations benefit from improved efficiency and accountability by establishing budgets that reflect overarching corporate goals.

Advantages of Agile Budgeting for Modern Enterprises

Agile budgeting offers modern enterprises enhanced flexibility by allowing continuous adjustments based on real-time performance data and market changes, promoting more accurate resource allocation. This method supports cross-functional collaboration and faster decision-making, helping companies respond swiftly to evolving business priorities. Compared to rigid top-down budgeting, agile budgeting reduces inefficiencies and aligns financial planning closely with strategic goals and operational realities.

Challenges in Implementing Each Budgeting Style

Top-Down Budgeting often faces challenges like limited flexibility and employee resistance due to centralized decision-making, which can hinder responsiveness to market changes. Agile Budgeting, while promoting adaptability and continuous feedback, struggles with maintaining financial discipline and consistency across departments, potentially causing resource misallocation. Balancing control with flexibility remains a core difficulty in implementing either budgeting style effectively within corporate management.

Decision-Making Impact: Top-Down vs Agile Budgets

Top-down budgets centralize decision-making authority, enabling corporate management to set clear financial targets but often limit flexibility and responsiveness to changing market conditions. Agile budgets promote decentralized decision-making, empowering teams to adjust allocations dynamically based on real-time data and evolving business priorities, which enhances adaptability and innovation. The choice between top-down and agile budgeting significantly influences organizational agility, risk management, and the speed of strategic execution.

Best Practices for Choosing the Right Budget Model

Top-Down Budgeting streamlines resource allocation through executive decision-making, ideal for organizations requiring strict financial control and aligned strategic goals. Agile Budgeting promotes flexibility and continuous adjustment, enabling teams to respond quickly to market changes and iterative project demands. Combining data-driven performance metrics with organizational culture assessment helps corporate management select the optimal budget model for sustainable growth and operational efficiency.

Future Trends in Corporate Budget Management

Top-down budgeting remains prevalent in corporate management due to its clear structure and control but increasingly integrates agile elements to enhance adaptability in dynamic markets. Future trends emphasize hybrid models that leverage real-time data analytics and iterative forecasting, enabling faster response to economic fluctuations and strategic shifts. Leveraging AI-driven tools for continuous budget adjustments supports predictive accuracy and alignment with corporate goals in uncertain environments.

Related Important Terms

Adaptive Budgeting

Top-Down Budgeting relies on fixed, hierarchical allocations established by senior management, often lacking flexibility to respond to market changes, whereas Agile Budgeting embraces Adaptive Budgeting principles by continuously adjusting financial plans based on real-time performance data and evolving business needs. Adaptive Budgeting enhances corporate management's ability to optimize resource allocation, improve responsiveness, and support strategic decision-making in dynamic environments.

Rolling Forecast

Top-Down Budgeting sets fixed financial targets dictated by senior management, while Agile Budgeting with Rolling Forecasts enables continuous adjustments based on real-time performance and market changes. Rolling Forecasts improve corporate management by increasing flexibility, accuracy, and alignment with strategic goals through frequent updates to revenue, expenses, and cash flow projections.

Zero-Based Agile Budget

Zero-Based Agile Budget integrates the principles of zero-based budgeting with agile methodologies, enabling corporate management to continuously reassess resource allocation based on current project needs and strategic priorities rather than relying on traditional top-down budget constraints. This approach enhances financial flexibility, improves responsiveness to market changes, and ensures that every dollar spent drives maximum value.

Strategic Allocation Streams

Top-down budgeting emphasizes strategic allocation streams determined by executive leadership, ensuring alignment with overall corporate objectives and long-term goals. Agile budgeting adapts these streams dynamically, allowing for iterative adjustments based on real-time project performance and shifting market conditions.

Dynamic Resource Pooling

Top-Down Budgeting allocates fixed resources based on strategic targets, often limiting flexibility, while Agile Budgeting leverages dynamic resource pooling to reallocate funds rapidly in response to changing priorities and project demands. Dynamic resource pooling enhances corporate management by enabling real-time budget adjustments, optimizing capital efficiency, and supporting adaptive decision-making in volatile business environments.

Continuous Reforecasting

Top-down budgets allocate fixed resources based on strategic goals, often limiting flexibility, while agile budgets emphasize continuous reforecasting to adapt quickly to market changes and operational insights. Continuous reforecasting in agile budgeting enhances corporate management by enabling real-time adjustments, improving resource allocation accuracy, and supporting dynamic decision-making.

Empowered Budget Nodes

Top-Down Budget allocates resources through centralized decision-making, often limiting flexibility in responding to dynamic business needs, whereas Agile Budget empowers decentralized budget nodes with autonomy, enabling faster adaptation and more precise allocation aligned with real-time project demands. This empowerment of budget nodes fosters accountability and accelerates innovation by allowing teams to manage their financial resources directly within corporate management structures.

Sprint-Based Expenditure

Top-Down Budget allocates fixed resources at the start of a fiscal period, limiting flexibility in Sprint-Based Expenditure for corporate management. Agile Budget emphasizes iterative funding aligned with sprint cycles, enabling real-time adjustments and optimized resource allocation to meet evolving project needs.

Top-Down Allocation Matrix

Top-Down Allocation Matrix in budget management streamlines resource distribution by setting predefined financial limits based on strategic priorities, enhancing control and accountability within corporate structures. This approach contrasts with Agile Budgeting by emphasizing fixed allocations and hierarchical decision-making, which supports long-term planning but may reduce flexibility in responding to dynamic market conditions.

Cross-Functional Budget Pivot

Top-Down Budgeting enables corporate management to allocate financial resources from a high-level perspective, facilitating strategic alignment but often limiting flexibility in dynamic environments. Agile Budgeting emphasizes iterative planning and cross-functional budget pivots, allowing teams to rapidly reallocate funds based on real-time project priorities and performance metrics.

Top-Down Budget vs Agile Budget for corporate management. Infographic

moneydiff.com

moneydiff.com