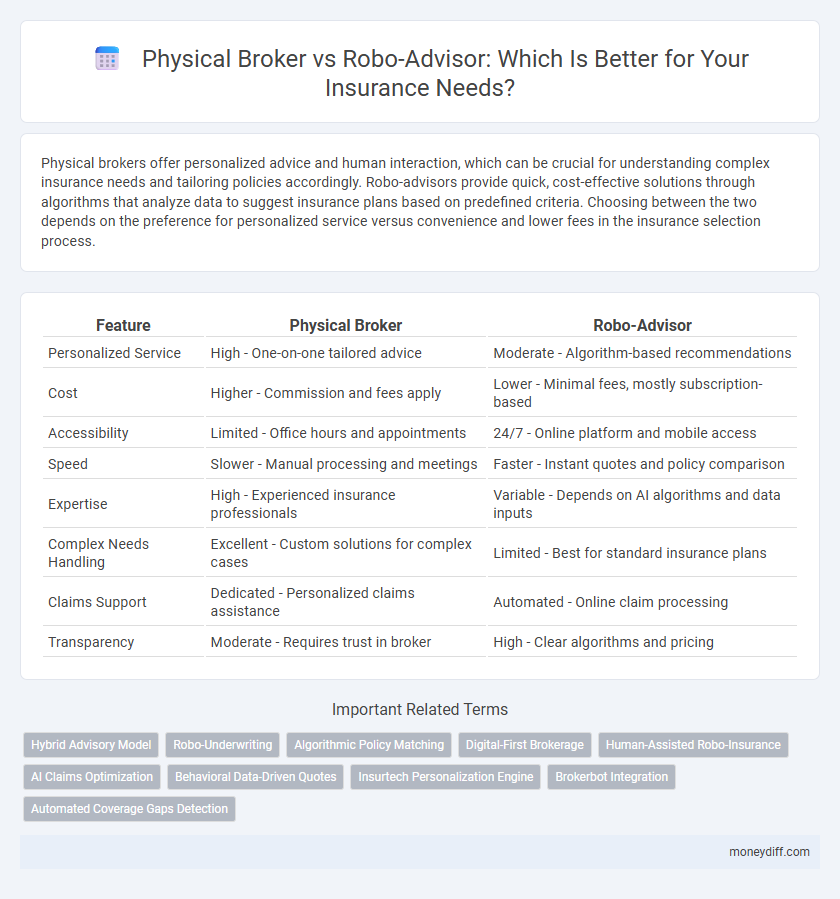

Physical brokers offer personalized advice and human interaction, which can be crucial for understanding complex insurance needs and tailoring policies accordingly. Robo-advisors provide quick, cost-effective solutions through algorithms that analyze data to suggest insurance plans based on predefined criteria. Choosing between the two depends on the preference for personalized service versus convenience and lower fees in the insurance selection process.

Table of Comparison

| Feature | Physical Broker | Robo-Advisor |

|---|---|---|

| Personalized Service | High - One-on-one tailored advice | Moderate - Algorithm-based recommendations |

| Cost | Higher - Commission and fees apply | Lower - Minimal fees, mostly subscription-based |

| Accessibility | Limited - Office hours and appointments | 24/7 - Online platform and mobile access |

| Speed | Slower - Manual processing and meetings | Faster - Instant quotes and policy comparison |

| Expertise | High - Experienced insurance professionals | Variable - Depends on AI algorithms and data inputs |

| Complex Needs Handling | Excellent - Custom solutions for complex cases | Limited - Best for standard insurance plans |

| Claims Support | Dedicated - Personalized claims assistance | Automated - Online claim processing |

| Transparency | Moderate - Requires trust in broker | High - Clear algorithms and pricing |

Introduction to Insurance Advisors: Physical Brokers vs Robo-Advisors

Physical insurance brokers offer personalized guidance by assessing individual client needs, leveraging extensive market knowledge to tailor policies and ensure comprehensive coverage. Robo-advisors utilize automated algorithms to analyze data quickly, providing cost-effective, accessible insurance recommendations with minimal human intervention. Both options present distinct advantages in terms of customization, convenience, and cost-efficiency, shaping the evolving insurance advisory landscape.

