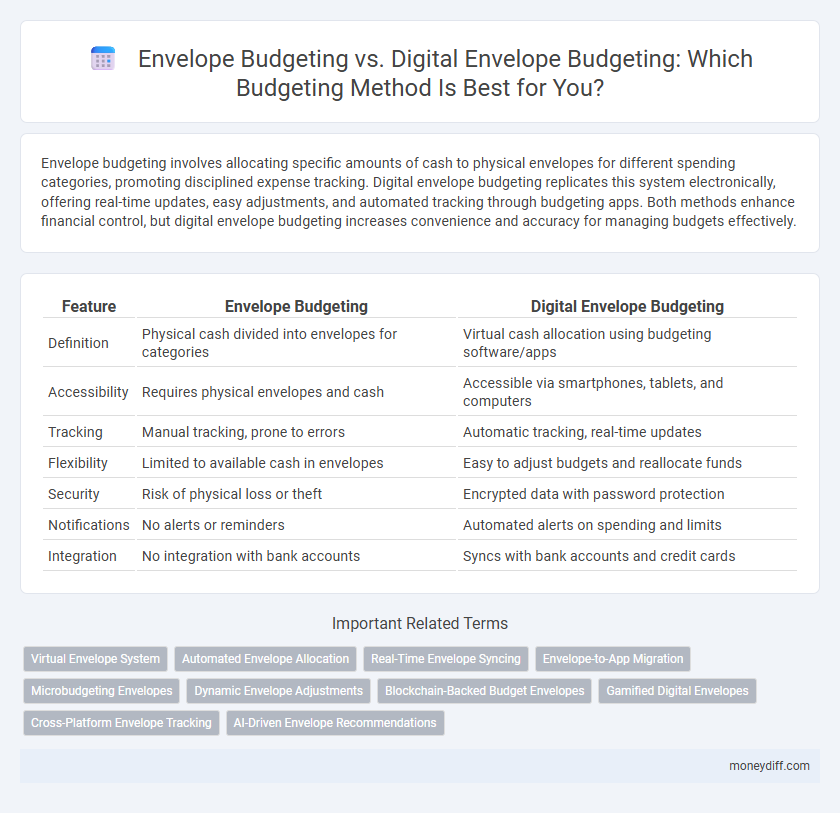

Envelope budgeting involves allocating specific amounts of cash to physical envelopes for different spending categories, promoting disciplined expense tracking. Digital envelope budgeting replicates this system electronically, offering real-time updates, easy adjustments, and automated tracking through budgeting apps. Both methods enhance financial control, but digital envelope budgeting increases convenience and accuracy for managing budgets effectively.

Table of Comparison

| Feature | Envelope Budgeting | Digital Envelope Budgeting |

|---|---|---|

| Definition | Physical cash divided into envelopes for categories | Virtual cash allocation using budgeting software/apps |

| Accessibility | Requires physical envelopes and cash | Accessible via smartphones, tablets, and computers |

| Tracking | Manual tracking, prone to errors | Automatic tracking, real-time updates |

| Flexibility | Limited to available cash in envelopes | Easy to adjust budgets and reallocate funds |

| Security | Risk of physical loss or theft | Encrypted data with password protection |

| Notifications | No alerts or reminders | Automated alerts on spending and limits |

| Integration | No integration with bank accounts | Syncs with bank accounts and credit cards |

Understanding Envelope Budgeting: A Classic Approach

Envelope budgeting involves allocating specific amounts of cash into physical envelopes for each spending category, promoting disciplined spending and clear financial limits. This traditional method enhances money management by visually restricting expenses to preset envelopes, reducing the risk of overspending. Envelope budgeting relies on tangible cash handling, contrasting with digital alternatives that use apps to simulate this allocation.

Digital Envelope Budgeting: The Modern Evolution

Digital envelope budgeting revolutionizes traditional budgeting by leveraging technology to allocate funds into virtual envelopes, providing real-time tracking and enhanced flexibility. Unlike physical envelope budgeting, digital methods integrate with banking apps and financial software, enabling automated transactions and instant updates on spending limits. This modern approach reduces errors, increases accessibility, and supports dynamic adjustments based on changing financial priorities.

Key Differences Between Physical and Digital Envelopes

Envelope budgeting uses physical envelopes labeled with spending categories, helping to control cash flow by limiting expenditures to the cash inside each envelope. Digital envelope budgeting leverages apps or software to allocate funds into virtual envelopes, offering real-time tracking, instant updates, and integration with bank accounts. The key differences include accessibility, ease of adjustments, and automation, with digital methods providing enhanced convenience and fewer risks of overspending due to instant notifications and transaction records.

Setting Up a Traditional Envelope Budget System

Setting up a traditional envelope budgeting system involves allocating cash into physical envelopes labeled for categories like groceries, rent, and entertainment, ensuring strict spending limits per category. This method promotes disciplined cash management and immediate visual caps on expenses, reducing the risk of overspending. Envelope budgeting encourages mindful spending habits by forcing users to face tangible limits, unlike digital methods that rely on app-based reminders and virtual allocations.

How Digital Envelope Budgeting Works

Digital envelope budgeting allocates funds into virtual envelopes tied to specific spending categories, allowing real-time tracking and adjustments via budgeting apps. Unlike traditional envelope budgeting that uses physical cash, digital methods sync with bank accounts to automatically update balances and provide alerts when nearing limits. This system enhances accuracy and flexibility, optimizing financial control through seamless integration and instant data updates.

