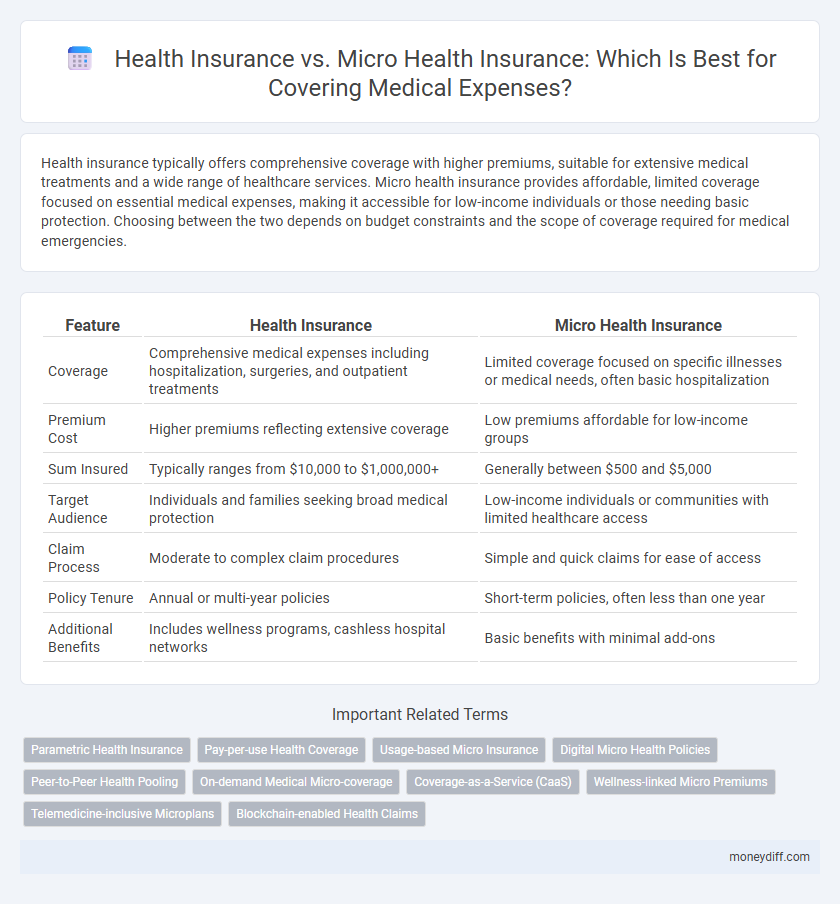

Health insurance typically offers comprehensive coverage with higher premiums, suitable for extensive medical treatments and a wide range of healthcare services. Micro health insurance provides affordable, limited coverage focused on essential medical expenses, making it accessible for low-income individuals or those needing basic protection. Choosing between the two depends on budget constraints and the scope of coverage required for medical emergencies.

Table of Comparison

| Feature | Health Insurance | Micro Health Insurance |

|---|---|---|

| Coverage | Comprehensive medical expenses including hospitalization, surgeries, and outpatient treatments | Limited coverage focused on specific illnesses or medical needs, often basic hospitalization |

| Premium Cost | Higher premiums reflecting extensive coverage | Low premiums affordable for low-income groups |

| Sum Insured | Typically ranges from $10,000 to $1,000,000+ | Generally between $500 and $5,000 |

| Target Audience | Individuals and families seeking broad medical protection | Low-income individuals or communities with limited healthcare access |

| Claim Process | Moderate to complex claim procedures | Simple and quick claims for ease of access |

| Policy Tenure | Annual or multi-year policies | Short-term policies, often less than one year |

| Additional Benefits | Includes wellness programs, cashless hospital networks | Basic benefits with minimal add-ons |

Understanding Health Insurance and Micro Health Insurance

Health insurance provides comprehensive coverage for a wide range of medical expenses, including hospitalization, surgeries, and outpatient care, typically with higher premiums tailored for extensive protection. Micro health insurance offers limited, affordable coverage designed for low-income individuals, focusing on primary healthcare and minor medical treatments with lower premiums and simplified enrollment. Understanding the scope, cost, and benefits of each type helps consumers choose insurance that aligns with their financial capacity and healthcare needs.