Key Differences Between Physical Brokers and Robo-Advisors

Physical brokers provide personalized insurance advice through face-to-face interactions, leveraging their expertise to tailor policies to individual client needs, while robo-advisors use algorithms and data-driven models to offer automated, cost-effective insurance options. Physical brokers can handle complex insurance scenarios with human judgment and negotiate directly with insurers, whereas robo-advisors excel in speed, convenience, and accessibility, often featuring user-friendly digital platforms for instant quotes. The choice between a physical broker and a robo-advisor depends on the client's preference for customization, personal service, and technological efficiency in managing insurance policies.

Cost Comparison: Broker Fees vs Robo-Advisor Charges

Physical insurance brokers typically charge commissions ranging from 5% to 15% of the policy premium, which can increase overall costs. Robo-advisors generally offer lower fees, often between 0.25% and 0.75% of assets under management or a flat service fee, making them more cost-effective for budget-conscious clients. The reduced overhead and automated processes of robo-advisors contribute to their affordability compared to traditional broker fees.

Personalization: Human Touch or Algorithmic Solutions?

Physical brokers excel in personalized insurance advice by assessing clients' unique financial situations, risk tolerance, and coverage needs through direct interaction and tailored recommendations. Robo-advisors utilize advanced algorithms and data analytics to quickly generate insurance options based on user inputs, offering efficiency and cost-effectiveness without human bias. The choice between a human touch and algorithmic solutions depends on the client's preference for customized, empathetic guidance versus streamlined, data-driven decision-making.

Accessibility and Convenience: Online Platforms vs Face-to-Face Meetings

Online insurance platforms offer 24/7 accessibility, enabling users to compare policies, get quotes, and purchase coverage from any location with internet access, streamlining convenience and saving time. Physical brokers provide personalized face-to-face consultations that foster trust and allow for tailored advice, especially beneficial for complex insurance needs or clients unfamiliar with digital tools. Robo-advisors balance accessibility and convenience by automating recommendations through AI-driven platforms, yet lack the nuanced personal touch and adaptability of in-person broker interactions.

Transparency in Insurance Recommendations

Physical brokers in insurance provide personalized transparency by explaining policy details and potential risks in person, fostering trust through direct communication. Robo-advisors offer transparency through algorithm-driven recommendations and clear, data-backed comparisons but may lack the nuanced explanation that human brokers provide. Choosing between the two depends on the preference for human interaction versus data-driven clarity in insurance decision-making.

Expertise and Experience: Human Knowledge vs AI Capabilities

Physical insurance brokers leverage years of industry expertise and nuanced understanding of client needs to tailor comprehensive coverage solutions. Robo-advisors utilize advanced AI algorithms and vast data analysis to quickly generate personalized insurance recommendations based on risk profiles. While human brokers offer empathetic guidance and adaptability, AI excels in processing large datasets for optimized, cost-effective policy suggestions.

Claim Assistance: Physical Support Against Digital Processes

Physical brokers offer personalized claim assistance by navigating complex paperwork and providing face-to-face support, ensuring clients fully understand each step of the insurance claims process. Robo-advisors streamline claims through automated systems and digital platforms, enabling faster submissions but lacking tailored guidance during disputes or intricate claim situations. The choice between a physical broker and a robo-advisor hinges on the need for human interaction versus efficient digital processing in managing insurance claims.

Security and Data Privacy Considerations

Physical brokers provide personalized security measures by managing sensitive client information through direct interactions, which can reduce exposure to cyber threats. Robo-advisors utilize advanced encryption and automated protocols to protect data, but their digital nature may increase vulnerability to hacking and data breaches. Evaluating security involves balancing face-to-face confidentiality with the technological safeguards embedded in automated insurance advisory platforms.