Pros and Cons of Physical Envelope Budgeting

Physical envelope budgeting offers tangible control over spending by allocating cash into labeled envelopes for specific expenses, promoting discipline and preventing overspending. However, it lacks the flexibility and convenience of digital tracking, is prone to loss or theft, and can be cumbersome to manage for multiple budget categories. While effective for visual learners and those seeking simplicity, it does not provide real-time updates or detailed analytics available in digital envelope budgeting apps.

Advantages and Drawbacks of Digital Envelope Budgeting

Digital envelope budgeting offers real-time transaction tracking and automated categorization, enhancing accuracy and convenience compared to traditional envelope budgeting. However, it relies heavily on technology, which can present security risks and requires a learning curve for less tech-savvy users. The digital method also depends on consistent device access, potentially limiting usability in areas with poor internet connectivity.

Security and Accessibility: Physical vs Digital Envelopes

Envelope budgeting involves allocating cash into physical envelopes for each expense category, offering tangible security by limiting overspending but posing risks of loss or theft. Digital envelope budgeting uses encrypted apps to create virtual envelopes, enhancing accessibility across devices while incorporating advanced security measures like biometric authentication and data encryption. The digital model provides real-time tracking and backup, reducing the risk of physical loss but depends on cybersecurity protocols to protect sensitive financial data.

Tracking Expenses: Manual vs App-Based Solutions

Envelope budgeting relies on physical cash envelopes to track expenses, making it simple to see spending limits but prone to errors and lack of real-time updates. Digital envelope budgeting uses app-based solutions that automatically categorize transactions, offer instant notifications, and provide detailed spending insights, enhancing accuracy and convenience. App-based tracking enables synchronization across devices, ensuring up-to-date budgeting information at all times.

Choosing the Right Envelope Budgeting Method for You

Envelope budgeting involves physically separating cash into labeled envelopes for specific expenses, which provides a tactile, straightforward approach to managing finances. Digital envelope budgeting uses apps or software to allocate virtual funds into categories, offering real-time tracking, automation, and easier adjustments. Choose the method that aligns with your lifestyle--physical envelopes enhance spending awareness, while digital tools offer convenience and detailed financial insights.

Related Important Terms

Virtual Envelope System

Virtual envelope system in digital envelope budgeting offers enhanced flexibility and real-time tracking compared to traditional envelope budgeting, allowing users to allocate funds into virtual categories for precise expense management. This method leverages apps and software to automate transactions and provide instant updates, improving budgeting accuracy and convenience.

Automated Envelope Allocation

Automated envelope allocation in digital envelope budgeting streamlines fund distribution by using software algorithms to categorize expenses and adjust spending limits in real-time, enhancing accuracy compared to manual envelope budgeting. This automation reduces human error, provides instant budget updates, and enables more efficient tracking of financial goals across multiple envelopes.

Real-Time Envelope Syncing

Envelope budgeting divides funds into physical categories, limiting flexibility and requiring manual adjustments, while digital envelope budgeting enables real-time envelope syncing across devices, improving accuracy and instant budget updates. This synchronization ensures immediate tracking of spending, avoids overspending, and enhances financial control by reflecting actual balances in every envelope instantly.

Envelope-to-App Migration

Envelope budgeting involves physically categorizing cash into labeled envelopes for different expense categories, while digital envelope budgeting uses apps to replicate this method virtually, enhancing tracking and accessibility. Migrating from envelope to app budget systems streamlines expense management by offering real-time updates, automated alerts, and easier adjustments, reducing cash handling errors and improving financial discipline.

Microbudgeting Envelopes

Envelope budgeting traditionally uses physical envelopes to allocate cash for specific expenses, promoting disciplined spending through tangible limits. Digital envelope budgeting enhances microbudgeting envelopes by automating tracking, enabling real-time adjustments, and offering detailed expense categorization to optimize financial control and accuracy.

Dynamic Envelope Adjustments

Envelope budgeting uses fixed cash categories to allocate funds, limiting flexibility when spending needs change, whereas digital envelope budgeting allows dynamic envelope adjustments in real time, enabling users to reallocate funds seamlessly across categories based on evolving expenses. This adaptive feature in digital envelopes enhances financial control by accommodating unexpected costs without disrupting the entire budget framework.

Blockchain-Backed Budget Envelopes

Blockchain-backed budget envelopes enhance traditional envelope budgeting by providing transparent, immutable records and real-time tracking of fund allocations. This digital envelope budgeting method leverages smart contracts to automate expense limits, reduce overspending, and improve financial accountability.

Gamified Digital Envelopes

Gamified digital envelopes enhance traditional envelope budgeting by integrating interactive features and rewards that motivate users to stick to spending limits, increasing engagement and financial discipline. This digital approach uses real-time tracking and behavioral incentives, making budgeting more intuitive and effective compared to manual envelope methods.

Cross-Platform Envelope Tracking

Envelope budgeting divides funds into physical categories to control spending, while digital envelope budgeting uses apps to track expenses across multiple devices in real-time. Digital envelope budgeting enhances cross-platform envelope tracking by syncing transactions and balances instantly on smartphones, tablets, and desktops, ensuring accurate budget management anytime, anywhere.

AI-Driven Envelope Recommendations

Envelope budgeting allocates funds to predefined categories using physical or digital envelopes, while digital envelope budgeting enhances this method by integrating AI-driven envelope recommendations that analyze spending patterns and predict future expenses to optimize budget allocations. AI-driven systems dynamically adjust envelopes, providing personalized insights and improving financial discipline through real-time data and machine learning algorithms.

Envelope Budgeting vs Digital Envelope Budgeting for Budget Infographic

moneydiff.com

moneydiff.com