Key Differences Between Health Insurance and Micro Health Insurance

Health insurance typically offers comprehensive coverage with higher sum insured amounts, broader hospital networks, and longer policy terms, whereas micro health insurance focuses on providing affordable, limited coverage primarily for low-income individuals or families. Micro health insurance plans often have lower premiums, restricted benefits, minimal waiting periods, and simplified claim processes tailored for basic medical expenses. Health insurance plans generally include extensive outpatient and inpatient benefits, preventive care, and multiple add-ons, contrasting with the essential coverage of micro health insurance designed to cover critical healthcare needs.

Coverage Scope: What’s Included in Each Option?

Health insurance typically offers comprehensive coverage including hospitalization, surgery, outpatient care, prescription drugs, and preventive services, often with higher coverage limits and broader provider networks. Micro health insurance focuses on essential medical expenses, covering primary healthcare, minor treatments, and sometimes limited hospitalization, designed for affordability and quick access in low-income or underserved populations. Both options vary in premium costs and claim processes, with micro health insurance prioritizing basic coverage and health insurance providing extensive protection for diverse medical needs.

Cost Comparison: Premiums and Out-of-Pocket Expenses

Health insurance typically involves higher premiums with more comprehensive coverage, whereas micro health insurance offers lower premiums tailored for minimal medical needs but may result in higher out-of-pocket expenses during treatment. Micro health insurance is designed to address affordability for low-income groups, making it a cost-effective short-term solution. Evaluating the trade-offs between premium costs and potential out-of-pocket expenses is crucial for selecting the appropriate plan based on individual health risk and financial capacity.

Accessibility: Who Can Apply and How?

Health insurance typically requires applicants to meet specific eligibility criteria such as age limits, medical history, and sometimes employment status, often necessitating a more complex application process through insurers or employers. Micro health insurance offers broader accessibility with simplified enrollment, targeting low-income individuals and families, frequently available through community organizations or digital platforms. This accessibility difference makes micro health insurance particularly suited for underserved populations needing affordable coverage for medical expenses.

Claim Process: Steps and Ease of Reimbursement

Health insurance typically involves a more complex claim process requiring detailed documentation, multiple approvals, and longer reimbursement timelines, often spanning weeks. Micro health insurance offers a simplified claim procedure with minimal paperwork and faster approval, designed to facilitate quick access to funds. The ease of reimbursement in micro health insurance makes it ideal for low-income groups seeking immediate financial relief for medical expenses.

Flexibility and Customization of Plans

Health insurance offers broader coverage with customizable plans that can be tailored to include various medical services, ensuring comprehensive protection for individuals and families. Micro health insurance provides more flexible, smaller-scale coverage options designed to meet specific, immediate medical expense needs, often catering to low-income or underserved populations. Both types prioritize plan adaptability, but health insurance plans generally allow for greater customization in benefits and premiums compared to the more standardized, affordable micro health insurance schemes.

Suitability: Which Insurance Fits Different Income Groups?

Health insurance plans generally suit middle to high-income groups seeking comprehensive coverage with higher premiums and extensive benefits. Micro health insurance targets low-income individuals and families, offering affordable premiums with limited but essential medical expense coverage. Choosing between these depends on income stability, healthcare needs, and premium affordability within each demographic.

Limitations and Exclusions of Both Insurance Types

Health insurance policies typically offer broader coverage but often exclude pre-existing conditions and may have high deductibles and co-payments, limiting immediate financial relief. Micro health insurance focuses on low-cost, limited coverage plans that exclude major treatments, chronic illnesses, and lengthy hospital stays, restricting access to comprehensive care. Both insurance types may impose caps on claim amounts and exclude outpatient treatments, emphasizing the importance of understanding policy-specific limitations before enrollment.