Choosing the Right Solution for Your Insurance Needs

Choosing the right solution for your insurance needs depends on factors such as personalized advice, cost efficiency, and convenience. Physical brokers offer tailored consultations and nuanced policy comparisons, ideal for complex insurance requirements or those seeking human interaction. Robo-advisors provide automated, cost-effective options with quick quotes and policy management, suitable for straightforward insurance purchases with minimal personalized guidance.

Related Important Terms

Hybrid Advisory Model

The Hybrid Advisory Model combines the personalized expertise of a physical broker with the efficiency and data-driven insights of a robo-advisor, enhancing client decision-making in insurance purchasing. This approach leverages human judgment for complex cases and automated algorithms for routine policy management, optimizing coverage accuracy and cost-effectiveness.

Robo-Underwriting

Robo-underwriting leverages advanced algorithms and AI to assess insurance applications swiftly, reducing human error and processing time compared to traditional physical brokers. This technology improves accuracy in risk evaluation and offers personalized policy recommendations, enhancing efficiency and customer experience in the insurance industry.

Algorithmic Policy Matching

Algorithmic policy matching in robo-advisors leverages advanced machine learning models to analyze vast datasets of insurance products, optimizing coverage personalization and cost-efficiency based on individual risk profiles. In contrast, physical brokers rely on manual expertise and client interactions, which may limit scalability and introduce subjective biases in policy recommendations.

Digital-First Brokerage

Digital-first brokerages leverage advanced algorithms and real-time data analytics to offer personalized insurance solutions, streamlining client onboarding and claims processing compared to traditional physical brokers. By integrating AI-driven risk assessment and customer support chatbots, these platforms deliver efficient, cost-effective insurance services with enhanced transparency and scalability.

Human-Assisted Robo-Insurance

Human-assisted robo-insurance integrates the efficiency of automated algorithms with personalized guidance from licensed brokers, ensuring tailored insurance recommendations based on real-time data and individual risk profiles. This hybrid approach enhances customer trust and satisfaction by combining the precision of AI-driven analytics with the nuanced expertise of human advisors in complex insurance decisions.

AI Claims Optimization

AI claims optimization enhances robo-advisors by streamlining claim assessments, reducing processing time, and minimizing human error compared to physical brokers. Leveraging machine learning algorithms, robo-advisors deliver personalized policy adjustments and faster settlements, driving efficiency and cost savings in insurance claim management.

Behavioral Data-Driven Quotes

Physical brokers leverage personalized behavioral data and in-depth client interactions to tailor insurance quotes, offering nuanced risk assessment based on real-time lifestyle inputs. Robo-advisors utilize advanced algorithms and large datasets to generate rapid, data-driven insurance quotes with consistent precision but may lack the behavioral insights gleaned from human brokers.

Insurtech Personalization Engine

Insurtech Personalization Engines leverage advanced algorithms and AI to deliver tailored insurance recommendations, outperforming traditional physical brokers by providing real-time data analysis and customized policy options. These digital platforms enhance customer experience through predictive analytics and seamless integration with user profiles, enabling more precise and efficient coverage solutions compared to conventional advisory methods.

Brokerbot Integration

Brokerbot integration enhances robo-advisors by automating personalized insurance recommendations using advanced algorithms and real-time data analysis. This technology improves efficiency and accuracy, offering clients optimized policy options without the need for a physical broker's direct intervention.

Automated Coverage Gaps Detection

Automated coverage gaps detection powered by advanced AI algorithms enables robo-advisors to quickly analyze policy details and identify inconsistencies or missing protections in real time, enhancing precision and efficiency. Physical brokers rely on manual assessments and personal expertise, which can lead to slower detection and potential human errors in recognizing critical coverage gaps.

Physical Broker vs Robo-Advisor for insurance. Infographic

moneydiff.com

moneydiff.com