Making the Right Choice for Your Medical Expense Needs

Health insurance provides comprehensive coverage with higher premiums, ideal for individuals seeking extensive medical expense protection and access to a wide network of healthcare providers. Micro health insurance offers affordable, limited coverage tailored for low-income groups or specific medical needs, emphasizing essential treatments and cashless hospital services. Evaluating medical expense requirements, budget constraints, and desired coverage scope helps in making the right choice between health insurance and micro health insurance plans.

Related Important Terms

Parametric Health Insurance

Parametric health insurance offers a streamlined approach by triggering payouts based on predefined health events or indices, reducing claim processing times compared to traditional health insurance policies. Micro health insurance caters to low-income populations with affordable premiums and limited coverage, while parametric models enhance efficiency and transparency in managing medical expenses through objective, data-driven triggers.

Pay-per-use Health Coverage

Pay-per-use health coverage in micro health insurance offers affordable, flexible medical expense protection with premiums based solely on actual service usage, contrasting with traditional health insurance that requires fixed, higher monthly payments regardless of claims. This model enhances accessibility for low-income individuals by minimizing upfront costs and aligning coverage costs directly with healthcare consumption.

Usage-based Micro Insurance

Usage-based Micro Health Insurance offers tailored coverage by leveraging real-time health data and usage patterns, providing affordable protection for low-income individuals with limited medical expenses. In contrast, traditional Health Insurance typically involves higher premiums and broader coverage, often exceeding the specific needs of users seeking cost-effective, on-demand medical expense solutions.

Digital Micro Health Policies

Digital micro health policies offer affordable, flexible coverage tailored for low-income individuals, providing essential medical expense support with quick online access and minimal paperwork. Unlike traditional health insurance, these policies emphasize convenience and cost-efficiency, ensuring broader healthcare inclusion through digital platforms and targeted micro-coverage.

Peer-to-Peer Health Pooling

Health insurance typically involves traditional coverage plans with fixed premiums and insurer-managed risk pools, while micro health insurance leverages Peer-to-Peer (P2P) health pooling to create community-driven risk-sharing where members collectively manage medical expenses, enhancing affordability and transparency. P2P health pooling reduces administrative costs and fraud risk by directly linking peers, making micro health insurance a scalable solution for underserved populations with limited access to conventional health plans.

On-demand Medical Micro-coverage

On-demand Medical Micro-coverage offers flexible, low-cost health insurance solutions tailored for short-term or specific medical expenses, making it ideal for individuals seeking immediate financial protection without long-term commitments. Unlike traditional health insurance, micro health insurance provides targeted coverage with quick activation, addressing urgent healthcare needs and out-of-pocket costs efficiently.

Coverage-as-a-Service (CaaS)

Health insurance offers comprehensive Coverage-as-a-Service (CaaS) for extensive medical expenses, including hospitalization, surgeries, and outpatient treatments with high coverage limits and a broad network of providers. Micro health insurance delivers targeted CaaS with affordable premiums, designed to cover specific illnesses or basic medical needs, making it accessible for low-income individuals or short-term coverage requirements.

Wellness-linked Micro Premiums

Health insurance typically offers comprehensive coverage with higher premiums, while micro health insurance provides targeted protection with wellness-linked micro premiums that adjust based on the insured's health behaviors and preventive care engagement. Wellness-linked micro premiums incentivize healthier lifestyles by reducing costs through regular health check-ups, fitness activities, and chronic disease management, making micro health insurance an affordable and proactive choice for managing medical expenses.

Telemedicine-inclusive Microplans

Telemedicine-inclusive micro health insurance plans offer affordable coverage tailored for low-income individuals, providing essential medical expense protection with remote doctor consultations and quick claims processing. These microplans bridge gaps in traditional health insurance by ensuring accessible healthcare services, particularly for users in rural areas or those with limited budget flexibility.

Blockchain-enabled Health Claims

Blockchain-enabled health claims enhance transparency and security in both health insurance and micro health insurance, reducing fraud and accelerating claim settlements for medical expenses. Micro health insurance leverages blockchain to offer affordable, fast, and accessible coverage for underserved populations, while traditional health insurance uses the technology to streamline complex claim processes and improve data accuracy.

Health insurance vs Micro health insurance for medical expenses. Infographic

moneydiff.com

moneydiff.com